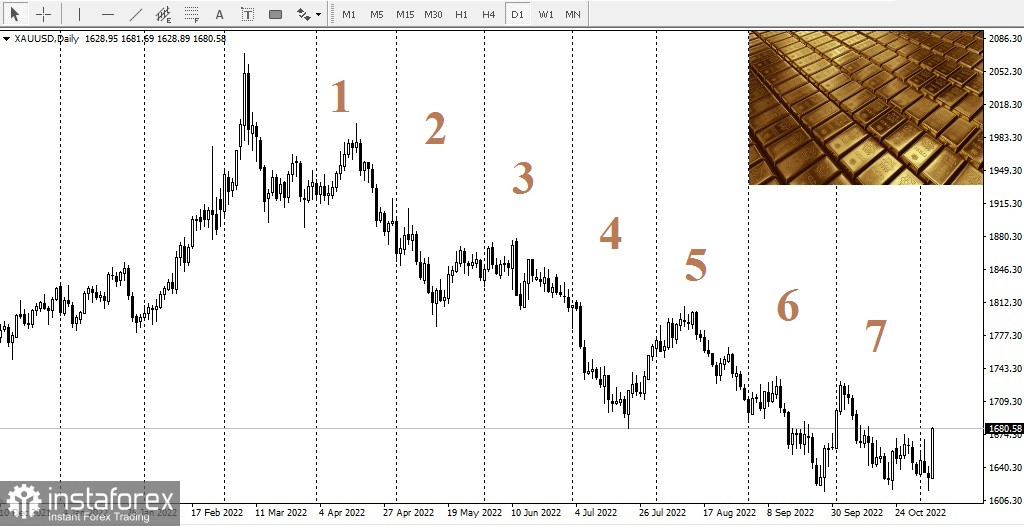

Gold's bounce off a two-year low, followed by a nearly 3% gain on Friday, is creating solid bullish momentum among Wall Street analysts; however, some also point out that the precious metal still has some work to do to reverse the months-long downward trend.

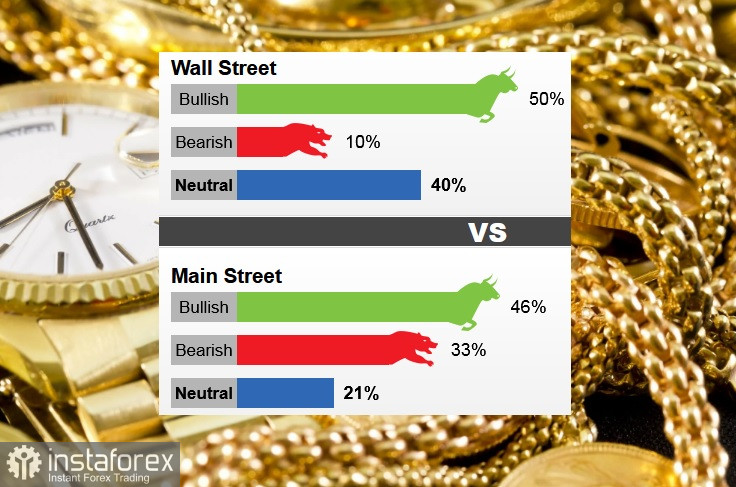

The latest survey shows that market sentiment continues to improve and most market analysts expect prices to rise in the near future. Retail investors are also looking positively.

Bullish sentiment has been on the rise all week after gold prices ended October with their seventh straight monthly drop, the longest losing streak in 50 years.

Rising bond yields and the US dollar, which is at its highest level in 20 years, remain critical headwinds for gold; however, some analysts note that growing fears of a recession are driving demand for gold as a safe-haven asset.

Ole Hansen, head of commodity strategy at Saxo Bank, said the US recession would force the Federal Reserve to end its tightening cycle before it reaches its 2% inflation target. He added that a stagflationary environment of low economic growth and high inflation would be bullish for gold.

However, in anticipation that gold prices will have enough momentum to rise, a return to $1,680 will simply return the market to neutral territory.

Christopher Vecchio, senior market analyst at DailyFX.com, said he is neutral on gold as he would also like to see an initial push above $1,680 leading to $1,730.

Last week, 20 market professionals took part in the Wall Street survey. Ten analysts, or 50%, said they are optimistic this week. Two analysts, or 10%, said they were bearish. Eight analysts, or 40%, said they were neutral about the precious metal.

As for retail, 520 respondents took part in online surveys. A total of 240 voters, or 46%, called for an increase in the price of gold. Another 169, or 33%, predicted a fall in prices. While the remaining 111 voters, or 21%, were in favor of a side market.

Friday's rally helped gold prices end the week positively.

Problems in the labor market adds to the recession fears. On Friday, the Bureau of Labor Statistics said 261,000 jobs were created in October, exceeding all expectations. However, some analysts believe that if you delve into the essence, you can see a growing weakness.

Along with rising bullish fundamentals for gold, many analysts note that the technical outlook has turned positive as well.

"Gold had been building a technical base above $1,620 support and appears to be starting to launch up off of there," said Colin Cheshinsky, chief market strategist at SIA Wealth Management.

He added that bond yields remain well above 4%, which would be a deterrent for gold. And the Fed continues to raise interest rates, and in these conditions, gold's rally may turn towards sales.