Former Treasury Secretary Larry Summers said the Fed should pursue its current policy. Moreover, he warned that expectations that the central bank would reverse its policy were unreasonable and exacerbated the situation among economists due to pushing up inflation.

Stocks rose ahead of the Federal Reserve meeting on Wednesday.

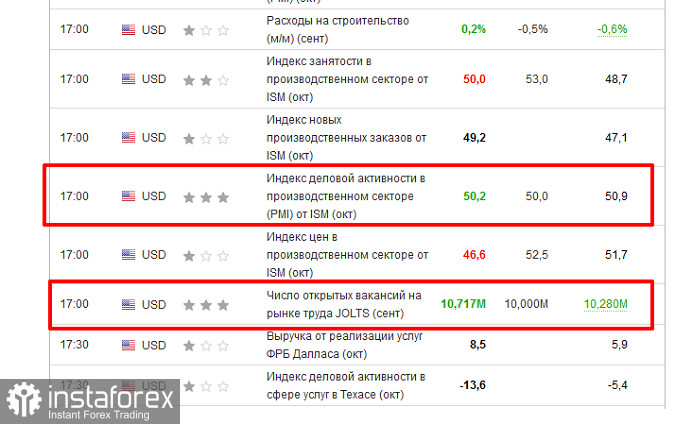

European stocks and futures and US stocks gained after the S&P 500 fell on Tuesday. This was triggered by a surge in job openings in the labor market:.

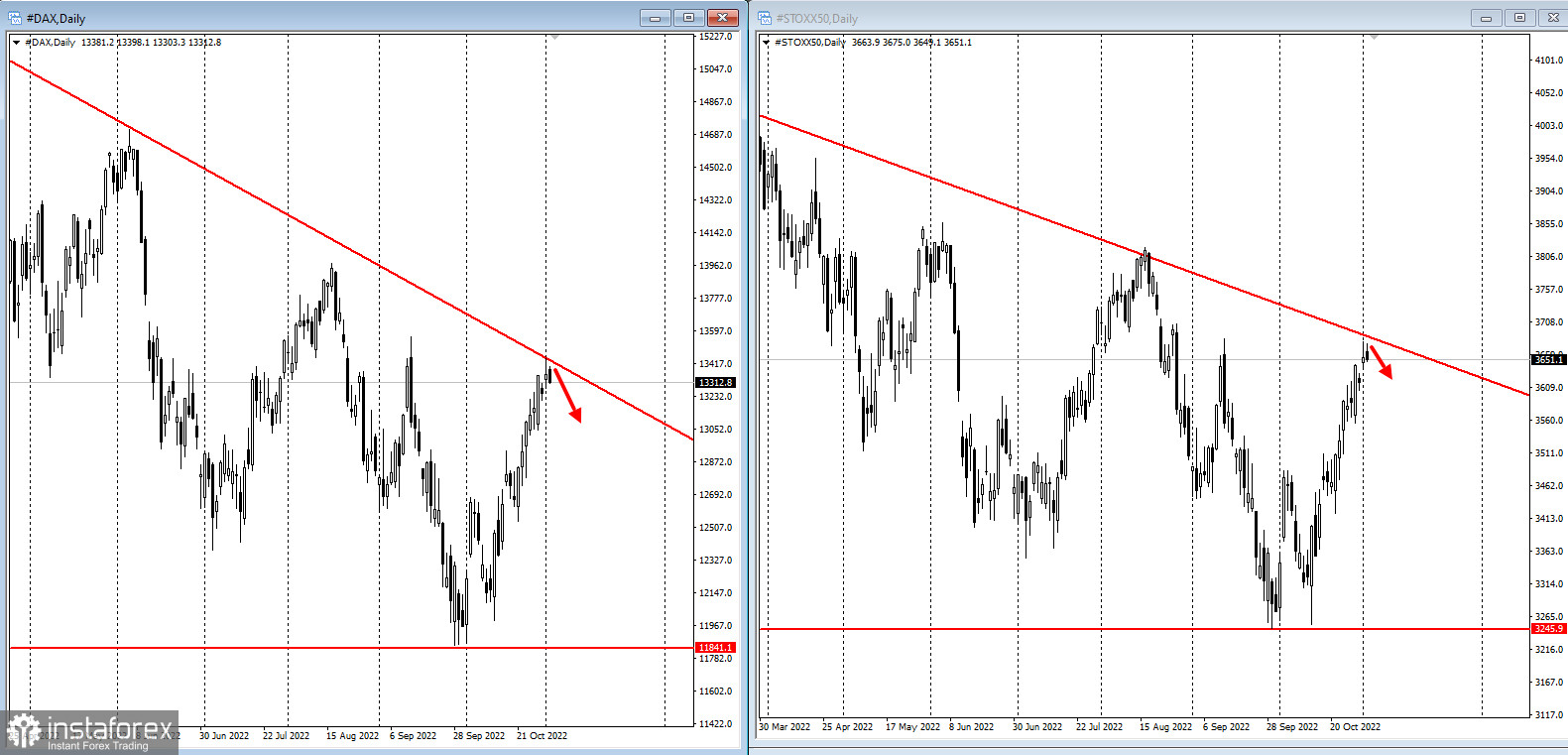

European stock indices are trading above their US counterparts. So far, they have bounced off trend resistance with great downside potential:

Traders are discussing mixed economic data ahead of the Fed meeting. The central bank is likely to raise interest rates by 75 basis points for the fourth straight time. Therefore, the upper limit of the target range will reach 4%, the highest level since 2008 as it continues its most aggressive tightening campaign since the 1980s.

10-year Treasury yields were trading slightly above 4%, while 2-year Treasury yields remained at nearly 4.5%.

Meanwhile, China announced a seven-day lockdown around Foxconn Technology Group's main plant in Zhengzhou. This move will severely cut shipments to the world's largest iPhone factory.

Oil prices rose after reports that US crude stocks were shrinking. The Moscow Exchange Index reacted positively to this news:

Key events this week:

- EIA crude oil inventory report, Wednesday

- Federal Reserve rate decision, Wednesday

- US MBA mortgage applications, ADP employment, Wednesday

- Bank of England rate decision, Thursday

- US factory orders, durable goods, trade, initial jobless claims, ISM services index, Thursday

- ECB President Christine Lagarde speaks, Thursday

- US nonfarm payrolls, unemployment, Friday