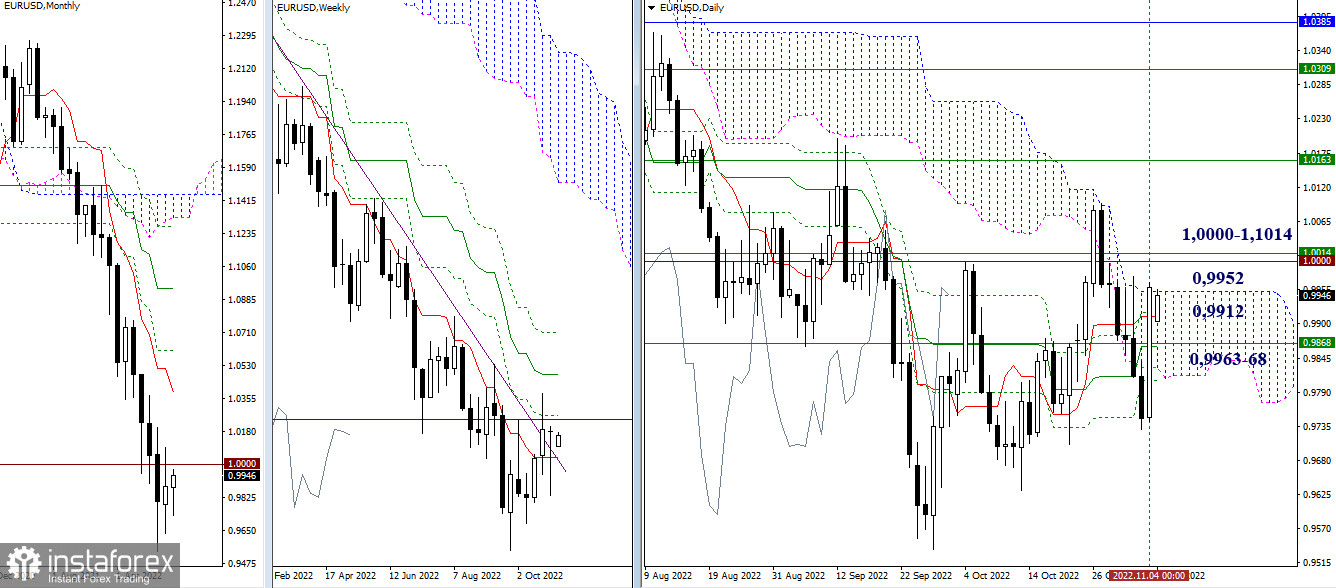

EUR/USD

Higher timeframes

Today, at the opening of the week, a fairly deep downward gap has formed. Now bulls are trying to close it and restore their positions to the closing point of last week. The main task for the bulls to gain new prospects in this area is to go beyond the resistances of 0.9952 - 1.0000 - 1.1014 (upper limit of the daily cloud + weekly and psychological level). The nearest most important supports today can be noted at 0.9912 (daily short-term trend) and 0.9863–68 (daily medium-term + weekly short-term trend).

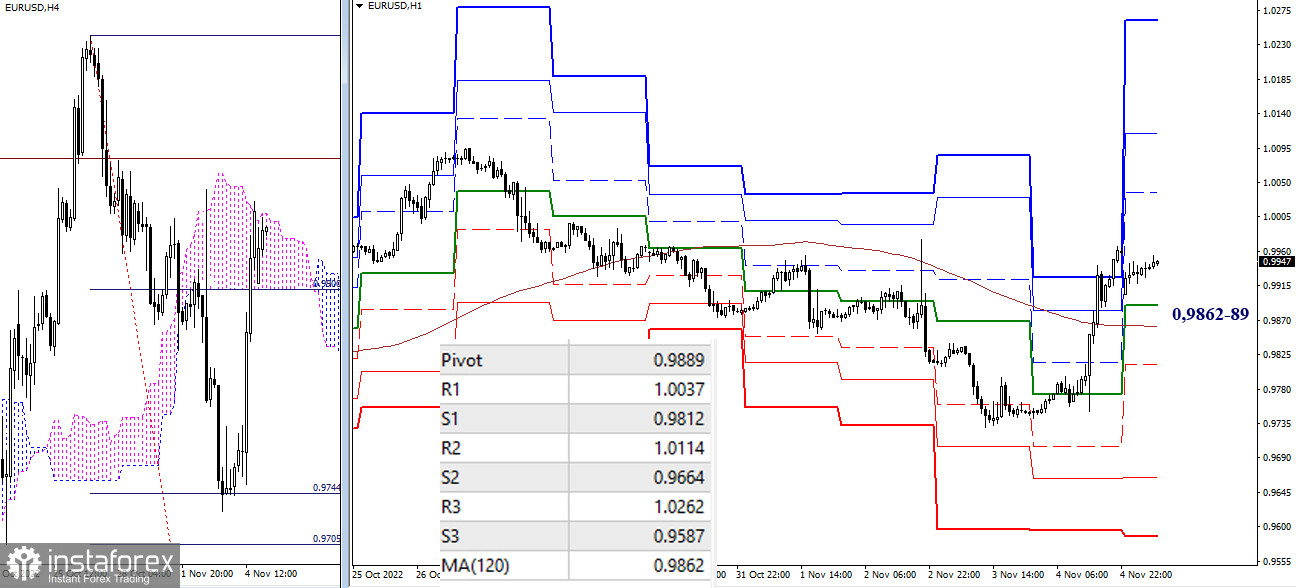

H4 – H1

Having worked out the last target for the breakout of the H4 cloud at the first target (0.9744), bulls managed to end the decline and, having seized the initiative, changed the current balance of power in the lower timeframes. As of writing, the main advantage belongs to the bulls, and their benchmarks for continued rise today can be noted at 1.0037 - 1.0114 - 1.0262 (resistance of the classic pivot points). Key levels form support now at 0.9862–89 (central pivot of the day + weekly long-term trend). Consolidation below will change the distribution in the preponderance of forces.

***

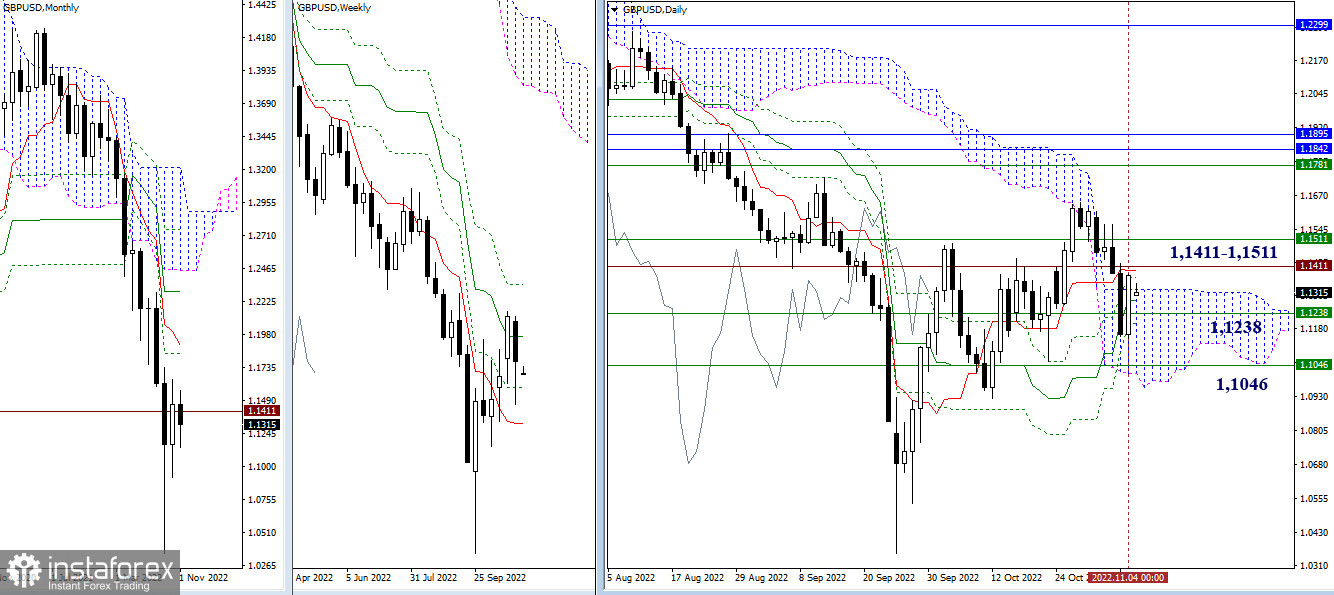

GBP/USD

Higher timeframes

Today, the opening of the new week is marked by a downward gap. The market thought. We look forward to what will happen next. For bulls to continue recovering positions and moving towards the unification of monthly and weekly resistances (1.1781 - 1.1842 - 1.1895), they first need to reliably overcome the nearest zone 1.1411 - 1.1511, where bearish interests protect the historical level and weekly medium-term trend. At the same time, it should be noted that the upper limit of the daily cloud (1.1324) currently influences the situation, and the main supports today are at the boundaries of the weekly levels of 1.1238 and 1.1046.

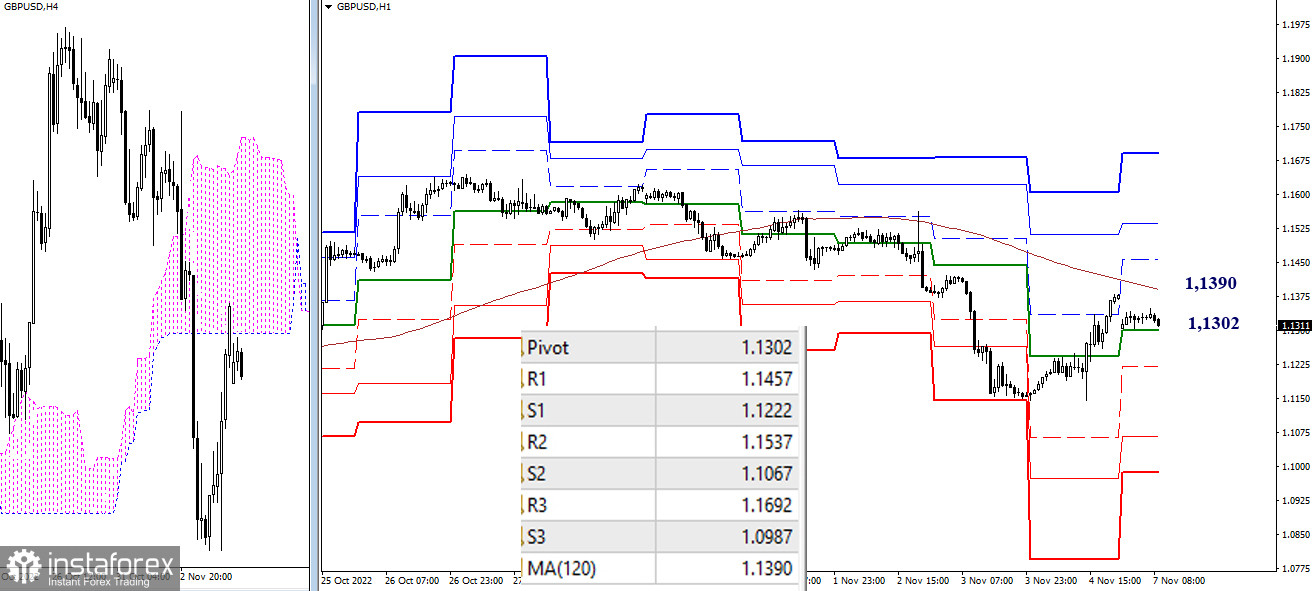

H4 – H1

The day before, bulls performed a fairly effective rise and captured the support of the central pivot point of the day (1.1302). The key resistance today is located at 1.1390 (weekly long-term trend). The breakdown and reversal of the moving average will change the current balance of power, giving the main advantage to the side of the bulls. The classic pivot points (1.1457 – 1.1537 – 1.1692 ) will become benchmarks for continuing the rise within the day. If the bulls decide to complete the ascent, then the support on their way today can be noted at 1.1222 – 1.1067 – 1.0987 (classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)