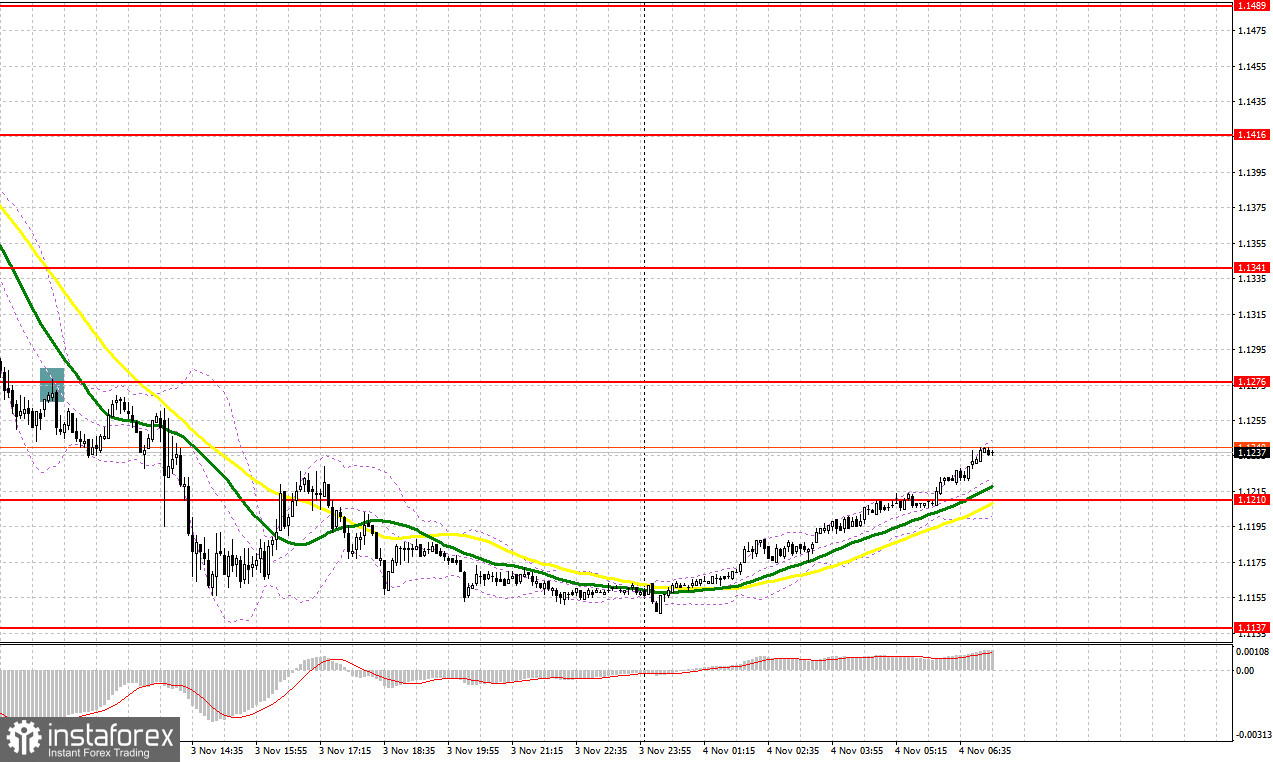

Yesterday there was only one signal for entering the market. Let's take a look at the 5-minute chart and see what happened. Earlier, I asked you to pay attention to the 1.1380 level to decide when to enter the market. The bears did not make us wait long and continued to actively sell the pound. A breakout of 1.1380 took place without a reverse test, so I failed to enter short positions there, as well as from 1.1307. In the afternoon, after a slight correction to the area of 1.1276, the bulls failed to settle above this range. A false breakout there was a signal to sell the pound, which resulted in a move down by more than 60 points.

When to go long on GBP/USD:

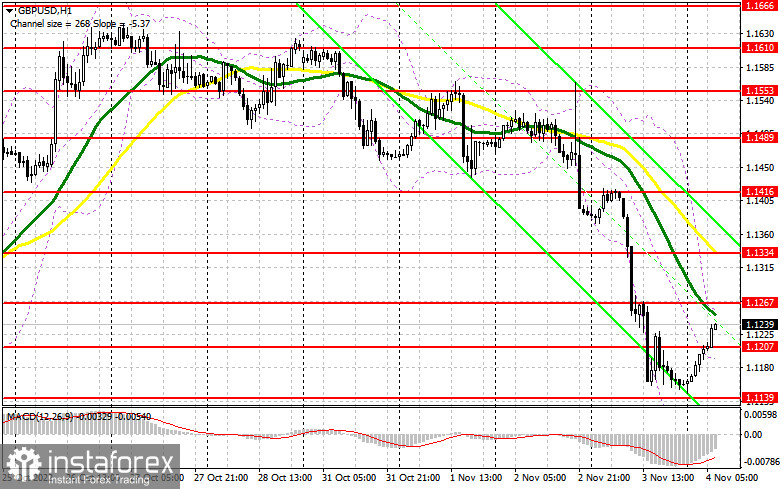

Yesterday, the Bank of England raised interest rates to 3.0%, but, contrary to the forecasts and expectations of economists, announced that it intends to slow down with a further increase in aggressive measures, since without this the economy begins to "burst at the seams", and the aggravation of the mortgage market crisis with a crisis in the cost of living of households in the next few years will definitely lead to to the GDP being reduced by 3.0% and even to zero growth. In other words, according to the central bank's expectations, a recession cannot be avoided, so do not expect anything good in the near future. Despite this, the BoE intends to continue to fight high inflation, just not with such aggressive measures. And so the pound fell by almost 250 points from the opening level of the day and the pair will obviously continue to be under pressure in the near future. A report on the PMI index for the construction sector in the UK will be released today, which will pass the market, as well as a speech from Huw Pill, a member of the BoE's CMP.

In case the pair falls after the Asian correction, a false breakout in the area of the nearest support at 1.1207 will be a signal to open longs in order to restore and update the resistance of 1.1267, slightly above which the moving averages, playing on the bears' side, go. A breakout and a test of this range may change the situation, allowing bulls to build a more powerful correction with the prospect of updating 1.1334, but this will be possible only after the release of disappointing US statistics. The farthest target of the bulls will be 1.1416, where I recommend locking in profits. If the bulls do not cope with the tasks set and miss 1.1207, the pressure on the pair will increase. If this happens, I recommend longs on a false breakout of 1.1139. It will be wise to go long after a bounce off from 1.1066, or even lower, expecting a rise of 30-35 pips.

When to go short on GBP/USD:

Bears will try to keep the pair in the bearish trend formed on October 27th. Their initial task is to regain control of support at 1.1207, but don't forget about protecting 1.1267 either. In case the pound grows and we receive disappointing reports on the UK, a false breakout at 1.1267 will be an excellent signal to open short positions further along the trend, which will help push the GBP/USD back to 1.1207, an intermediate support formed at the end of the Asian session. A breakout and test of this level will be a reason to open shorts in anticipation of updating the low at 1.1139, which was not reached yesterday. The farthest target will be 1.1066, where I recommend locking in profits.

In case the pair grows and bears fail to protect 1.1267, the bulls will continue to enter the market, counting on building an upward trend. This will push the GBP/USD to the 1.1334 area. A false breakout at this level will provide an entry point into short positions with the goal of moving down. If bears are not active there, I advise you to sell GBP/USD immediately from 1.1416, expecting a decline of 30-35 pips.

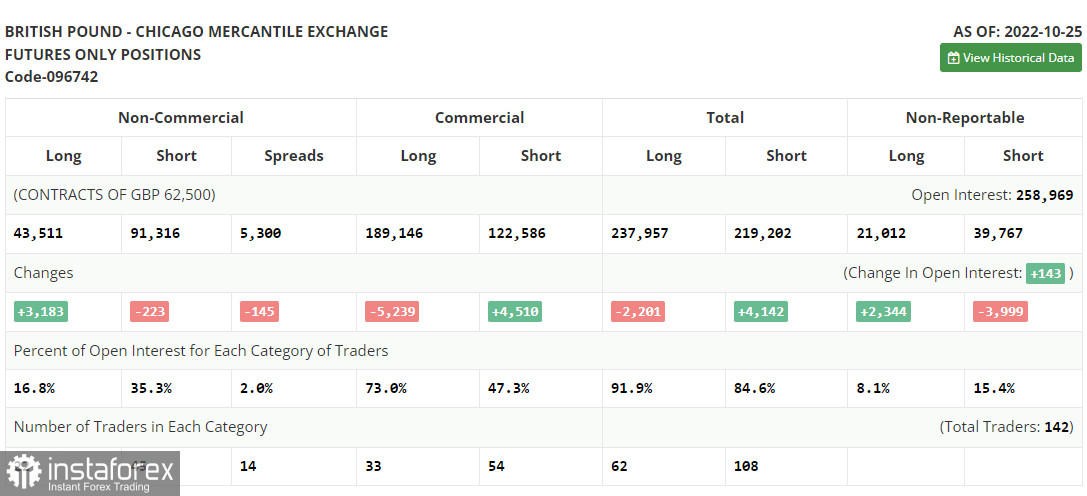

COT report:

The Commitment of Traders (COT) report for October 25 showed that short positions decreased while long ones had grown. Political changes in the UK are playing on the bulls' side, but now many are waiting for how the Bank of England will behave in relation to rates, as well as a new economic program from British Prime Minister Rishi Sunak. Do not forget that the pound, as a risky asset, largely reacts to the Federal Reserve's decisions on interest rates. The committee will hold a meeting this week, where the rate will be raised by 0.75%, which may weaken the position of GBP/USD and lead to a larger decline. However, only the Fed's commitment to maintaining a super-aggressive policy in the near future will be able to change the upward trend in the pound. Otherwise, it will be possible to observe the next pullback of the pound up. The latest COT report indicates that long non-commercial positions increased by 3,183 to the level of 43,511, while short non-commercial positions decreased by 223 to the level of 91,316, which led to a slight decrease in the negative value of the non-commercial net position to -47,805 versus -51,211 a week earlier. The weekly closing price rose to 1.1489 against 1.1332.

Indicator signals:

Trading is performed below the 30- and 50-day moving averages, which indicates further decline for the pair.

Moving averages

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair drops, the lower limit of the indicator around 1.1139 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.