How long will the crypto winter last? The decline in venture funding and history say one thing, the US midterm elections and the decrease in the correlation of crypto assets with US stock indices say another. Such is the market. There can be no single opinion. Not everyone can be winners at once. There will always be people who have lost money. Our task is not to be among them.

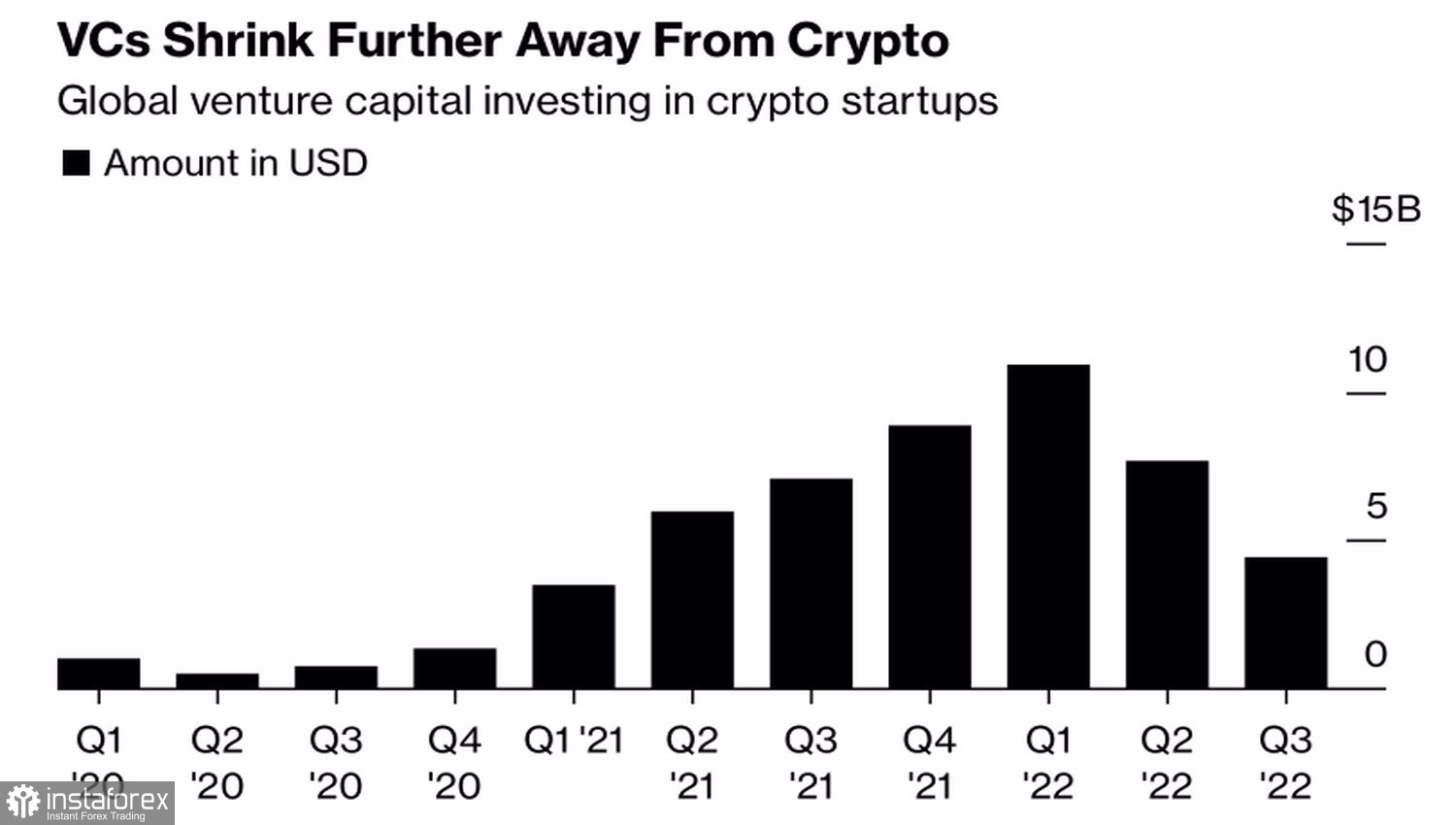

According to JP Morgan research, the volume of venture capital financing in crypto assets in the third quarter collapsed to $4.4 billion, which is more than an annual minimum. According to the bank, this is a disturbing development, indicating a loss of interest in the crypto industry. Most likely, the decline in BTCUSD in July–August was not a purely seasonal event, as previously assumed.

Dynamics of Venture Funding in the Crypto Industry

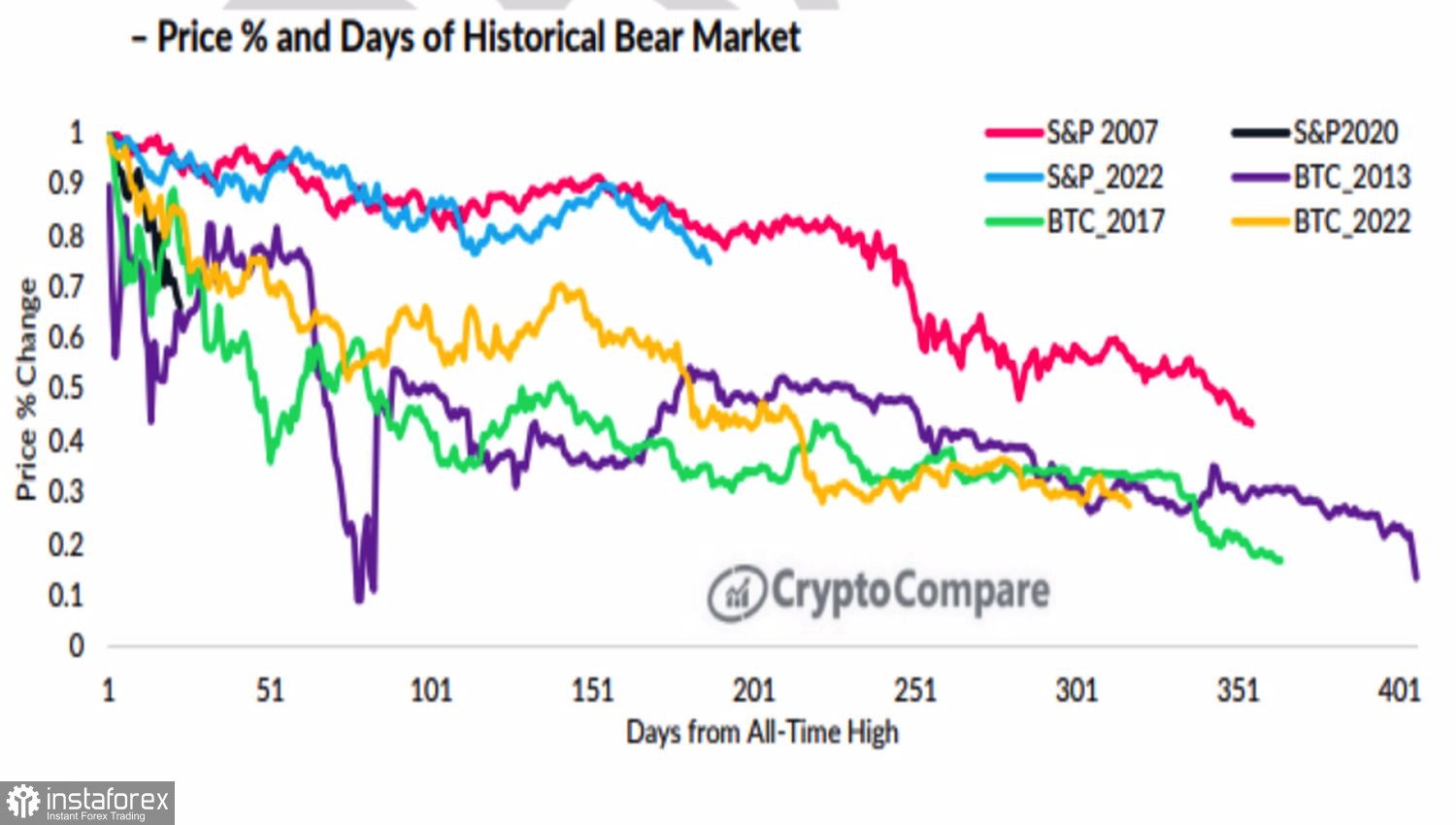

The bitcoin bear market is not over yet, CryptoCompare also says. The research company draws attention to previous downward trends: in 2013 and 2017, the value of the token decreased by 83% and 87%, while the fall lasted 364 and 406 trading days. Currently, the drawdown is 73%, and the decline in BTCUSD quotes continues for 357 days. According to CryptoCompare, some kind of event will happen in the near future that will provoke a serious turmoil in the financial markets and restore the downward trend for bitcoin.

S&P 500 and Bitcoin during bear markets

At the same time, the stability of the leader of the cryptocurrency sector to factors that were previously among the main drivers of changes in BTCUSD quotes suggests that investors are looking for new assets and find them in the digital sphere. Indeed, if US stocks collapsed in response to Jerome Powell's announcement that the peak federal funds rate will be higher than currently assumed, then bitcoin held its own. It quickly regained lost positions and is set to return to the local peak of 21,000 that emerged at the end of October.

Such dynamics of the token led to a decrease in its 30-day correlation with the Nasdaq Composite to 0.26, the lowest level since the beginning of January. The connection of 0.75 and above, which has been observed throughout most of the year, is considered strong, and in May and September it approached the ideal values of 0.93 and 0.96. When most of the speculators, dissatisfied with the fall in volatility, capitalization from almost $3 trillion in November to $984 million and daily trading volumes for the leader of the cryptocurrency sector from 700 million to 61.3 million, leave, the remaining holders hint that the bottom has already been reached. It's time to move on to growth.

Moreover, the Republicans, who have repeatedly insisted on regulating the crypto assets sector, are most likely to win the midterm elections in the United States.

Technically, on the BTCUSD daily chart, the rebound from the moving averages increases the risks of forming a Broadening Wedge pattern. We keep the longs formed from the 20,100–20,200 area and build them up in case of updating the local high at 21,000.