Traders have long been questioning who manipulates prices in the gold market. Recent events show that if such a manipulator exists, it is central banks. In 2022, they purchased record volumes of gold since 1967. Aggressive tightening allowed them to buy the bullion cheaper.

The main driver of the XAU/USD quotes is not demand and supply but monetary policy. Those who doubt that should look at the federal funds rate. The Federal Reserve announced the first 0.25% rate hike in March. In May, the regulator raised rates already by 0.50%. Then, three 0.75% rate increases followed. A similar rate rise is expected in November. In light of the most aggressive tightening cycle in 40 years, gold plunged by 22% from its March high of $2,078 per ounce and hit the Double Bottom that formed in September-October.

The fall came due to the outflow of money from ETFs and an increase in demand for the precious metal among jewelers and central banks. According to the World Gold Council, gold demand reached 1,181 tonnes in the third quarter, up by 28% compared to the same period in 2021. Between September and December, central banks bought 673 tonnes of gold, the highest annual figure since 1967.

Central Bank Gold Demand

Central banks of Turkey, Uzbekistan, Qatar, and India appeared among the largest buyers of gold. Meanwhile, some regulators, namely China's and Russia's, intended to keep their purchases secret, Reuters pinpointed. Taking the account of this data, central banks can hardly be called manipulators. Indeed, Ankara, Beijing, and Moscow have been cutting interest rates lately. The fall in the XAU/USD quotes came due to aggressive tightening by the Federal Reserve and other world central banks.

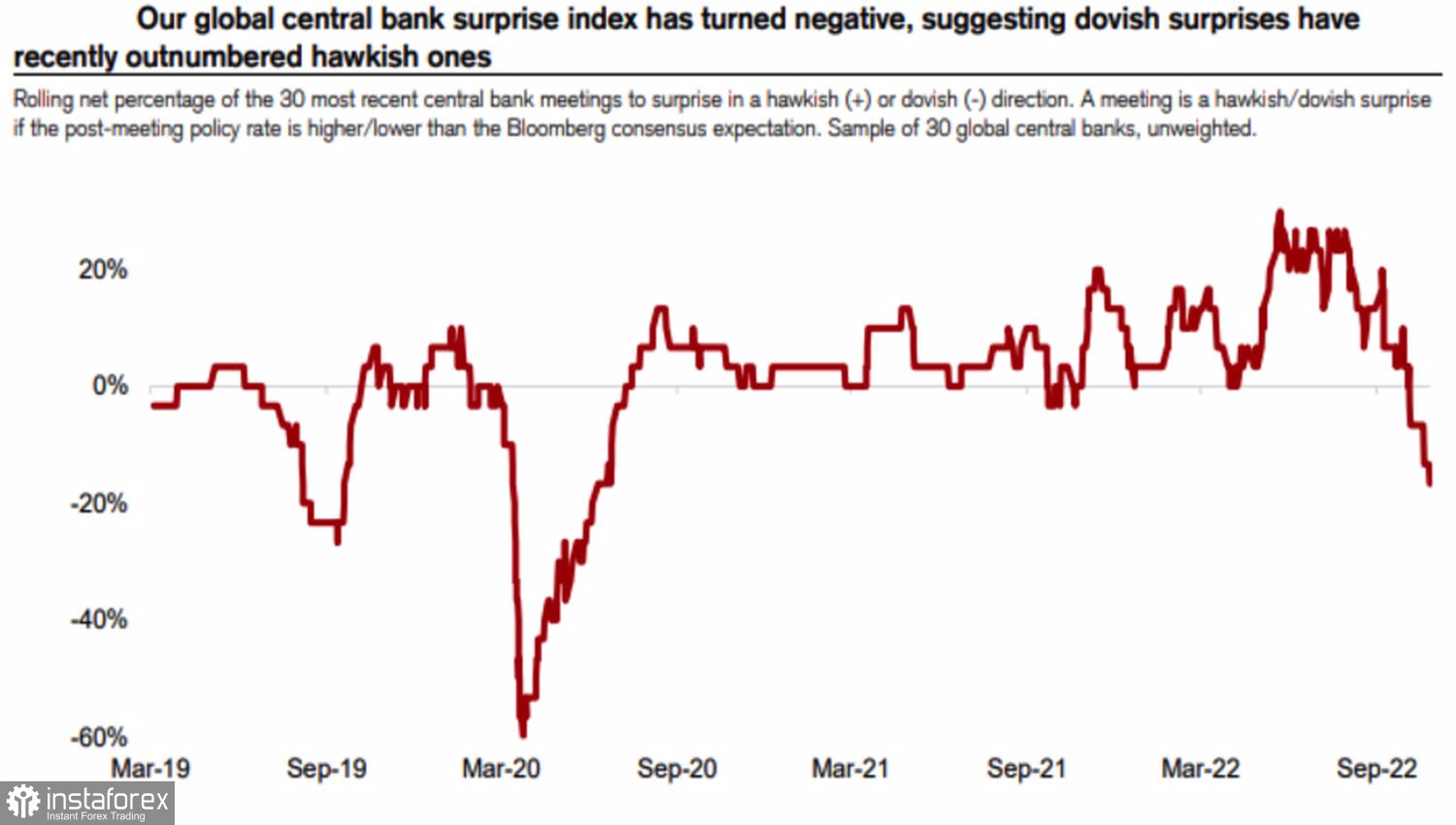

There has been increasing speculation that the tightening cycle is coming to an end. JP Morgan claims it will happen in early 2023. At the same time, Credit Suisse said, citing the global central bank surprise index data, that the peak of aggressiveness ended back in August.

Global Central Bank Surprise Index

If these assumptions are correct, it also means that the US dollar index is about to peak as well. The greenback's reversal could boost gold. It remains to be seen whether Chairman Powell will hint at the November meeting at the possibility of a reduction in the pace of rate hikes to 0.50% in December. If such a signal comes, the XAU/USD quotes will soar.

On the daily chart of the precious metal, there is a combination of the Double Bottom and 1-2-3 patterns. A breakout to $1,665 per ounce may activate the formation and give a buy signal. Alternatively, if gold goes below $1,630 per ounce, it will generate a sell signal with targets at $1,580 and $1,550.