Although yesterday, the pound sterling showed some activity, it did not bring any results. At first, the British pound was gaining in value amid the final data on the manufacturing PMI, which turned out to be slightly better than expected. Thus, the indicator declined to 46.2 points from 48.4 points instead of falling to 45.8 points. After that, the pound sterling returned to the levels recorded at the beginning of the day. The fact is that the US manufacturing PMI was also above projections. The indicator dropped to 50.4 points from 52.0 points, whereas economists had expected a decline to 49.9 points.

US Manufacturing PMI

At the moment, the pound sterling is showing just an insignificant rise. Until evening, the currency will hardly become active. Investors are unlikely to take a risk ahead of the Fed meeting at which the key interest rate could be hiked by 75 basis points. What is more, the regulator may announce that in December the benchmark rate will be hiked by 50 basis points. If the predictions come true, the market situation will hardly change significantly. However, yesterday, there were whispers that the Fed may launch a rally in the markets that will considerably boost the stock market. The fact is that the US inflation has been falling for three months in a row. This fact may force the regulator to alter its plans. That is why Jerome Powell may hint about a slower key interest rate hike or even about a first cut early next year. Taking into account such a possibility, traders will hardly take a risk ahead of the press conference.

Fed Key Interest Rate:

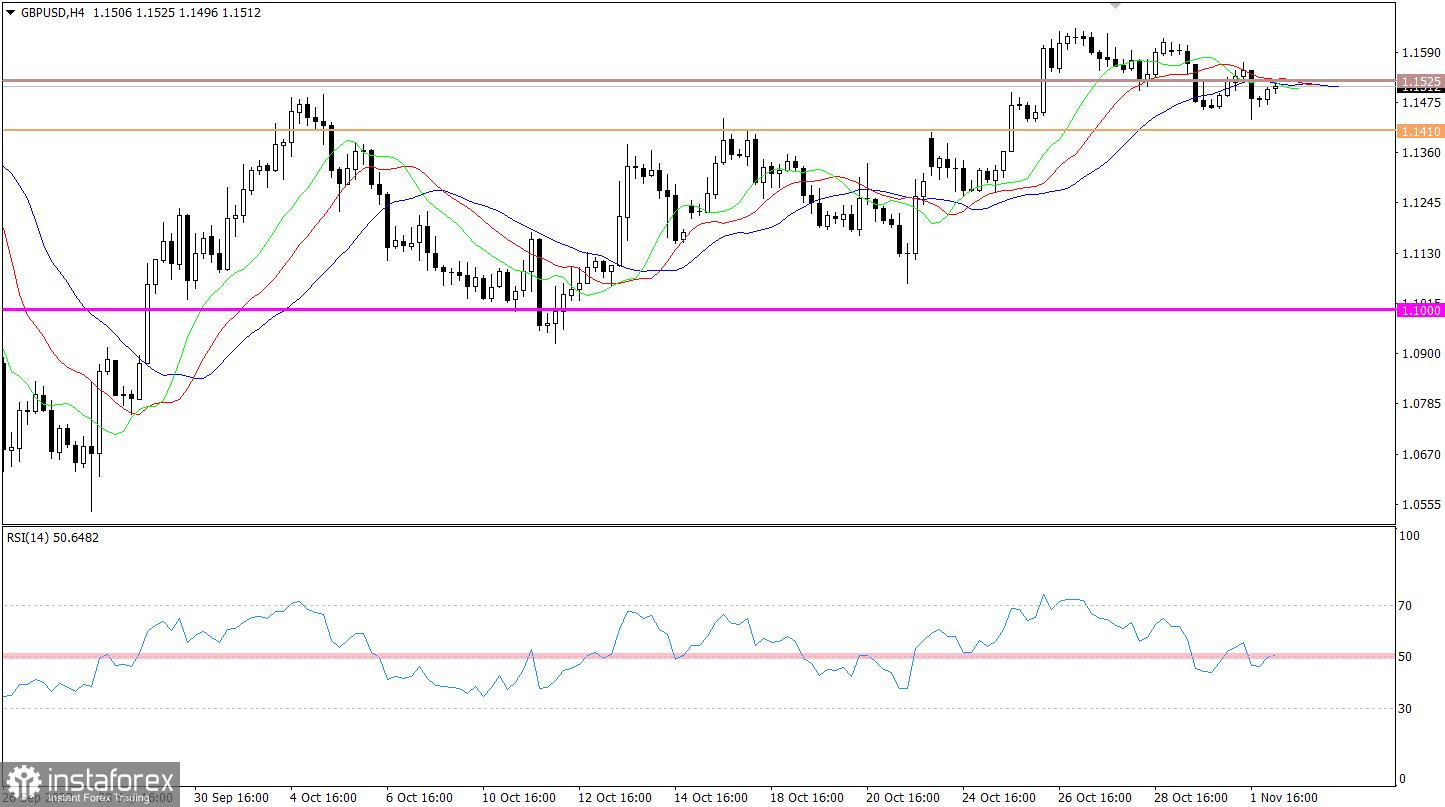

The pound/dollar pair is hovering within the limits of the earlier broken range of 1.1410/1.1525, showing moderate activity. In recent days, the price movement has been looking more like stagnation where the area of 1.1410/1.1525 has been acting as support.

On the four-hour chart, the RSI indicator is moving along the mid line 50, which proves stagnation. On the daily chart, the indicator is hovering in the upper area of 50/70, thus pointing to the bullish sentiment among traders.

On the four-hour chart, the Alligator's MAs have numerous intersections, which also confirms stagnation. On the daily chart, the indicator points to the upward cycle. The MAs are headed upwards.

Outlook

The current level is likely to affect traders' positions. However, the situation may change soon. The fact is that speculative activity is likely to surge during the US trade.

The upward cycle will become possible if the price climbs above 1.1600. If the price settles below 1.1400, it is likely to go on falling.

In terms of the complex indicator analysis, we see that the in the short-term and intraday periods, there is a mixed signal because of the price stagnation. In the mid-term period, we see buy signals caused by the upward cycle from the low of the trend.