Bitcoin ended the previous trading week on a bullish note, but the current trading activity is not enough for a rapid upward movement. Over the weekend, trading volumes expectedly decreased, which provoked pressure from sellers.

It is important to note that Saturday's bullish momentum allowed the cryptocurrency to hit $21.5k and end the trading day above $21k. This is a positive signal indicating growing bullish sentiment in the digital asset market.

The test of the $21.5k level provoked the activation of sellers, who subsequently managed to bring the price of BTC below $21k. On November 7, buyers became active again and made another attempt to gain a foothold above $21k.

Despite the unsuccessful attempt to storm $21k, we must admit that Bitcoin did not run out of bullish potential over the weekend. The asset has successfully traded the range of $20.4k–$20.7k and continues its upward movement to the area of $21k–$21.5k. The main question is whether the asset will succeed in a bullish run.

Fundamental background

Any analysis of the price of Bitcoin should start with fundamental factors that positively or negatively affect the movement of cryptocurrency. The main reason for the optimism of crypto investors was the increase in unemployment by 3.7%, which is a direct consequence of the aggressive policy of the Fed.

At the same time, returning to the Fed, it is important to note that the regulator does not consider it necessary to ease monetary policy. Markets are pricing in a high probability of a 50 basis point rate hike in November. Against such expectations, Glassnode analysts say they do not record a significant increase in demand in the crypto market.

An important catalyst for the growth of quotes of the crypto market and Bitcoin could be the collapse of the US dollar index. The asset reached the level of 113, followed by a fall to the local support level of 110. On November 7, DXY tried to win back the fall and reached the level of 111.8 but was stopped by the bears.

As a result, DXY is trading below 110, and at the end of the previous trading day, the index formed a strong "bearish engulfing" pattern. Technical metrics on the daily timeframe unanimously point to the continuation of the downward trend. The DXY correction could be a catalyst for the rise of Bitcoin and other high-risk assets.

On the daily SPX chart, an upward reversal is visible with a bullish crossover forming on the stochastic. The RSI index also resumed its upward movement, which indicates investors' bullish sentiment. Given the combination of factors, we expect to see another attempt by Bitcoin to break through $21k.

BTC/USD analysis

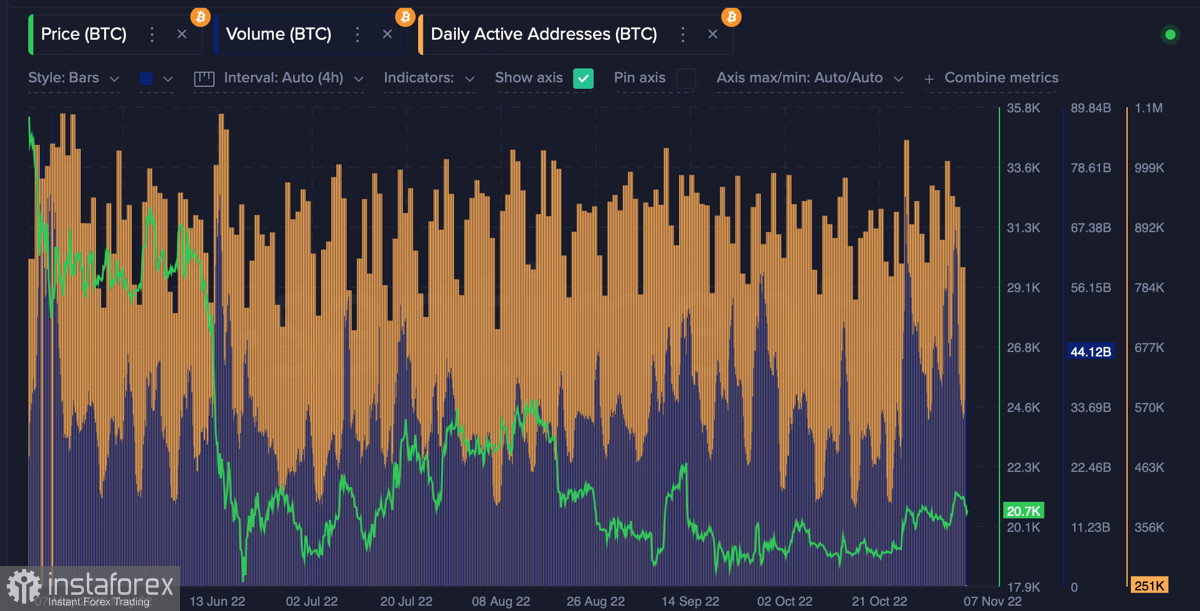

Bitcoin on-chain activity was expected to deflate over the weekend, but this is where we will see confirmation of the viability of the upward movement of BTC. Trading volumes and the number of unique addresses should show an increase in parallel with the upward price movement.

On the daily timeframe, we see that Bitcoin is trying to gain a foothold above the upper limit of the local range of last week at $20.4k–$20.7k. Technical metrics indicate the continuation of the downward movement and, as a result, the breakdown of the $20.7k level.

At the same time, a local support zone formed near $20.7k, which the bears failed to take on the first try. Moreover, even if it falls below $20.7k, Bitcoin will still have chances to rise as long as it stays above $20k–$20.4k. According to IntoTheBlock, in the $19k–$20.7k range, 2.13 million BTC were purchased by 4 million users.

Most of these volumes were absorbed to the $20.4k level, and therefore, under current market conditions, a downward breakout of this zone looks unlikely. Bitcoin plans for the week will be clear after the opening of the US markets.

If the asset holds the $20.7k level at the end of today's trading day, then in the next 1–2 days, we will see a retest of $21.5k. With a breakdown of $20.7k, BTC will need more time to consolidate for an upward push towards $21k. In any case, the dynamics of SPX and DXY, and bullish sentiment in the crypto market, indicate a continuation of the local BTC upward trend.