Futures for the S&P500 index rose by about 0.2%, and the high-tech NASDAQ gained about 0.3%. The industrial Dow Jones is trading almost unchanged. Treasury bonds were little changed before the release of US employment data. The Chinese stock market rose amid signs that the authorities are still trying to mitigate the effects of their Covid-Zero policy. Mining companies have grown in Europe following the rise in commodity prices.

All attention will be paid today to the employment data in the United States, which will give an idea of the strength of the labor market, which will affect the pace of tightening the Federal Reserve interest rates. If the labor market demonstrates strength again and the unemployment rate decreases, even more, you can safely sell futures and wait for another major decline in the stock market. If the statistics turn out to be much worse than economists' expectations, demand for risky assets may return by the end of the week, but this is unlikely to lead to a rapid rally. Today's figures should be considered in light of other statistics on the labor market, which indicate that the demand for labor remains at a fairly good level, which, at the moment, is bad for the stock market. Concerns about strong inflationary pressures outweigh any meaningful easing that the labor market may indicate.

The Federal Reserve's interest rate swaps point to an expected maximum rate above 5.14% around mid-2023.

As noted above, oil is growing along with commodities on rumors that China may ease Covid restrictions, and wheat is again preparing for price increases due to the "Black Sea route" that has not worked. In European countries, gas and electricity prices jumped after Electricite de France SA issued another warning about the problem with the nuclear fleet, which further increased pressure on energy shortages in the region this winter.

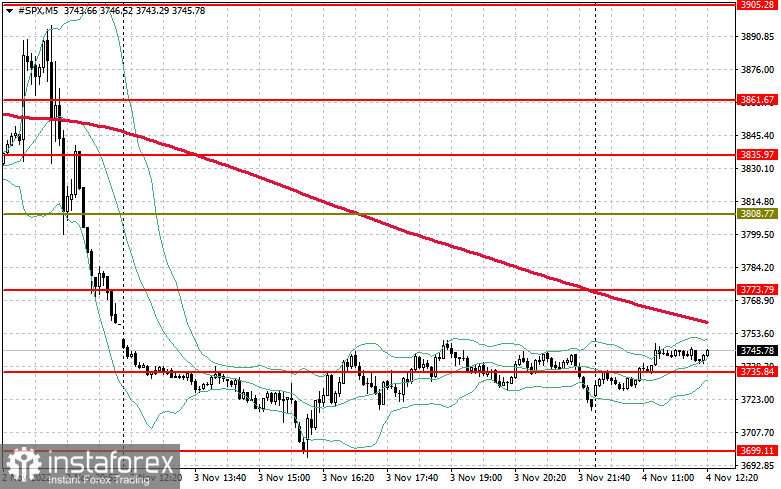

As for the technical picture of the S&P500, prices have stabilized after yesterday's stop of the bear market. The main task for buyers now is to protect the support of $3,735. As long as trading continues above this level, we can expect a return in demand for risky assets - especially if the US data disappoints. This will create good prerequisites for strengthening the trading instrument and returning $3,773 under control, just above which the level of $3,808 is located. A breakthrough in this area will strengthen the hope for an upward correction with an exit to the resistance of $3,835. The farthest target will be the $3,861 area. In a downward movement, buyers must declare themselves in the $3,735. A breakdown of this range will quickly push the trading instrument to $3,699 and open up the possibility of updating the support of $3,661.