The events of the previous trading week indicate that buyers have begun to return to the cryptocurrency market. Bitcoin and major cryptocurrencies have gone beyond the consolidation channels and are moving towards local highs.

There is a recovery of on-chain metrics of daily trading volumes and activity of unique addresses in the BTC network after a decline over the weekend. This is an important signal of growing buying activity and the desire to continue moving upward.

Fed meeting

On November 2, an important meeting of the Fed is expected, where the markets can hear key theses about the future policy of the regulator. Over the past few months, the uncompromising position of the Fed has led the markets to expect a recession in the US economy in the next six months.

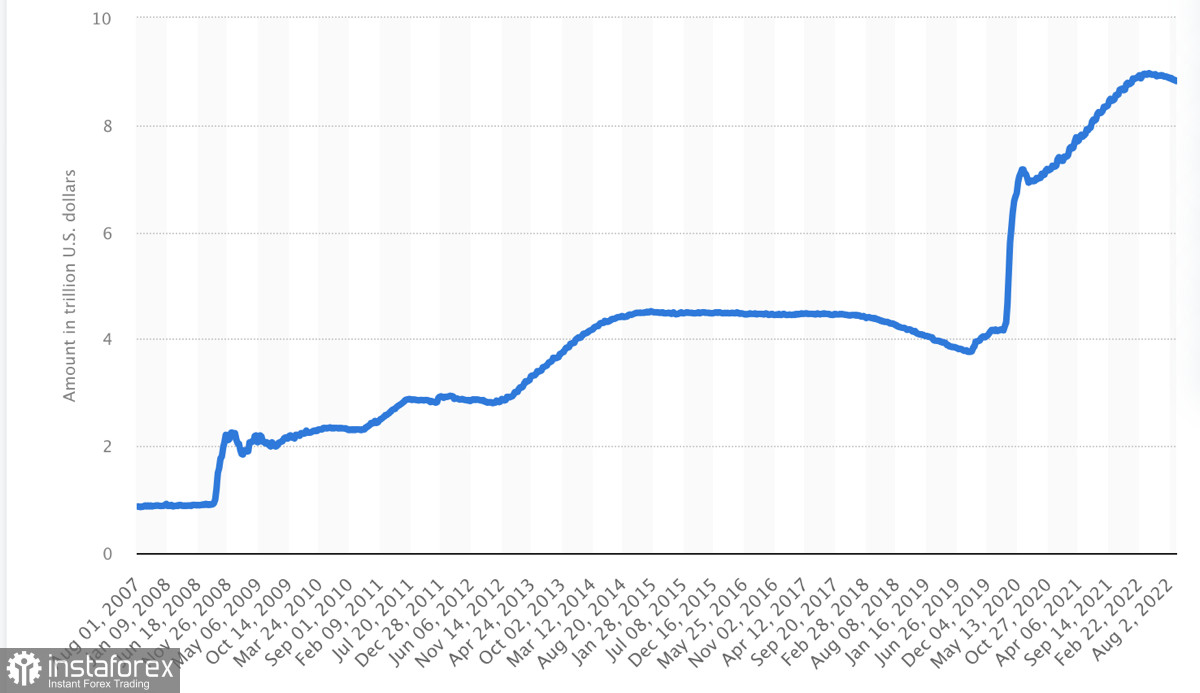

At today's meeting, investors want to hear signals from the regulator about a change in current policy. In anticipation of the meeting, Morgan Stanley experts noted that the money supply in the markets has declined significantly. This means that in the coming months, inflation will begin to decline rapidly.

If the Fed comes to a similar conclusion, it will fuel another upward spurt for cryptocurrencies and stock indices. At the same time, it is expected that the key rate will again be raised by 75 bps, but this decision is already included in the price.

The state of the markets before the Fed meeting

The main stock index S&P 500 has reached a resistance zone near the $3,900 level. Over the past five days, a clear dominance of the bears is visible, and the technical metrics on the daily timeframe are gradually turning sideways. This means that the SPX has lost its local bullish momentum.

The US dollar index locally recovered to the level of 111, but subsequently, the buying activity decreased. The stochastic oscillator has formed a bearish crossover, which indicates the dominance of sellers.

Overall, the DXY is dominated by selling with sluggish attempts by the bulls to even out the situation. The correction of the US dollar index continues, which is a positive signal for BTC.

Local bottom not formed?

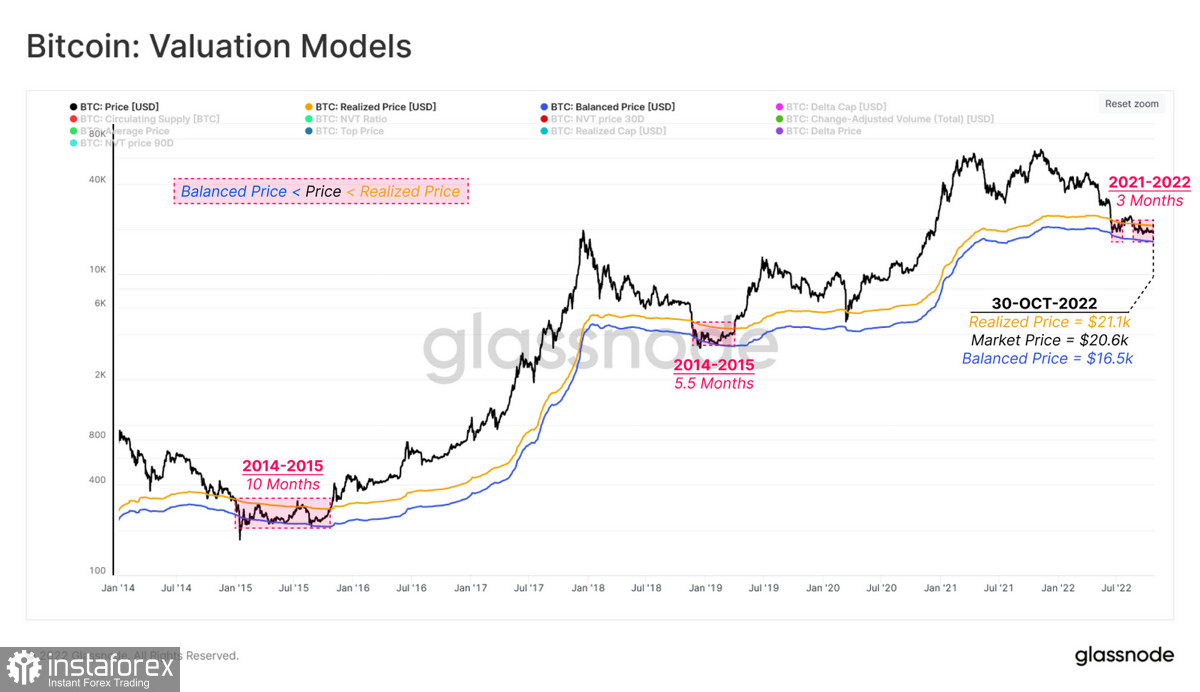

Glassnode analysts said in a weekly report that there are no signs of a local market bottom forming. It is likely that in the near future, Bitcoin will need an additional "redistribution" phase, during which large amounts of BTC will pass into the hands of long-term owners.

For the market, this means an increase in volatility and impulsive price movements in order to knock out investors' positions. There is already growing volatility in BTC, which will break the asset's correlation with gold and make the cryptocurrency more unpredictable.

In addition, daily BTC trading volumes on exchanges reached $543 billion. This value is the lowest since December 2020. Increased volatility and low trading volumes are ideal conditions for an additional stage of "redistribution," so active trading in the market will become more dangerous in the near term.

BTC/USD Analysis

Given the data from Glassnode, one can conclude that massive amounts of liquidity below the $17.6k level will be collected. As of November 2, Bitcoin is trying to gain a foothold above the downward trend line at $20.4k.

After the Fed meeting, there will be a surge in volatility that can send the price in any direction. In the next few days, it will become clear whether BTC is ready for further upward movement or to retest the local bottom.

An increase in the key rate and Powell's statements on the future policy of the Fed will help Bitcoin either gain a foothold above $20.4k. This will allow the cryptocurrency to continue its bullish move to the $22k level. If it finally consolidates below $20k, the price will head towards the $19.5k support zone and continue its downward movement towards the current market bottom.