Today, what many are expecting will not happen: it is unlikely that the Federal Reserve will announce a change in the future course of its policy, so it is possible that we may repeat the summer scenario, when everyone was about to expect one thing from the FOMC, but everything turned out completely otherwise. Let's figure out what to expect and how best to act today.

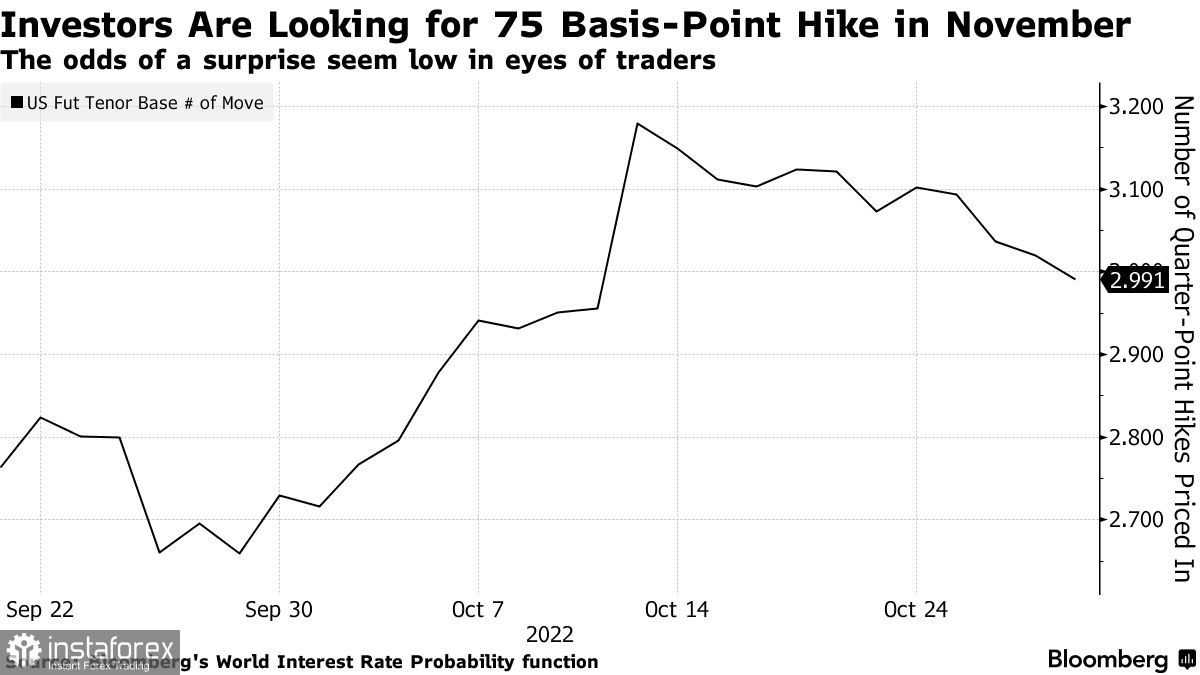

Most likely, the US central bank will hold a fourth super-scale interest rate hike, and Fed Chairman Jerome Powell will repeat his pledges to fight inflation. But whether it will open the door for a possible rate cut in the future is a big question. The Federal Open Market Committee is expected to raise rates by 75 basis points on Wednesday, to a range of 3.75% to 4%, the highest level since 2008. By doing so, the central bank will continue its most aggressive tightening campaign since the 1980s.

During his press conference, Powell may emphasize that the Fed remains steadfast in the idea of fighting inflation, leaving open options for further aggressive rate hikes at a meeting in mid-December this year. However, the markets are already divided into two camps: some expect another rate hike of 0.75%, while others believe that the Fed will slow down and raise them by only 50 basis points.

As I noted above, Powell's July speech was misinterpreted by investors as a short-term policy reversal, in response to which the markets rallied, which softened financial conditions and reflected on bond yields. This made it more difficult for the Fed to contain prices, which forced Powell to return to a tough tone of statements again. With the latest CPI data coming out, the Fed needs to continue to maintain tight financial conditions to keep the economy cool, only to help stop price increases in the near future.

Another important point is that the expected move from the Fed today will take place less than a week before the midterm elections in the United States, where the main accusations from Republicans are based precisely on high inflation, which was allowed by the Democratic Party and US President Joe Biden. Last week, two Democratic senators urged Powell not to cause unnecessary pain to the economy by raising rates too high.

As for the statements made today after the meeting, the dollar's succeeding direction will depend on them. If promises of a "further increase" in interest rates persist, the US dollar will strengthen its position against the euro and the British pound, as well as other risky assets. If the promises are "slightly changed", for example, in order to show that the Fed is getting closer to the economy, then this may have a positive impact on stock markets and risky assets, which will pull up the euro and the British pound.

Most likely, the Fed will recall its plans to reduce its huge balance sheet. Economists predict that the balance will reach $8.5 trillion by the end of the year before dropping to $6.7 trillion in December 2024.

As for the technical picture of EURUSD, the bears actively counterattacked, which led to a new wave of decline. For growth, it is necessary to return the pair above 0.9900 and 0.9950, which will spur the trading instrument to growth towards 1.0000 and 1.0040. However, the upward prospects will depend entirely on the further reaction of buyers of risky assets to the Fed meeting. The breakthrough of parity has taken place, which, for now, allows us to keep the market at the mercy of the bears. An exit below 0.9850 will increase the pressure on the trading instrument and push the euro to a low of 0.9820, which will only aggravate the position of buyers of risky assets in the market. Having missed 0.9820, it will be possible to wait for new lows around 0.9780 and 0.9750.

As for the technical picture of the GBPUSD, although the pound is being corrected, it has already reached quite important levels. Now the bulls are focused on defending the support at 1.1500 and breaking through the resistance at 1.1550, limiting the pair's growth potential. Only a break of 1.1550 will return prospects for recovery to the area of 1.1610 and 1.1690, after which it will be possible to speak of a sharper upward spurt of the pound, to the area of 1.1730 and 1.1780. We can talk about the trading instrument being under pressure after the bears take control of 1.1500. This will deal a blow to the bulls' positions and completely cancel out the short-term prospects of the bull market. A break of 1.1500 will push the GBPUSD back towards 1.1440 and 1.1345.