The EUR/USD pair resumed falling toward the level of 0.9782 on Monday. Tuesday morning started with a slight increase, but in my opinion, bear traders can continue to put pressure on the pair today and tomorrow. Let me remind you that one of the most important meetings of the Fed this year will take place tomorrow. The regulator may raise the interest rate by 0.75% for the fourth time and also declare that monetary policy may be tightened in smaller steps in the future. Traders may regard this statement as "dovish," as a result of which the US currency may resume its decline in the next few months.

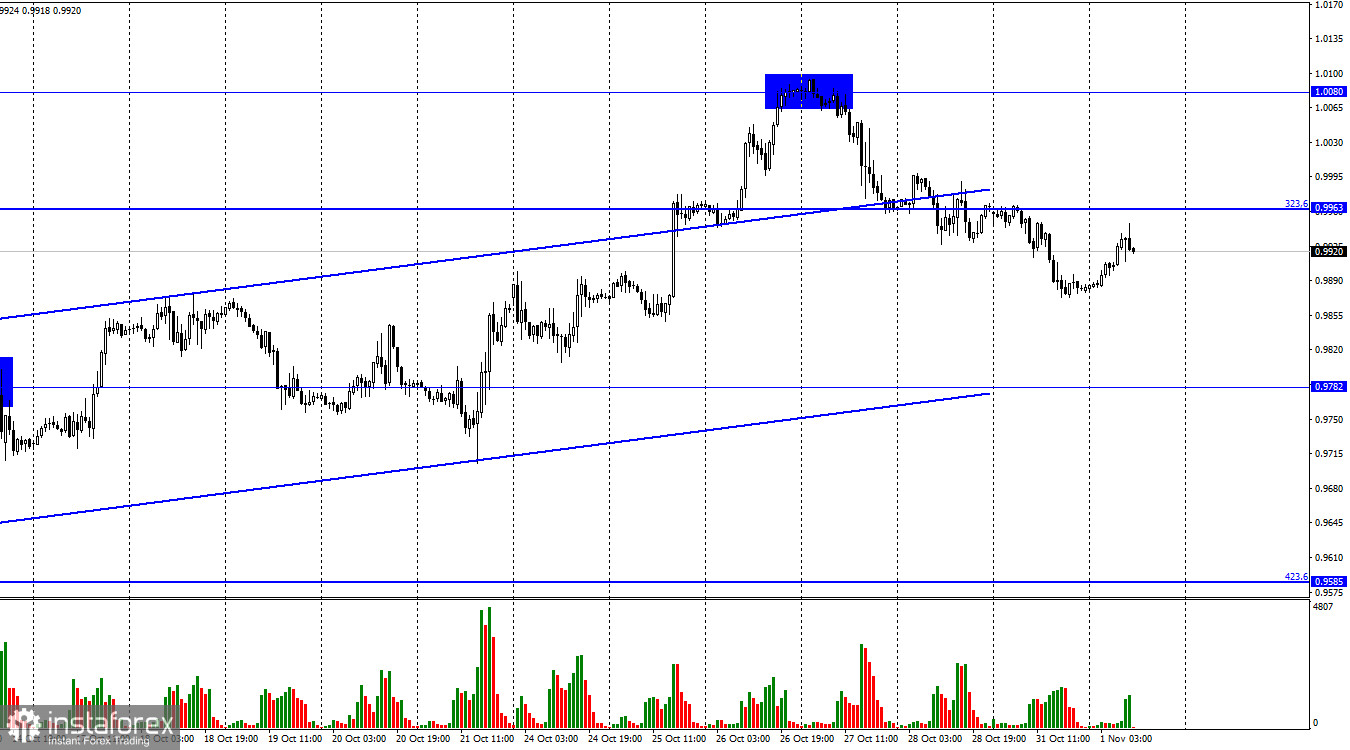

There is still an upward trend corridor on the hourly chart, which characterizes the mood of traders as "bullish." I would not say it is strong, but it is enough for the euro currency to grow slowly. Last week, the ECB raised the rate by another 0.75%, so tomorrow's Fed rate hike will be leveled. The US dollar may rise a little more before the meeting, but I expect the euro to grow in the future.

Yesterday, a rather important inflation report was also released in the European Union. It turned out that the consumer price index increased by another 0.8% y/y and is now 10.7%. Such a strong rise in prices in the European Union suggests that the ECB will have to raise the rate several times as much as possible to keep inflation from rising again. And at the same time, the Fed may reduce the pace of rate hikes. Thus, the US dollar will gradually give the initiative to the euro currency. I also cannot but mention the report on GDP in the third quarter of the EU, which showed an increase of 0.2%. It may seem to some that this is not much, but I want to note that the European economy is going through hard times, and small growth is also growth. It will still have time this winter to demonstrate a reduction due to a shortage of gas or its high cost.

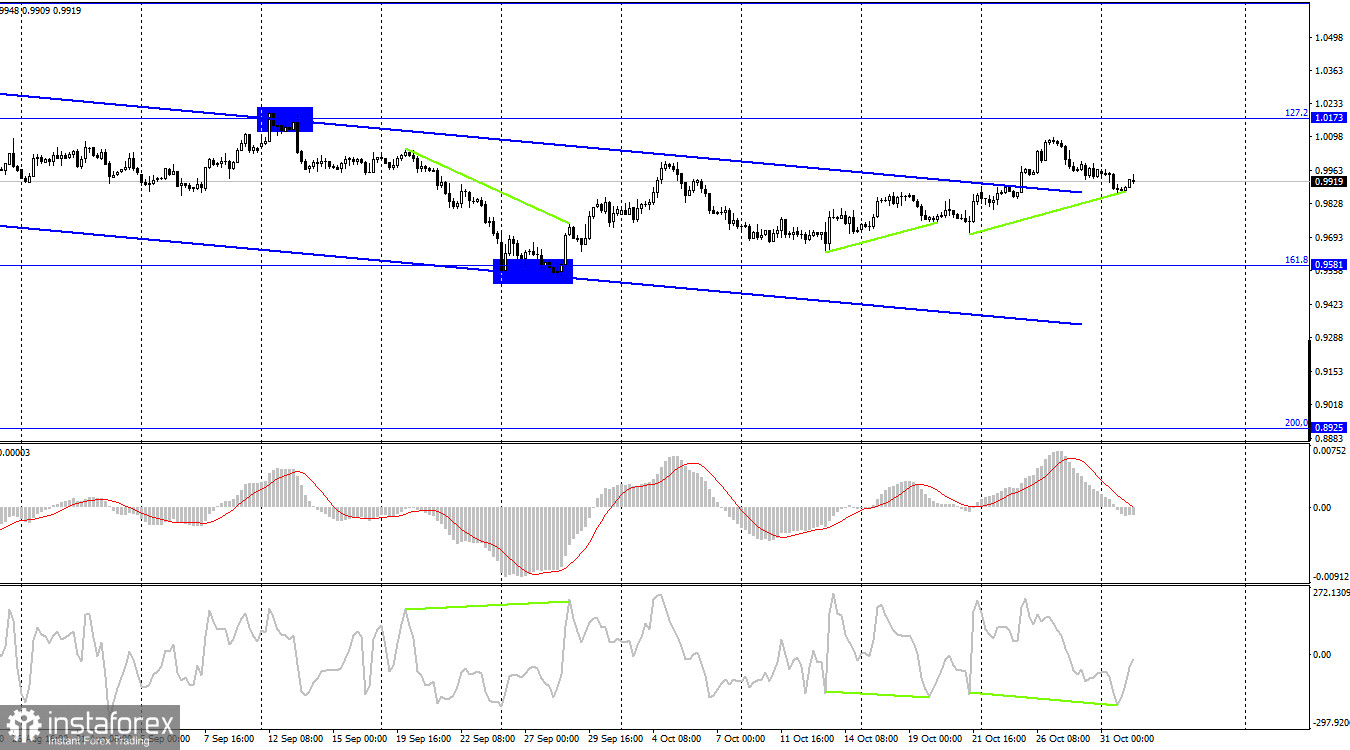

On the 4-hour chart, the pair has secured above the downward trend corridor and can continue the growth toward the corrective level of 127.2% (1.0173). This is the key moment of this month, as this consolidation changes the graphic picture from "bearish" to "bullish." A "bullish" divergence was also formed in the CCI indicator, which increases the likelihood of further growth of the euro currency.

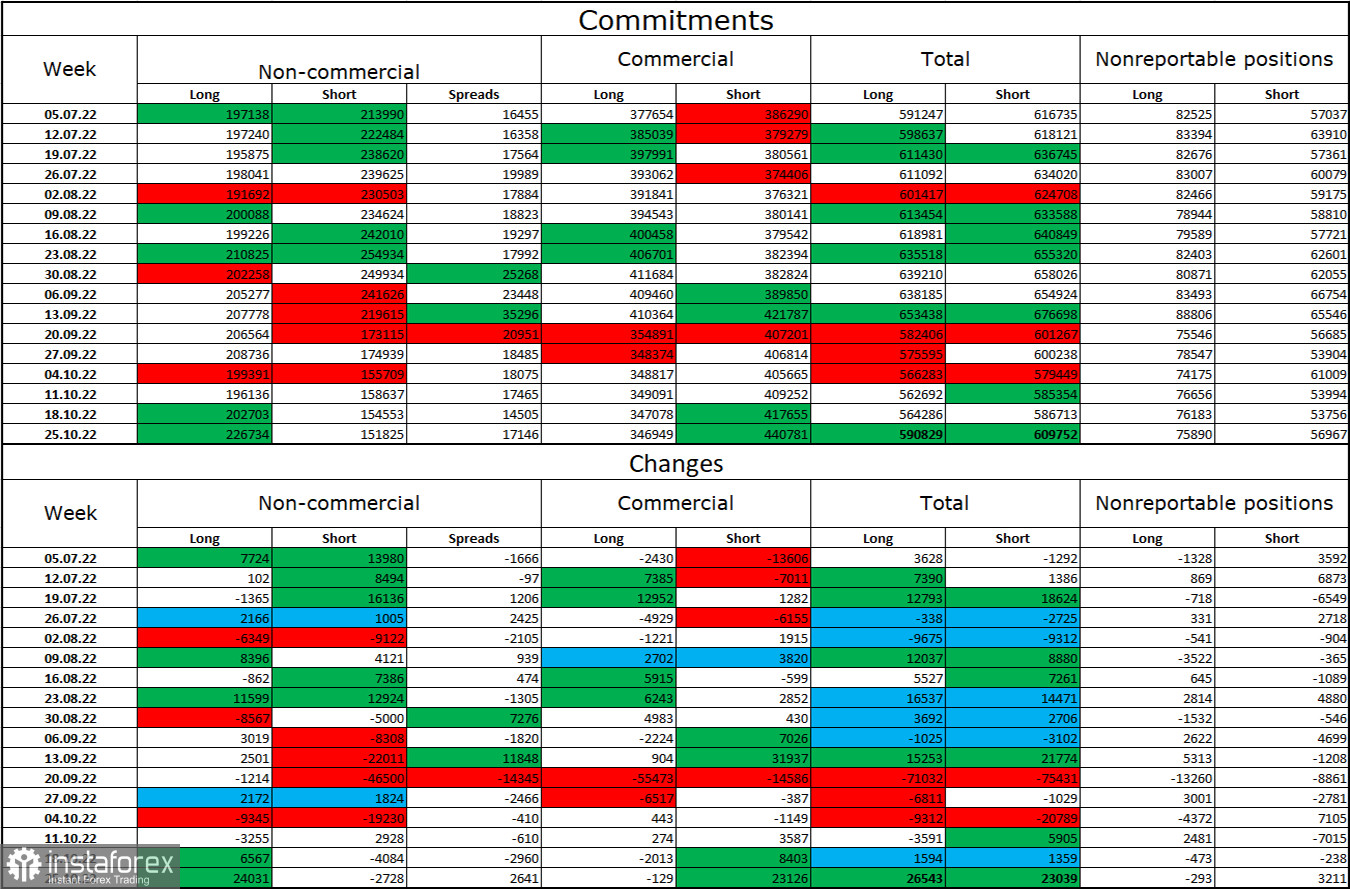

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 24,031 long contracts and closed 2,728 short contracts. This means that the mood of large traders has become more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 226 thousand, and short contracts – 151 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not ready to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, so far, even the bullish mood of the major players does not allow the euro to show strong growth.

News calendar for the USA and the European Union:

US - index of business activity in the manufacturing sector (PMI) (13:45 UTC).

US - index of business activity in the manufacturing sector (PMI) from ISM (14:00 UTC).

On November 1, the calendar of economic events in the United States contains two important entries. In the European Union today - nothing. The influence of the information background on the mood today may be average in strength.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair when rebounding from the 1.0080 level with targets of 0.9963 and 0.9782. The first level has been worked out, and we can expect a fall to the second. I recommend buying the euro currency when rebounding from the 0.9782 level on the hourly chart with targets of 0.9963 and 1.0080.