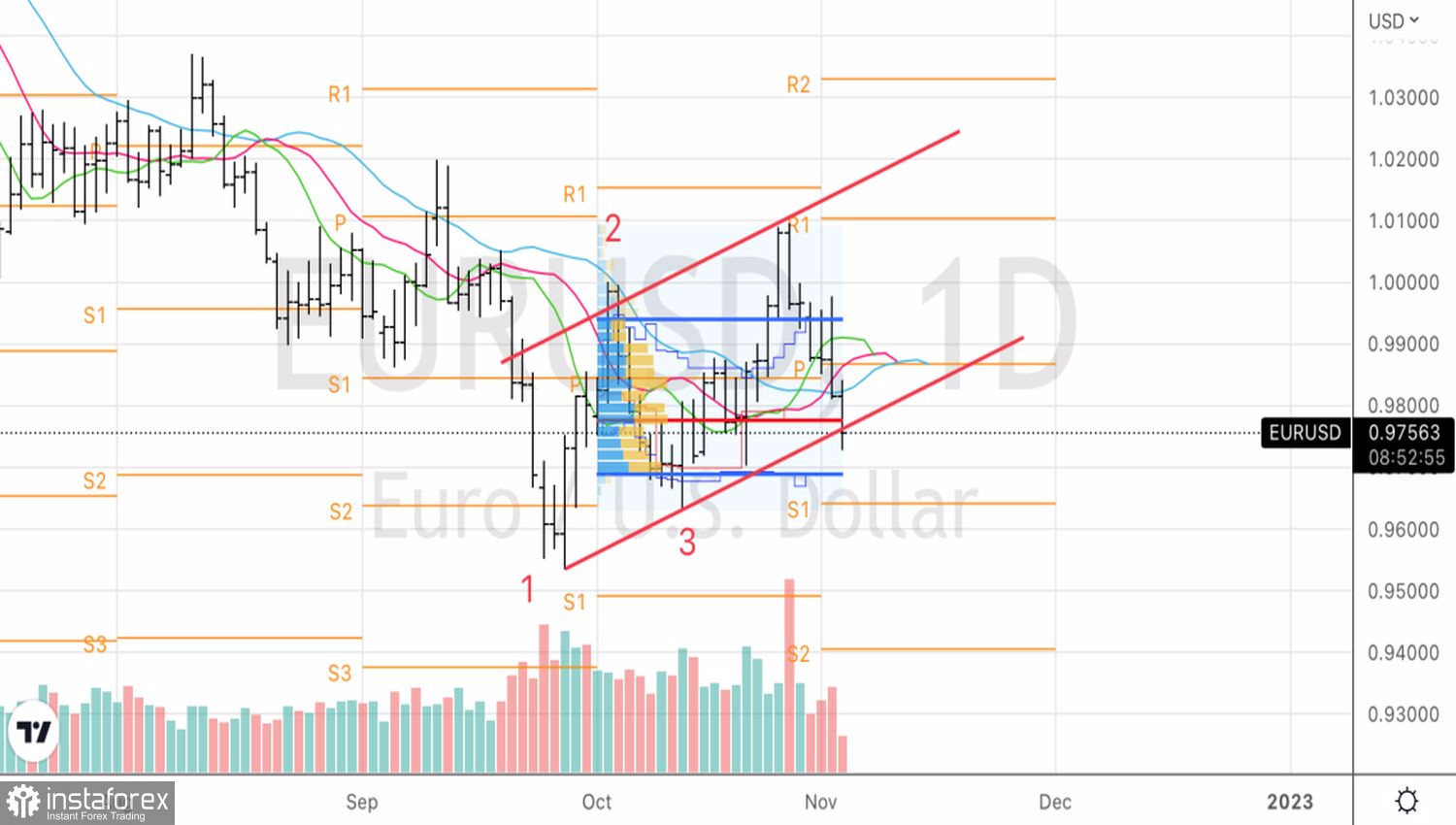

Theater of one actor. The press conference following the results of the November meeting of the FOMC was enchanting. Fed Chairman Jerome Powell did some work on the bugs. His job was to signal to investors that the monetary tightening cycle is slowing down without weakening financial conditions, as they did in July. And it worked! After taking off to 0.9975, the EURUSD pair fell like a stone.

The reference that the Fed is going to take into account the cumulative effect of previous rate hikes sent stocks up, improved global risk appetite, and sent the US dollar on the run. Prior to this, the market talked a lot about the time lag between the growth of borrowing costs and the slowdown in inflation, and such formulations were perceived by investors as a decrease in the rate of monetary restriction. Alas, everything changed during the press conference.

It seems Powell has made a deal with the devil, because he managed the impossible: to make the stock market fall in response to signals of a reduction in the rate hike in the federal funds rate at the next FOMC meeting or after one. Investors were very belligerent, but references to higher borrowing costs at the peak of the monetary tightening cycle brought them back to earth. The scale of rate increases will decrease, but their ceiling will be higher. It's not "dovish" at all.

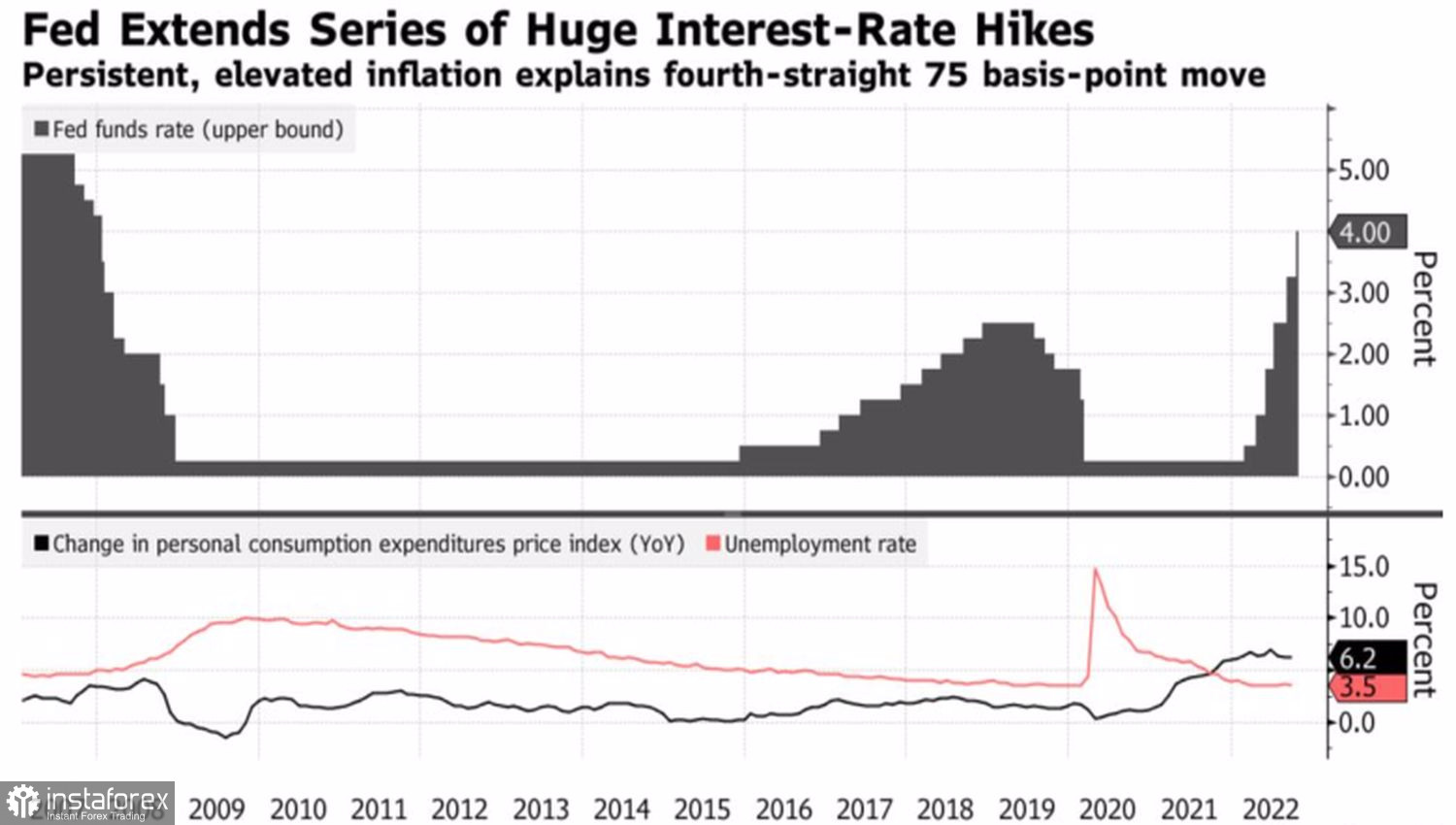

Dynamics of the Fed rate, US inflation and unemployment

The Fed raised the cost of borrowing by 75 bps to 4%, while Jerome Powell talked about reaching such a level of rates, which, according to the central bank, is restrictive. The campaign to tighten monetary policy is not over yet, the chances of avoiding a recession have decreased, but they are still there.

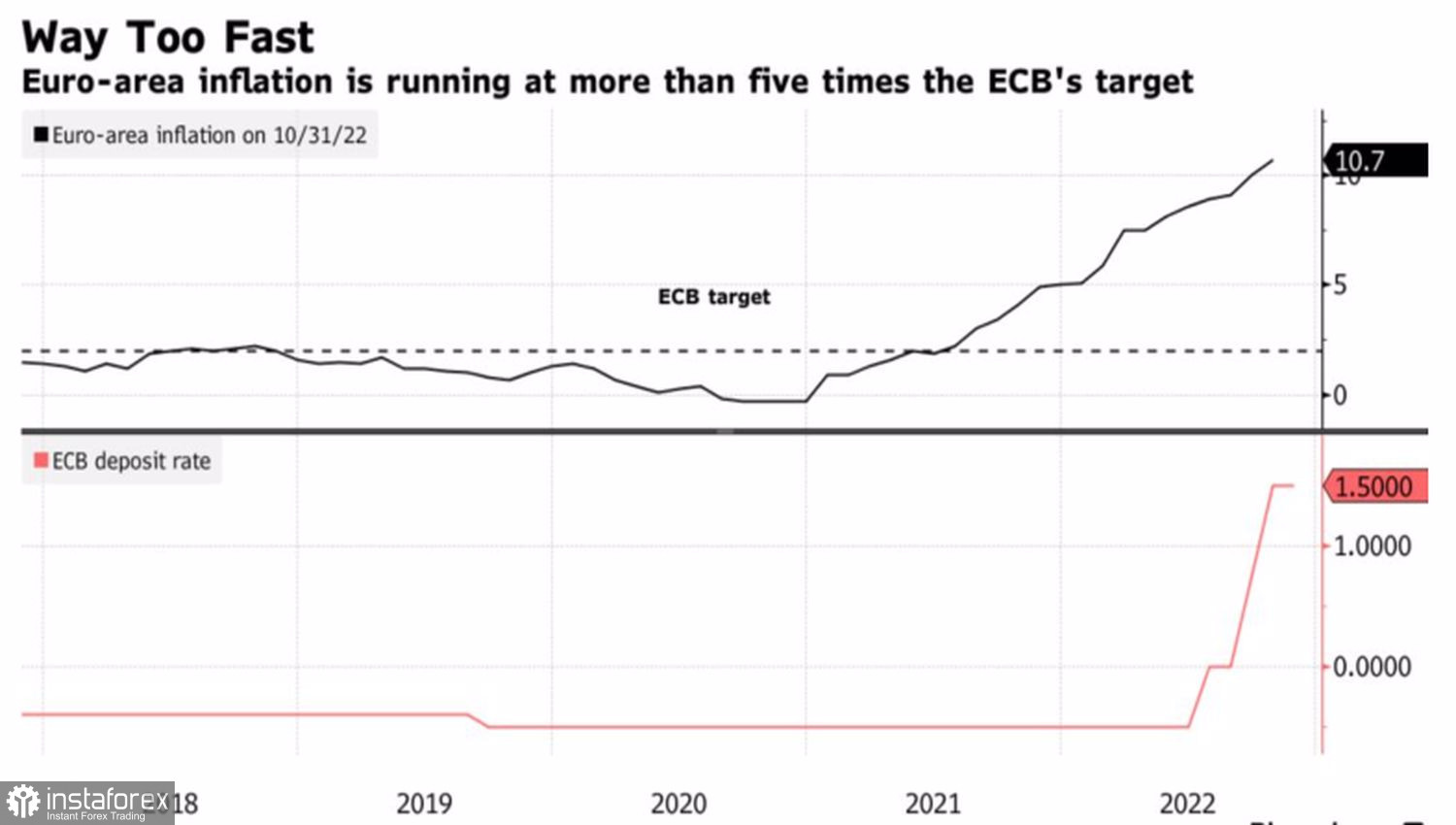

However, there is no need to delude ourselves that the economic downturn will help beat inflation. According to ECB President Christine Lagarde, the recession will not be able to tame inflation.

Dynamics of the ECB rate and European inflation

Thus, the Fed's monetary restriction cycle continues, it's too early to talk about a pause, and the peak value of the federal funds rate will actually be higher than envisaged in the September FOMC forecast, which was about 4.6%—the derivatives market is currently giving out 5%. However, rumors circulate on Forex that in order to return inflation to the target of 2%, it will be necessary to increase the cost of borrowing to 6%.

In any case, rates have room to rise, as do US Treasury yields, which supports a favorable environment for the dollar. 30 out of 40 experts polled by Reuters believe that the USD index will return to 20-year highs or renew them by the end of the year.

Technically, on the EURUSD daily chart, confident breaks of the fair value and the lower boundary of the rising trading channel indicate the exhaustion of the corrective movement and a return to the "bearish" trend. We hold the shorts formed from the level of 0.985 and build them up on pullbacks. The marks 0.964 and 0.95 appear as targets.