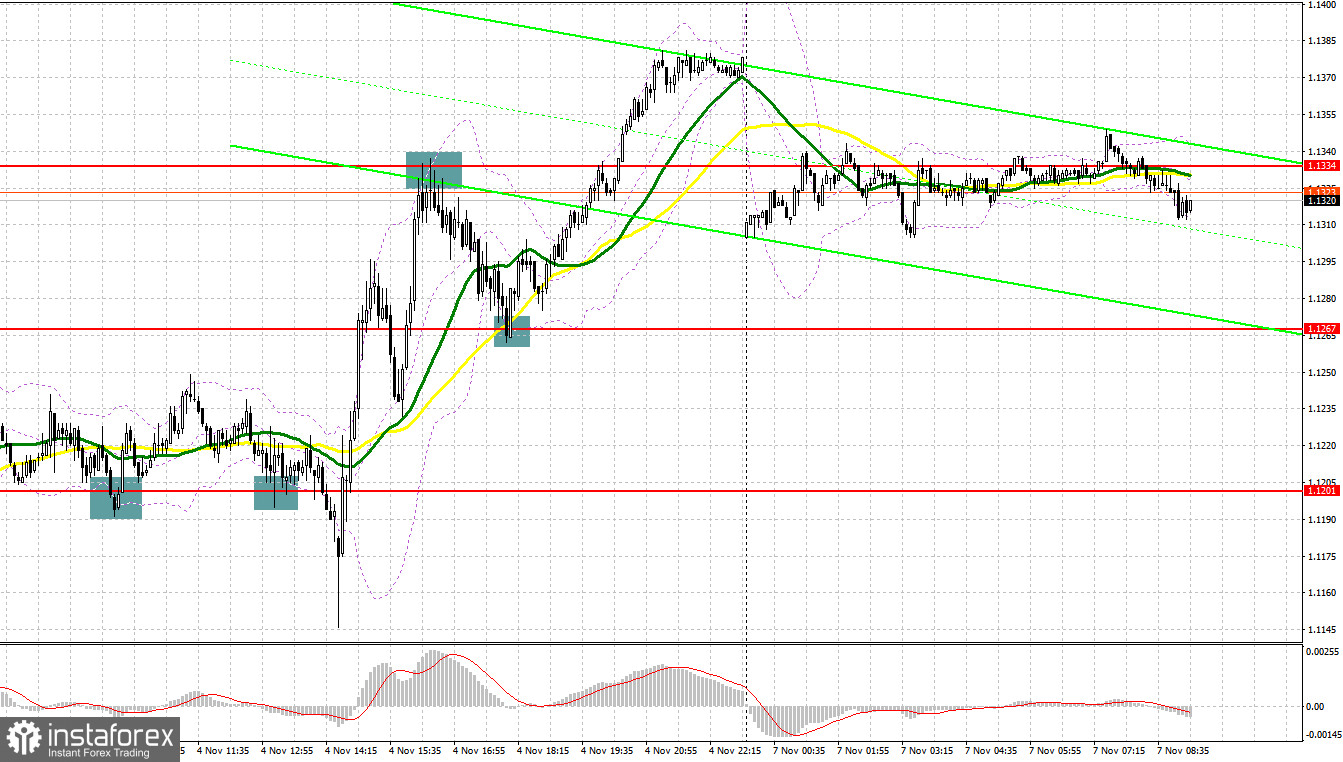

We received several good entry signals on Friday. Let's amaze the pair on the 5-minute chart. In my morning review, I mentioned the level of 1.1207 and recommended entering the market from there. Bears continued to sell off the pound. A false breakout at the level of 1.1207 created a good entry point for going long which resulted in a rise of more than 40 pips. After that, bulls lost momentum. In the afternoon, the pound advanced sharply and only a false breakout of 1.1334 formed a sell signal. As a result, the quote fell by 70 pips. As buyers were defending the support level of 1.1267, we got a nice entry point within the uptrend and saw the pair rising by another 100 pips.

For long positions on GBP/USD:

A weaker-than-expected data from the US triggered a sell-off in the US dollar. This allowed the pound to win back almost all the losses it faced last week. Bulls are acting more cautiously now as they see no ground for adding more long positions on the pound. The speech by Huw Pill, BoE chief economist, is unlikely to change the market sentiment. Therefore, the upside potential of the pair may be limited by the nearest resistance of 1.1348. The best moment to open long positions will be a false breakout at the support at 1.1267. This is where the moving averages playing on the side of the buyers are located. The formation of a false breakout at this range will generate a buy signal with a possible retest of the resistance level of 1.1348 that was formed in the Asian session. A breakout and a downward test of this range can change the situation for the bulls, allowing them to develop a stronger correction with the target at 1.1416. The level of 1.1489 will serve as the highest target where I recommend profit taking. If bulls fail to protect the area of 1.1267, the pair will come under more pressure as this will prove that there are no serious buyers in the market. If so, I would recommend buying the pair only on a false breakout at 1.1207. Long positions on GBP/USD can be opened right after a rebound from 1.1150 or 1.1066, bearing in mind a possible intraday correction of 30-35 pips.

For short positions on GBP/USD:

Bears are staying cautious at the moment, keeping their activity low although it is obvious that the majority of traders would like to sell the pound even after such a sharp rise. The first thing that sellers need to do is to regain control of 1.1267. They also need to protect the level of 1.1348. If the pound advances following the speech by the BoE's member, a false breakout at 1.1348 will be a good signal for going short following the trend. This will allow bears to push GBP/USD back to the support of 1.1267 that was formed on Friday. A breakout and an upward retest of this range will create a good entry point to test the low of 1.1207. The level of 1.1150 will act the as furthest target where I recommend profit taking. In case GBP/USD rises and bears are idle at 1.1348, bulls will continue to enter the market in an attempt to develop an upside correction. This will send GBP/USD to the area of 1.1416. A false breakout of this level will create an entry point for selling the pair. If nothing happens there as well, I would recommend selling GBP/USD at 1.1489, considering a downside pullback of 30-35 pips within the day.

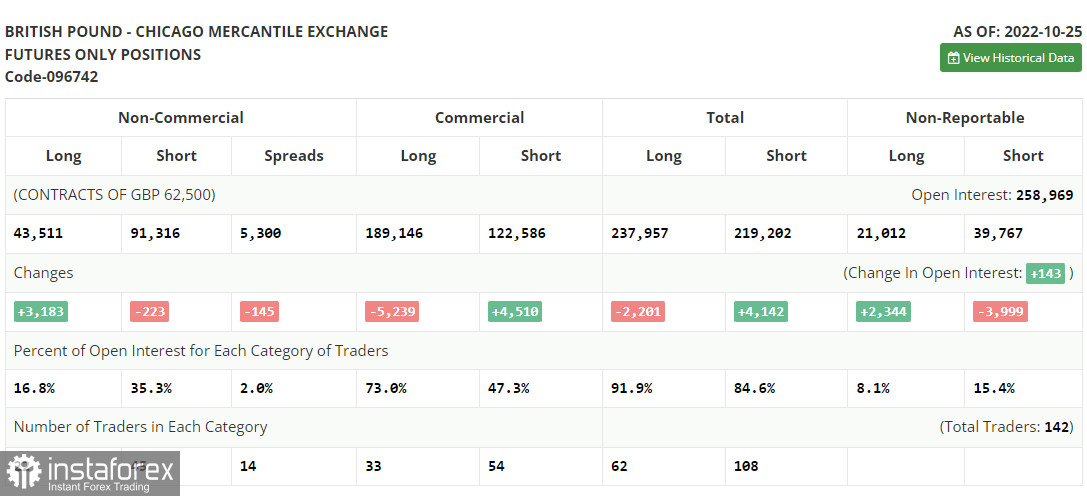

COT report:

The Commitment of Traders report for October 25 recorded a fall in short positions and a rise in the long ones. The recent political changes in the UK favor the British pound. Now traders are waiting for the BoE's decision regarding interest rates and the new economic program proposed by Prime Minister Rishi Sunak. Being a risk asset, the pound also reacts to the Fed's policy. The FOMC had a meeting last week where it raised the rate by 75 basis points. This step may ease GBP/USD and deepen its decline. If the Fed decides to stick to its aggressive monetary tightening in the coming months, the US dollar will continue to strengthen. Otherwise, we may observe another upside pullback in the pair. According to the recent COT report, long positions of the non-commercial group of traders increased by 3,183 to 43,511, while short positions dropped by 223 to 91,316. This caused the non-commercial net position to decrease to -47 805 from -51 211. The weekly closing price went up to 1.1489 versus 1.1332.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates that bulls are trying to take control over the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a downward movement, the lower band of the indicator at 1.1230. will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.