After the rapid growth in the previous two days, today, the dollar index (DXY) has rolled back down. As you know, the meetings of the central banks of the United States and Great Britain were held this week. The heads of both banks did not spoil the expectations of market participants by raising their interest rates by 0.75%.

Fed Chairman Jerome Powell once again strongly confirmed the intention of the leadership of the American central bank to stick to a tough course in monetary policy.

"It's very premature now to think about a pause, very premature to even talk about it," Powell told the press conference, also promising to give "an updated view of where rates should move" in December. He acknowledged that "the US economy has slowed significantly compared to last year," but "without price stability, there is no sustainable strong labor market... Price stability in the US is good for the world economy," Powell summed up his statements.

The Bank of England also raised its key rate sharply, by 75 bps, the biggest move since the 1980s, to 3%. However, in their comments, BoE officials clarified that this was perhaps the only extraordinary decision. Many economists believe that the next action of the regulator will be to raise interest rates by 0.50% and then by 0.25%. The combination of a protracted economic recession in the UK with the "blurred" position of the central bank regarding the need for aggressive containment of inflation creates the preconditions for weakening the pound. Economists already sees GBP/USD pair declining to 1.0600 by the end of the first quarter of next year.

Probably, in view of this, yesterday's strengthening of the dollar was especially noticeable in relation to the pound. Today, as we noted above, the dollar has rolled back from the positions it won the day before. Obviously, it needs new drivers to resume growth. Today, such a driver could be the publication (at 12:30 GMT) of the monthly report of the US Department of Labor with data for October.

The state of the labor market (together with data on GDP and inflation) is a key indicator for the Fed in determining the parameters of its monetary policy.

The result is higher than expected, and the growth of the indicators (average hourly wages and the number of new jobs created outside the agricultural sector) indicates the strength of the labor market, which is positively reflected in the US dollar.

Forecast for October (average hourly wages / number of new jobs created outside the agricultural sector / unemployment rate): +0.3% / +0.200 million / 3.6%, respectively.

The indicators can be called very positive. At the same time, unemployment remains at minimal levels. Nevertheless, the market reaction to the publication of the US Department of Labor report can be unpredictable because the indicators of previous monthly reports can often be revised, and not always for the better.

But if the Labor Department's report does turn out to be convincing evidence of the strength of the US labor market, then this will give the dollar the necessary additional bullish momentum, allowing the DXY index (reflected as CFD #USDX in the MT4 trading terminal) to end this week in positive territory, perhaps even fully offsetting the losses of the past two weeks.

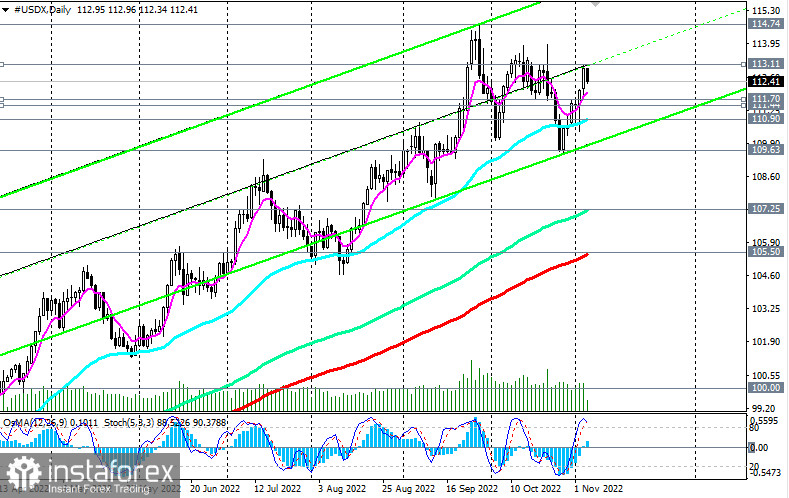

For all that, the DXY index maintains a positive trend. As of writing, DXY is near 112.40, in the middle of the range formed between the local support and resistance levels 114.74 and 109.37. At the same time, the general upward dynamics of the dollar remains, pushing the DXY index towards more than 20-year highs near 120.00, 121.00. The breakdown of the local "round" resistance levels 114.00, 115.00 will be a signal that the DXY index will return to growth.

Next week promises to be much calmer than the last 2. Both among the bulls and bears of the market, there are those who have lost significant funds due to strong volatility, fixing losses. Perhaps the next week will help them compensate for part of the losses incurred, and the winners - to strengthen their positions.