The long bitcoin consolidation, which was accompanied by a drop in volatility and trading volumes, ended on a positive note. Bitcoin has tested the $21k level, and the crypto market capitalization has again exceeded $1 trillion.

The successful movement of bitcoin was directly related to the current situation in related markets. In any case, the cryptocurrency managed to settle above $20k and significantly increase institutional interest.

Theories about a possible reversal of the local cryptocurrency trend, which will allow going beyond the $19k-$25k range, have become relevant again. At the same time, markets expect a key rate hike of 75 basis points following Wednesday's meeting.

On the one hand, this may have a negative impact on the crypto market and strengthen the position of the US dollar index. At the same time, Morgan Stanley analysts believe that the markets are overestimating the position of inflation, and in the near future the figure will decline much more rapidly.

According to the bank's analysts, the dynamics of changes in the M2 money supply in the system suggests that in the coming months the inflation rate will decline much faster than the markets expect. This could mean that before the end of 2022, markets may start to move up on inflationary reporting.

The crypto market comes to life

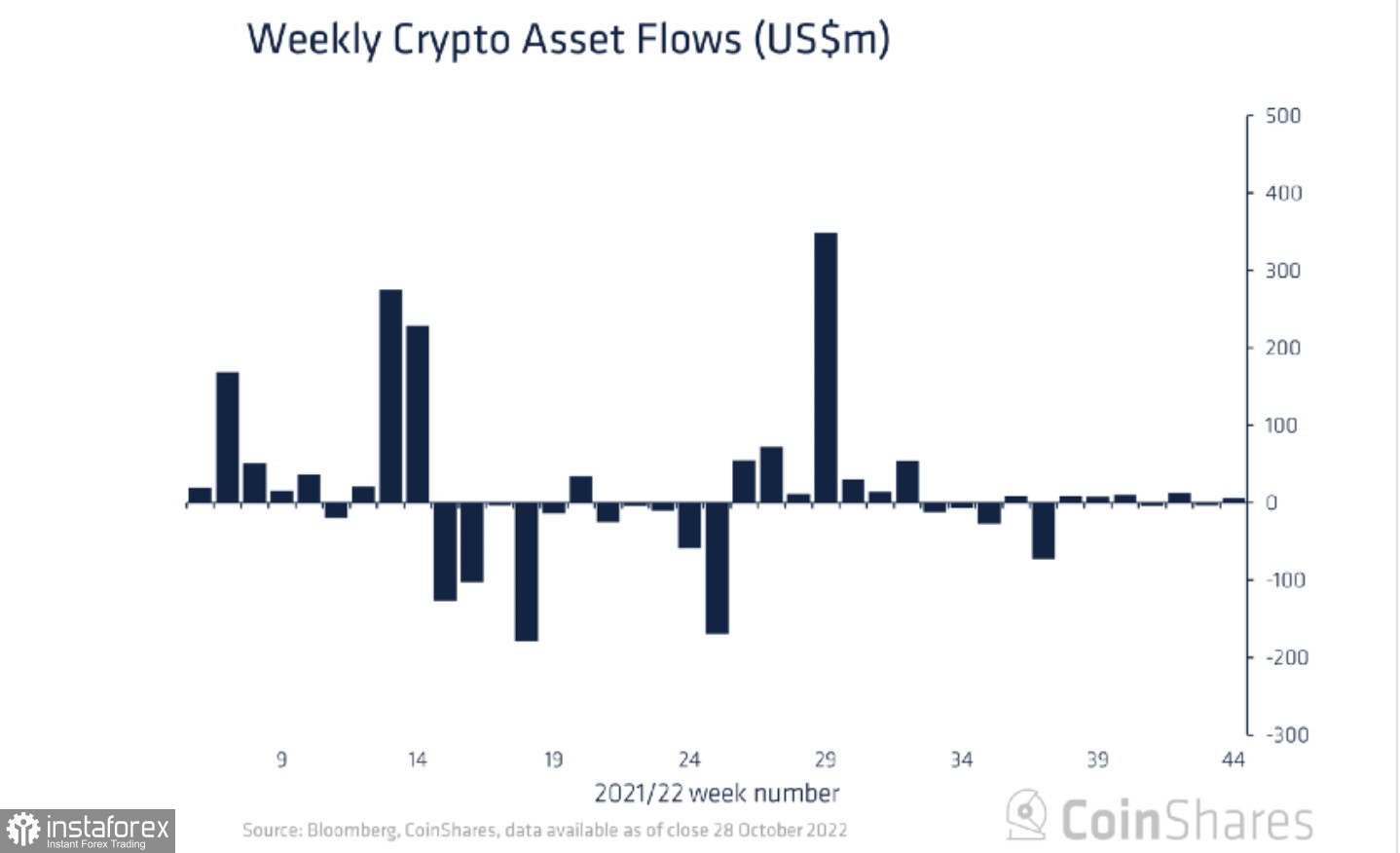

Positive news appears in the cryptocurrency market, where an influx of funds into crypto funds worth more than $6 million has been recorded. Despite the insignificance of investments, the inflow of funds indicates the likelihood of a positive trend.

CoinShares analysts also note a twofold increase in intraday trading volumes, which is an important factor for a further trend reversal. Fidelity also notes the growing interest of institutional investors in the crypto market.

Is it worth waiting for a local reversal of the BTC trend?

And here we come to an important question: is it worth waiting for a local trend reversal and, as a result, going beyond the $17.6k-$25k range? With the preservation and development of the current dynamics, this is likely. However, to assert at a distance of one week would be erroneous.

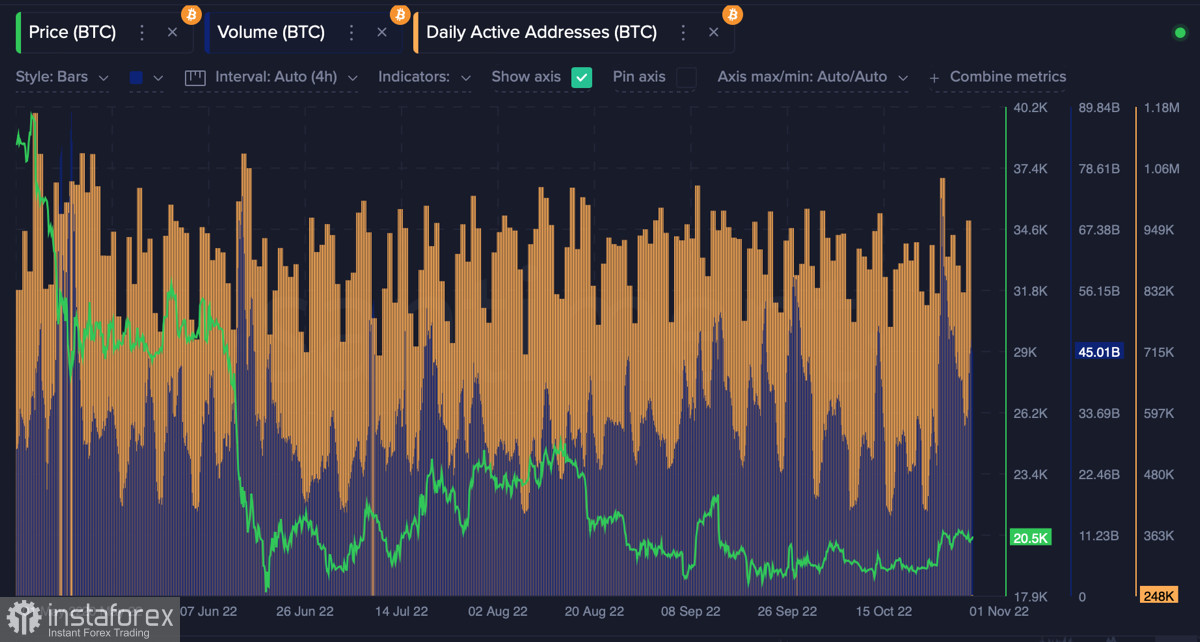

Recall that the key signal for a change in market sentiment will be a multiple increase in trading volumes during an upward movement. And the drop in trading activity in the implementation of downward pressure on the price. Maintaining such dynamics will mean a gradual change in trend.

It is important to understand that in conditions of limited liquidity, market makers can set "bull traps". They are designed to collect liquidity and do not significantly affect the price movement. To track and avoid such traps, it is important to work with the dynamics of trading volumes.

BTC/USD Analysis

As of November 1, there is a recovery in BTC trading volumes. The price continues to balance above the $20.4k downward trend level. The number of unique addresses is also starting to recover from the previous week.

Cryptocurrency technical metrics point to the need for local consolidation. This means that the bulls have no volumes to retest $21k. The situation can be radically changed by the Federal Reserve meeting, where the issue of raising the key rate will be considered.

Regardless of the outcome of the central bank's meeting, bitcoin may react impulsively and break the balance established last week. Therefore, the key tasks for BTC in the coming years will be to consolidate and hold the $20k-$20.4k range in order to resume the upward movement towards $21k.