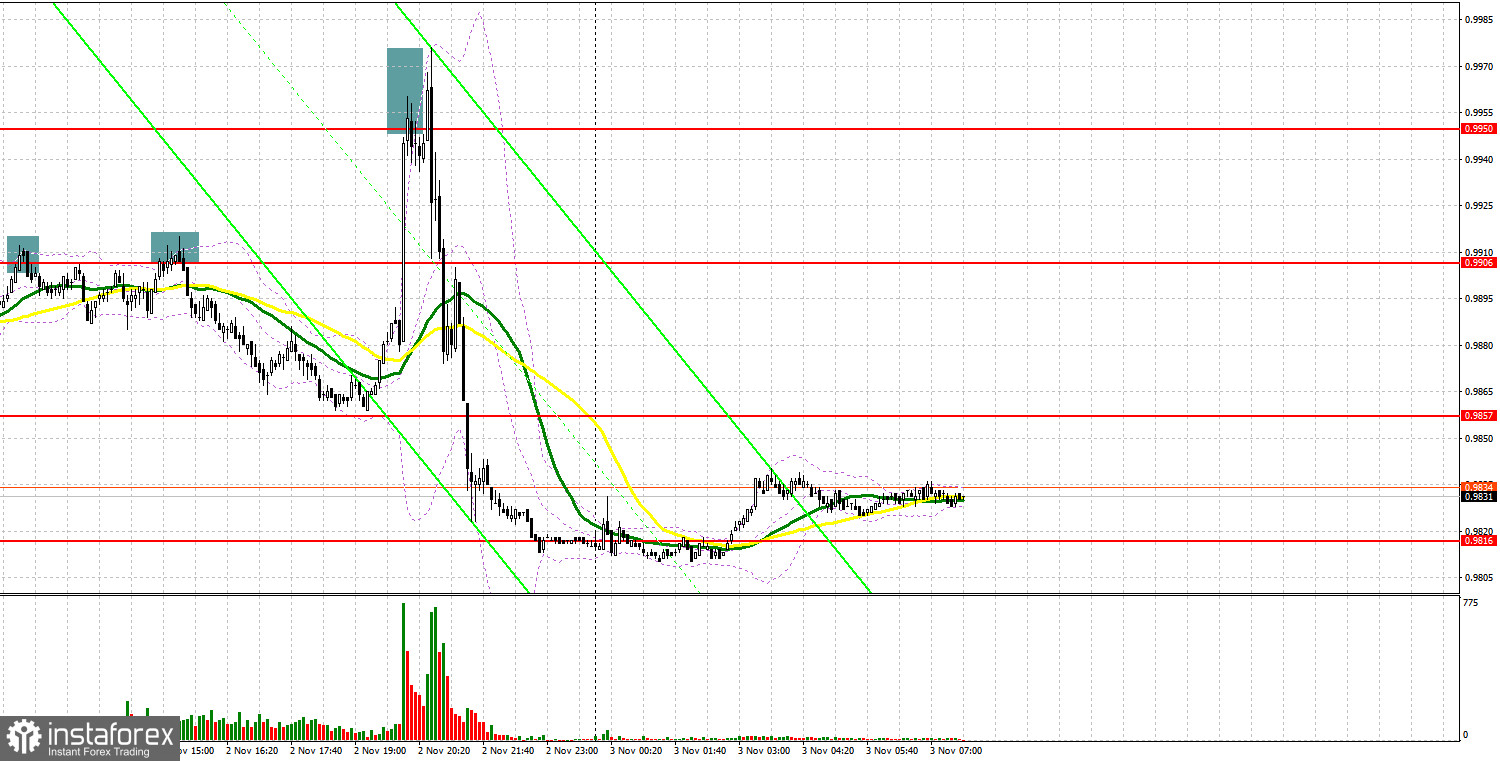

Yesterday several excellent market entry signals were formed, which made it possible to make good money. Let's take a look at the 5-minute chart and see what happened. Earlier, I asked you to pay attention to the 0.9906 to decide when to enter the market. Growth and a false breakout of this level provided traders with a short signal. As a result, the pair fell by 20 pips. In the afternoon, before the ADP report was released, another sell signal was formed from 0.9906, which resulted in a fall by more than 50 points. After the announcement of the Federal Reserve's decision, the euro strengthened, but it failed to cling to 0.9950 - a false breakout and a signal to sell. As a result: a fall by more than 120 points.

When to go long on EUR/USD:

Yesterday, the Fed raised interest rates and said that it is not ready to retreat from its goals yet and is not going to change policy in the near future. This resulted in the euro's fall and another big sell-off. During a speech by Fed Chairman Jerome Powell, it was stated that fundamental statistics will now be of particular importance, allegedly hinting that as soon as the economy starts to break down, the committee may seriously consider curtailing aggressive measures. Until that moment, no one will do anything, since the key goal is to return inflation to a level of 2.5%. This morning we are waiting for the figures on the unemployment rate in the euro area and the speech of European Central Bank President Christine Lagarde. It is unlikely that this will seriously help the euro in any way, so I bet on its further fall against the US dollar - especially before tomorrow's data on the US labor market.

In case the pair goes down, a false breakout in the area of the nearest support at 0.9800 will become a reason for building up longs with the prospect of stopping the bear market and a pause before tomorrow's reports. We can talk about the bulls' attempts to regain control over the market only after a breakthrough and settlement above 0.9844. A downward test of this level will open a direct path to 0.9887, where the moving averages pass, limiting the upward potential. A breakout of this level would hit the bears' stop orders and give a long signal with the possibility of moving to the 0.9930 area, which would strengthen the bullish correction. An exit above 0.9930 will serve as a reason for growth to the area of the weekly high of 0.9973, where I recommend to lock in profits. If the pair falls and bulls fail to protect 0.9800, then the pair will be under pressure, leading to another big drop. In this case, a false breakout of the support level near 0.9755 will give a long signal. It is also possible to go long after a bounce off the support level of 0.9706, or even lower - from 0.9679, expecting a rise of 30-35 pips.

When to go short on EUR/USD:

The bears have taken over the market after Powell's speech from yesterday, and most likely they will try to further push the euro even lower. Bears should protect the resistance at 0.9844, but even if you miss this level, nothing bad will happen. A false breakout at 0.9844 will give a good sell signal after obscure statistics on the unemployment rate in the eurozone and Lagarde's speech, which will provide a good entry point and allow a return to 0.9800. Settlement below this range, as well as an upward test, will be a reason to sell EUR/USD in order to remove bullish stops and a larger fall to the 0.9755 area, where bears will again face serious problems. The farthest target will be the area of 0.9706, where I recommend taking profits.

If EUR/USD moves up during the European session and bears fail to protect 0.9844, we may see a jump, which will lead to a correction to the 0.9887 area, where the moving averages are. In this case, I advise you not to rush into selling: I recommend opening shorts only if a false breakout is formed at 0.9887. It is also possible to go short after a rebound from the high of 0.9930, or even higher - from 0.9973, expecting a decline of 30-35 pips.

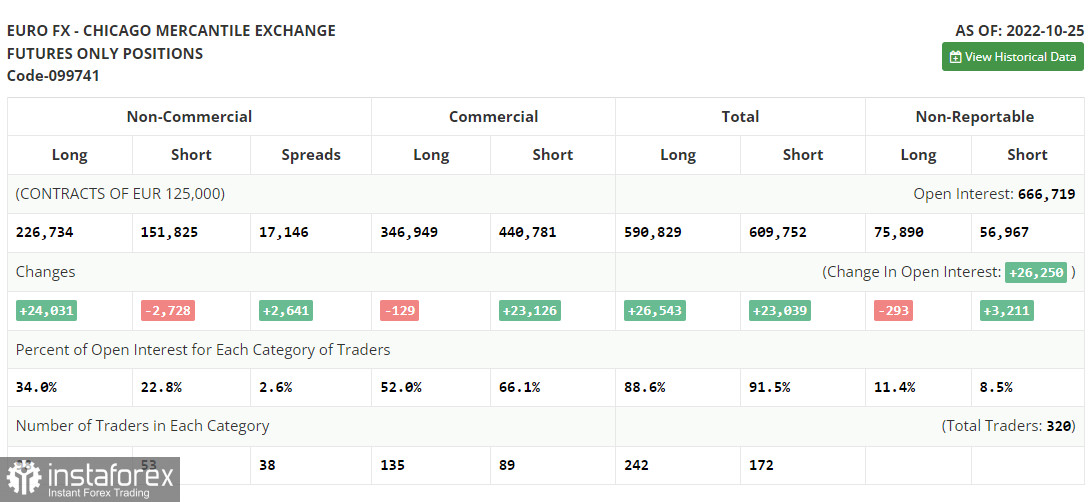

COT report:

According to the recent Commitment of Traders (COT) report from October 25, the number of short positions declined, whereas the number of long positions increased. It is obvious that demand for the US dollar has fallen. The fact is that there are more and more signs of an economic recession caused by the extremely aggressive Fed policy. It is highly possible that this week, the FOMC will raise the benchmark rate and will continue doing this ignoring economic problems until inflation starts sliding. However, the upward potential of the euro is also limited. Not so long ago, the ECB said that it might revise its policy and switch to a more dovish approach if the eurozone economy contracted even more. According to the COT report, the number of long non-commercial positions increased by 24,031 to 226,734, while the number of short non-commercial positions declined by 2,728 to 151,825. At the end of the week, the total non-commercial net position remained positive at 74,909 compared to 48,150 a week earlier. This indicates that investors are benefiting from the situation and continue to buy the cheap euro below parity, as well as accumulate long positions, expecting the end of the crisis. The weekly closing price rose to 1.0000 from 0.9895.

Signals of indicators:

Moving averages

Trading is performed below the 30- and 50-day moving averages, which shows that the pair is still under pressure.

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro/dollar pair rises, the upper limit of the indicator located at 0.9900 will act as resistance. If the pair drops, the lower limit of the indicator around 0.9800 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.