The last day of October is ripe for terrifying news, and it has nothing to do with Halloween.

Just yesterday it was reported that preliminary data from the European Statistical Office showed headline inflation this month in Europe was at 10.7% per annum. CNBC stated: "This is the highest monthly figure since the formation of the eurozone. Over the past 12 months, the 19-member bloc has faced higher prices, especially for energy and food."

The article also said that preliminary data from the European Statistical Office released on Monday showed that on an annualized basis, overall inflation in October was 10.7%. This is the highest monthly figure since the formation of the eurozone. And the growth was reinforced by geopolitical tensions in Ukraine."

For example, energy costs are expected to have the highest annual growth at 41.9%, up from September's energy inflation of 40.7%. Food, tobacco and alcohol prices also rose, from 11.8% in September to 13.1% in October.

In some eurozone countries, inflation has even exceeded 10%, while inflation in Italy has exceeded 12%. France reached only 7.1%, but Germany admitted that inflation reached 11.6%. Although the average is just below 11%, Estonia, Latvia and Lithuania peaked above 20% in October.

The news will certainly lead the European Central Bank to drastically change its current monetary policy to a much more aggressive one, including more massive rate hikes in the coming months to try to curb soaring inflation in Europe.

In America, the Federal Reserve's November meeting will begin today and end tomorrow. The conclusion will be followed by the release of a FOMC statement, along with a press conference by Fed Chairman Jerome Powell. This will likely include another 75 basis point interest rate hike and a more aggressive tone than Fed members have previously seen.

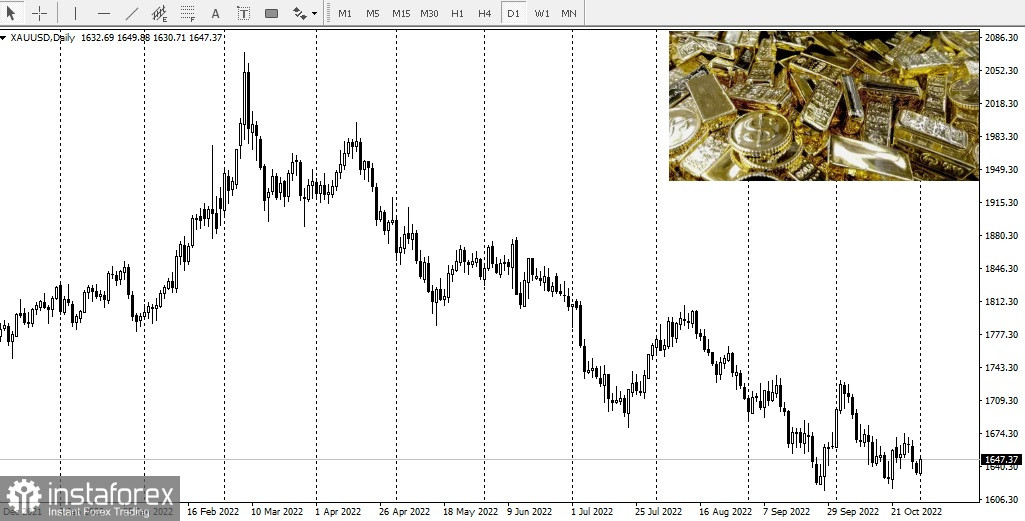

All this news caused the price of precious metals to fall. As the end of October approaches, traders and market participants have witnessed something not seen since 1982, when gold closed lower for seven consecutive months.

This is certainly a dramatic sell-off that could continue as long as central banks raise rates and the dollar remains strong in the United States.