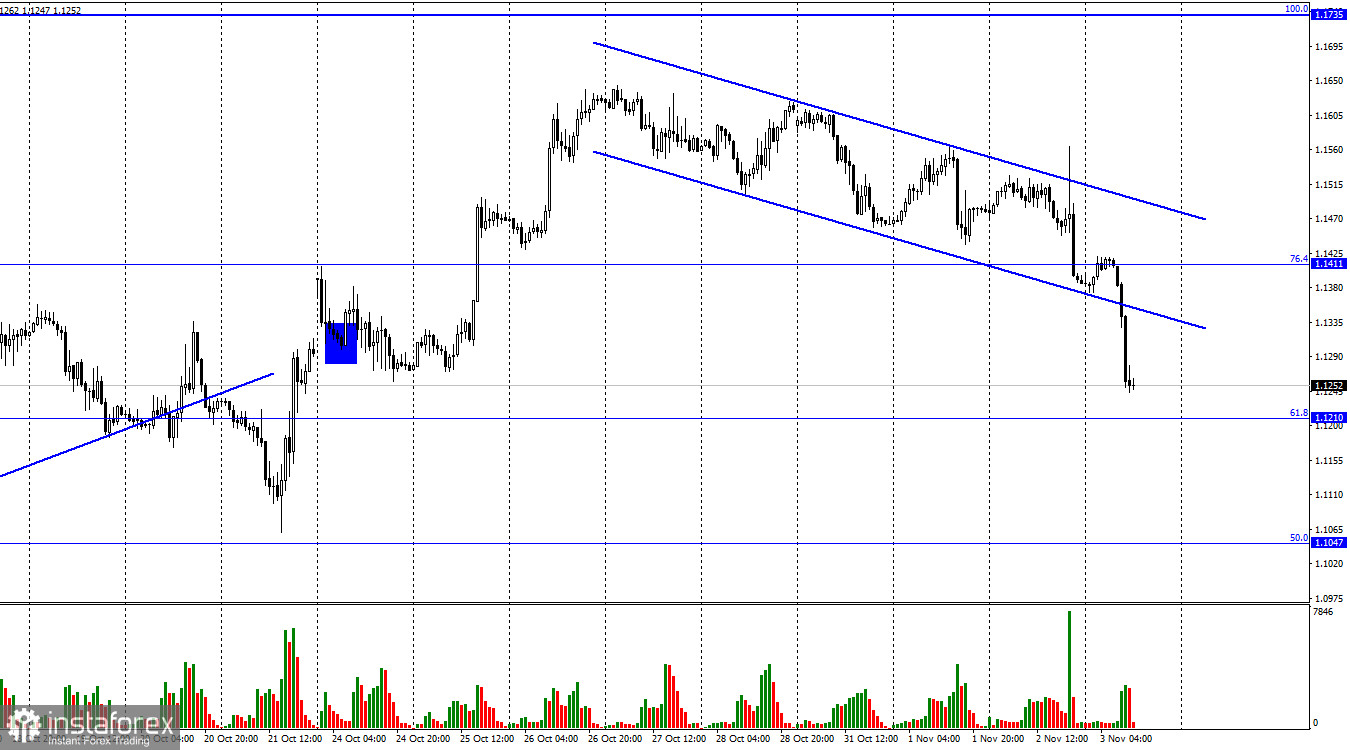

On Wednesday, GBP/USD continued to fall on the H1 chart. The pair intensified its decline as soon as traders learned the results of the FOMC meeting. By the time of writing, the pound has depreciated by as much as 230 pips and continues to fall. A rebound from the Fibonacci retracement level of 61.8% at 1.1210 may be in favor of the pound and may push it towards the next retracement level of 76.4% at 1.1411. A firm hold below the area of 1.1210 will pave the wave for a further decline towards the Fibo level of 50.0% at 1.1047.

Apart from another rate hike by the Fed and the hawkish rhetoric of its Chair Jerome Powell, it is worth noting his words about the so-called "soft landing". According to Powell, the chances for a soft landing for the US economy are getting slimmer. This may be viewed as a hint that next time the rate will be higher than expected which puts the economy at risk of a recession. Before that, the FOMC hoped that there would be no need to lift the rate to such a high level. So, markets assumed that the period of a rate-hiking cycle would soon come to an end. Inflation was supposed to slow down and the Fed was expected to ease monetary tightening before the economy starts to contract. Now, this scenario seems very unlikely. Yet, traders prefer to downplay this fact as the US dollar continues to rise in the course of the day.

The Bank of England will release the results of its policy meeting in a few hours. Against this backdrop, the pound/dollar pair may face strong fluctuations. It is almost certain that the Bank of England will raise the rate. I bet that the regulator will introduce a 75-basis-point rate hike but some traders assume that the increase can be much lower. Anyway, the market will react to this event. Half an hour later, BoE Governor Andrew Bailey will speak, and his rhetoric will also shape the market sentiment. Yesterday, it was not the rate hike itself that caused a reaction among traders but rather comments made by Jerome Powell. The same may happen today with the BoE.

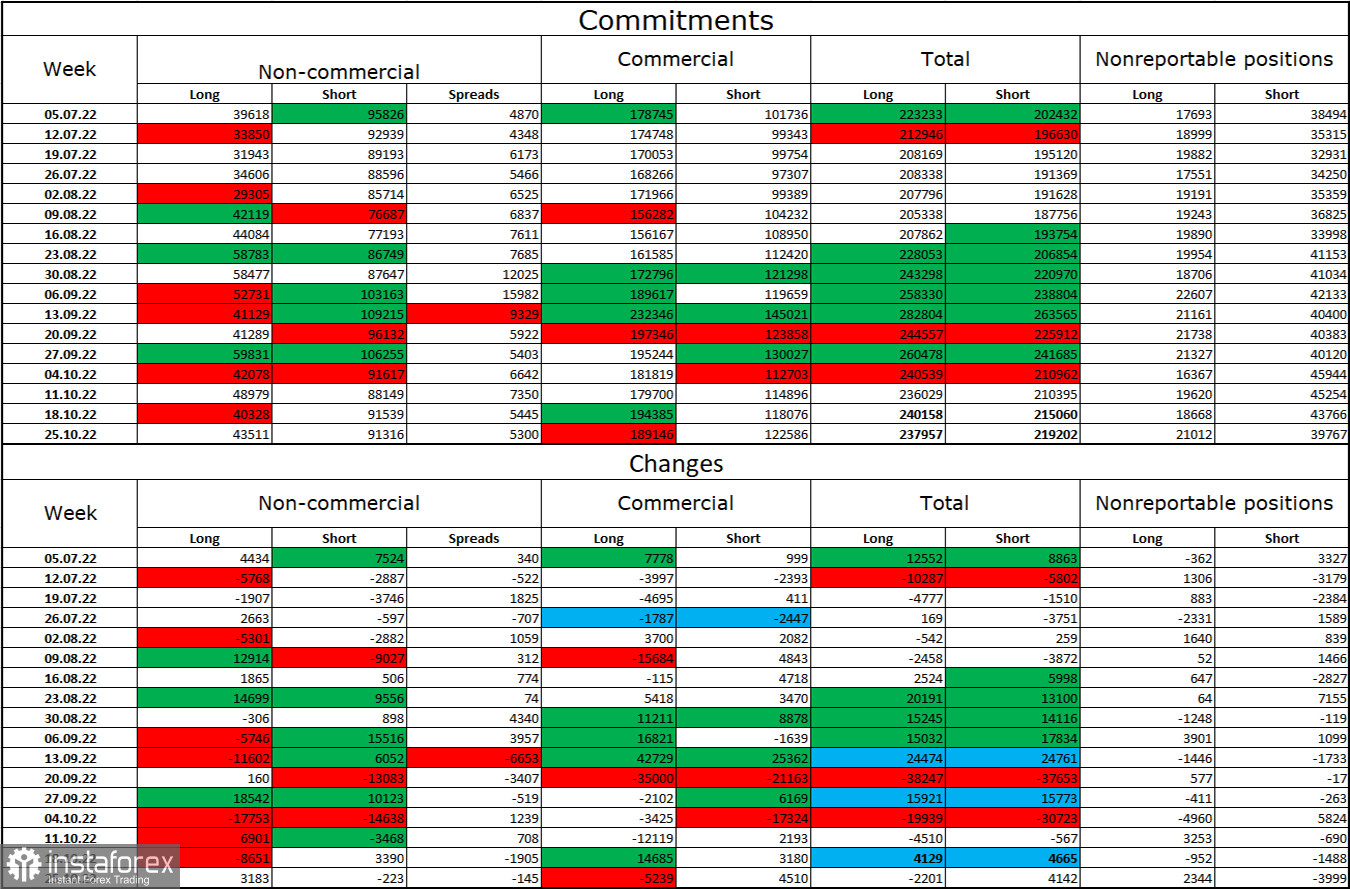

Over the past week, the non-commercial group of traders became a bit less bearish on the pair than the week earlier. Traders opened 3,183 long contracts and closed 223 short contracts. However, the overall sentiment of large market players remains bearish as short positions still outweigh the long ones. Therefore, institutional traders still prefer to sell the pound even though their sentiment has been slowly changing towards bullish in recent months. However, this is a slow and lengthy process. The pound may continue its uptrend only if supported by strong fundamental data which has not been so favorable lately. I would like to point out that although the sentiment of the euro trades has become bullish, the euro is still depreciating against the US dollar. As for the pound, even COT reports do not favor buying the pair.

Economic calendar for US and UK:

UK - BoE Interest Rate Decision (12-00 UTC).

UK - BoE Governor Bailey Speaks (12-30 UTC).

US - Initial Jobless Claims (12-30 UTC).

US - ISM Non-Manufacturing PMI (14-00 UTC).

US - Services PMI (13-45 UTC).

On Thursday, the Bank of England will announce its decision on the interest rate and its Governor will make a statement. These are the most important events of the day. The impact of the information background on the market sentiment can be quite strong today.

GBP/USD forecast and trading tips:

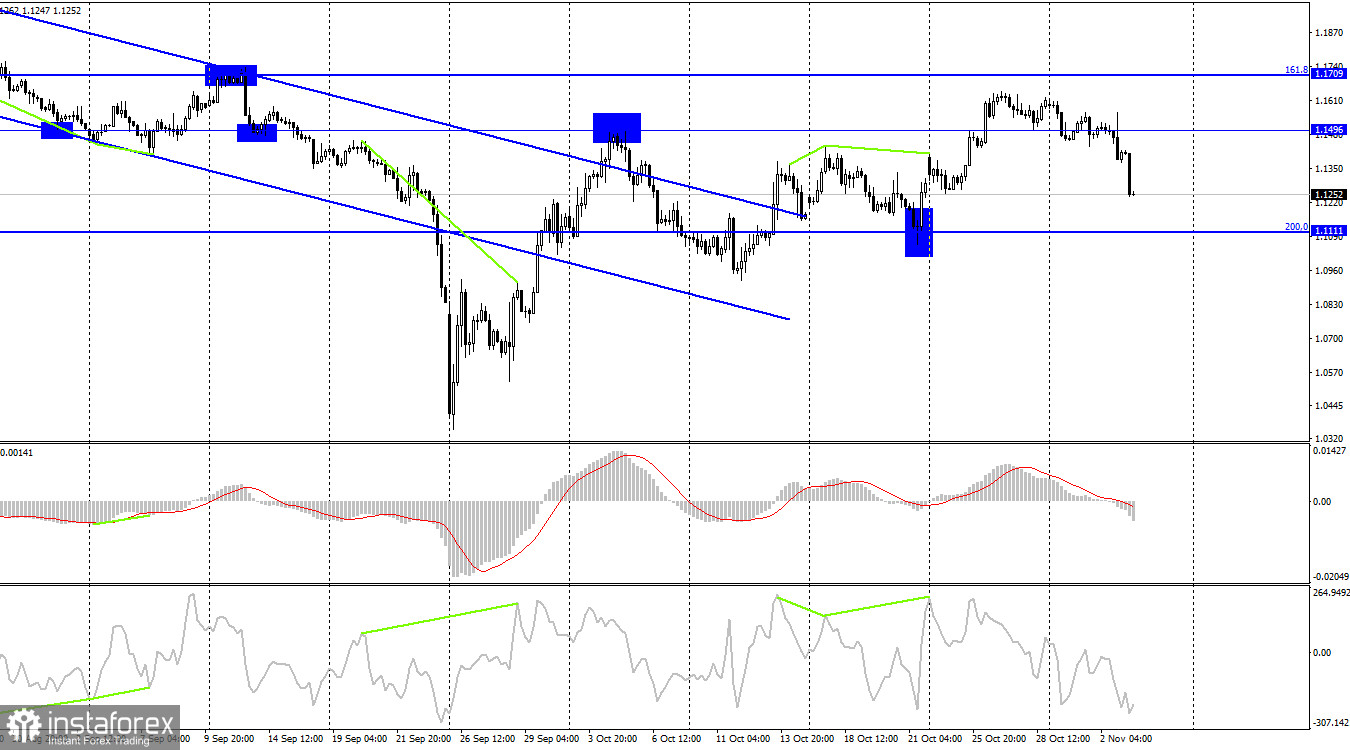

I would recommend selling the pound when the price closes below 1.1496 with the target at 1.1111. These trades can be kept open for now. You can buy the pound with the target at 1.1496 if the pair rebounds from the level of 1.1111.