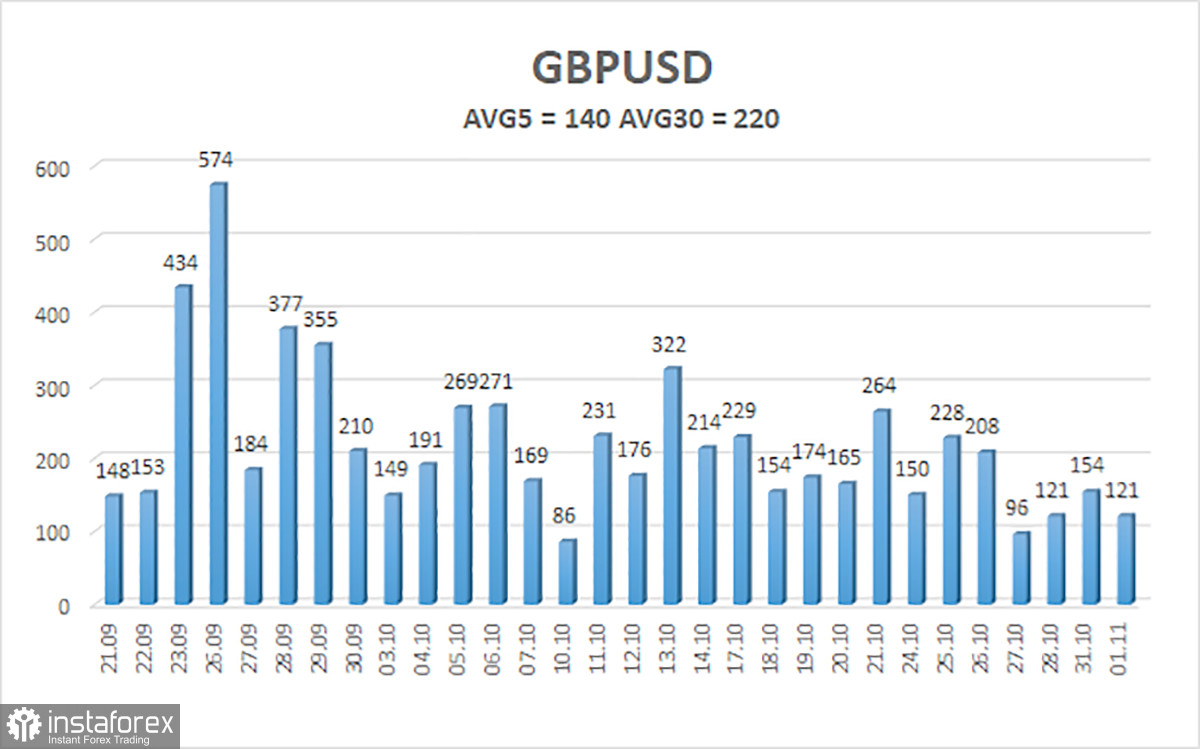

The GBP/USD currency pair has been trading very calmly over the past day, which surprises us a lot. The fact is that the results of an important meeting of the Fed will be announced today. Moreover, tomorrow – the meeting of the Bank of England. One would expect the pound/dollar pair to start moving very volatile from the beginning of the week. But instead, we see that volatility is decreasing (illustration below), and the market seems to have already taken into account any rate changes and the rhetoric of both regulators. However, it means that today and tomorrow, we can expect sharp spikes in volatility. But it will be extremely difficult to work them out since the pair can move in different directions for considerable distances for a short period.

In general, the British pound is now showing greater resistance against the dollar than the euro currency. It confidently continues to be located at a distance of about 1200 points from its annual lows. On the 24-hour TF, it has not yet been possible to overcome the Ichimoku cloud confidently, so the probability of a new fall remains the same as for the euro currency. Unfortunately for the pound, it still has no special reason to grow. As a preamble to the next paragraph, we can say that the pound fell by 1,000 points when it became known about Liz Truss' initiative to lower taxes, which would create a significant budget deficit, and increased by 1,100 points when it became known about the cancellation of this plan. Yesterday, Rishi Sunak and Jeremy Hunt decided to raise taxes for the British.

Rishi Sunak believes that taxes need to be raised

No sooner had Rishi Sunak assumed the post of Prime Minister than he immediately faced a call to hold general elections in Parliament. We wrote about this yesterday. The British opposition, represented by Labor, believes that too much time has passed since the last formation of the British Parliament, in which too many changes and permutations have fit, for which the British did not vote in 2019. Sunak refused, but the elections will still be held in 2024, so the Conservatives do not have much time to restore British confidence in their party.

And it is planned to start restoring trust, as Sunak said a few days ago, with an increase in taxes for all British citizens. Yes, you heard right. A few weeks ago, there were active talks to reduce some taxes so ordinary Britons and households could more easily cope with increased energy and heating prices. However, financier Sunak believes that the increased bills several times are not enough. The British themselves here and now should cover the budget deficit of 50 billion pounds.

From our point of view, the popularity of conservatives will only fall if the new "brilliant plan" is approved. To approve it, you won't even need the support of the opposition because, so far, the Conservatives have control over the Parliament and can make almost any decision. However, won't such an initiative lead to the resignation of Sunak himself? Yes, if taxes are raised, then the budget deficit can be avoided, but what will the British themselves say, to whom Liz Truss promised to ease their fate? Now it turns out that, on top of the highest inflation, taxes will also rise for them.

However, Sunak himself informed that wealthy citizens would pay more, and the most socially unprotected segments of the population would be provided with assistance. However, it is hard to believe that some social programs can increase taxes for poor Britons. By the way, the UK Finance Ministry also announced its intention to abandon the plan to reduce income tax from 20% to 19% in 2024, which Sunak himself proposed while still Finance Minister. No matter how it ends with a British revolt and a new change of power in the UK. The pound is holding up quite well so far, but tax increases can lead to the same devastating consequences as tax cuts, with a different sign.

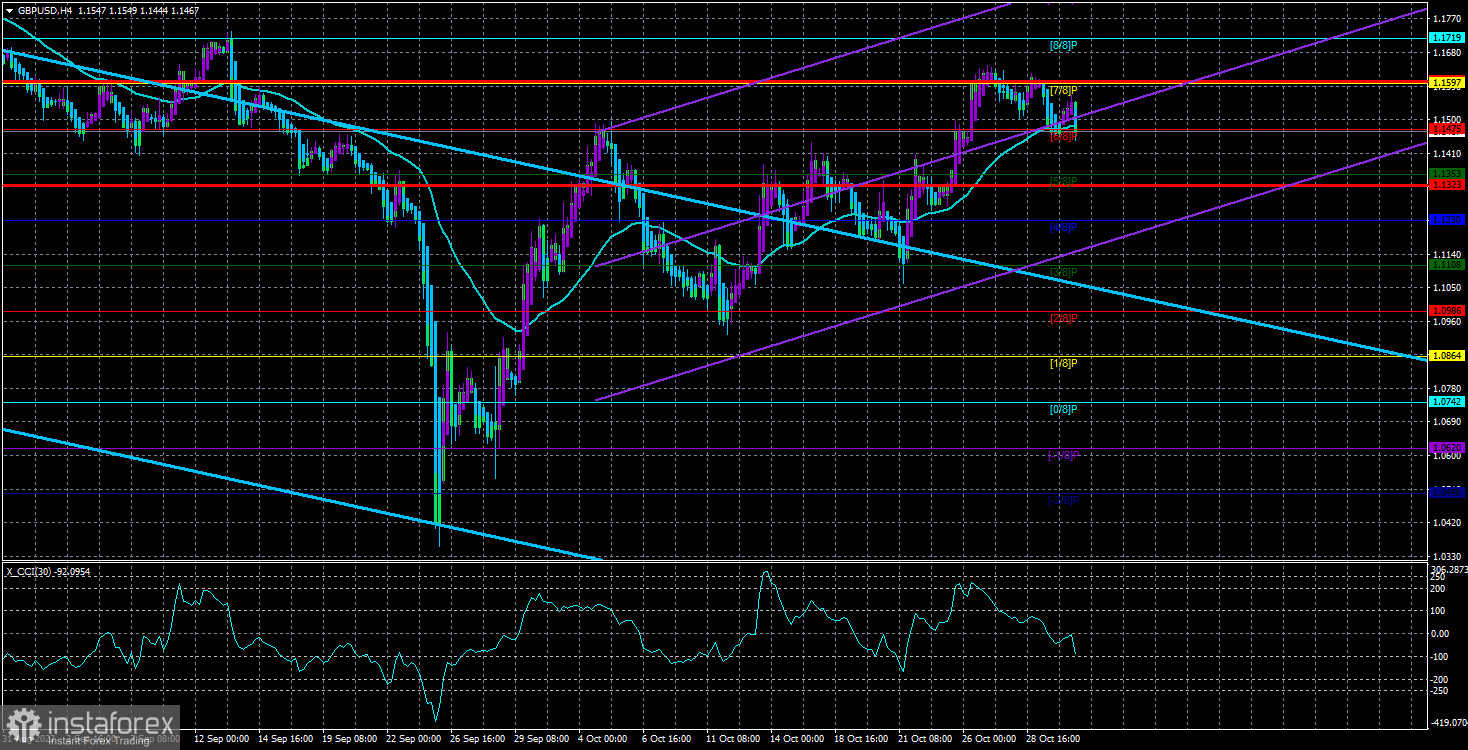

The average volatility of the GBP/USD pair over the last five trading days is 140 points. For the pound/dollar pair, this value is high. On Wednesday, November 2, thus, we expect movement inside the channel, limited by the levels of 1.1323 and 1.1601. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of movement to the north.

Nearest support levels:

S1 – 1.1475;

S2 – 1.1353;

S3 – 1.1230.

Nearest resistance levels:

R1 – 1.1597;

R2 – 1.1719;

R3 – 1.1841.

Trading Recommendations:

The GBP/USD pair continues to adjust in the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.1597 and 1.1719 should be considered in the event of a price rebound from the moving average. Sell orders should be opened when anchoring below the moving average with targets of 1.1353 and 1.1323.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now;

Murray Levels – target levels for movements and corrections;

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day based on current volatility indicators;

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.