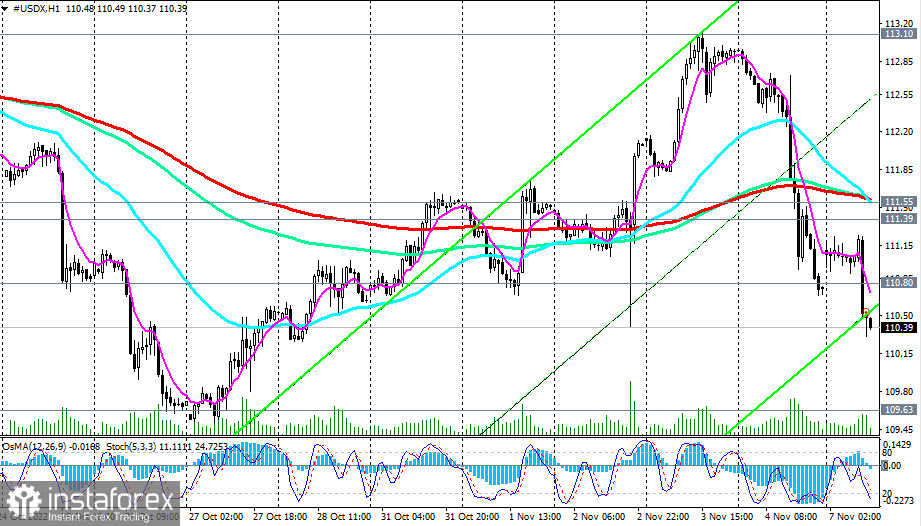

At the beginning of today's European trading session, the dollar is falling again, and the DXY dollar index has again moved into the "red" zone, dropping below Friday's low of 110.61 to 110.31 as of writing.

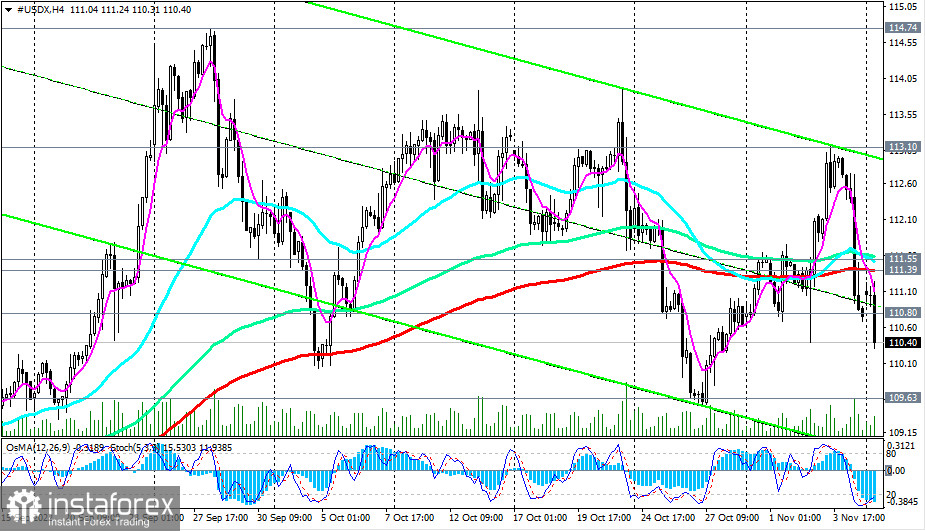

On Friday, the sellers managed to push the price below important support levels 111.55 (200 EMA on the 1-hour chart), 111.39 (200 EMA on the 4-hour chart), 110.80 (50 EMA on the daily chart).

The nearest support lies at the levels of 109.63, 109.00. Their breakdown will strengthen the negative dynamics of the dollar and CFD #USDX, sending it towards the key support levels 107.25 (144 EMA on the daily chart), 105.50 (200 EMA on the daily chart). But above them, the #USDX CFD remains in the long-term bull market zone. Therefore, when bullish drivers appear, dollar buyers will quickly take control of the situation again.

In turn, the growth of CFD #USDX in the area above the resistance level 111.55 will be the first signal to resume long positions.

Support levels: 109.63, 109.00, 107.25, 105.50

Resistance levels: 110.80, 111.39, 111.55, 113.10, 114.00, 114.74, 115.00

Trading Tips

Sell Stop 110.20. Stop Loss 110.90. Take Profit 109.70, 109.00, 107.25, 105.50

Buy Stop 110.90. Stop-Loss 110.20. Take-Profit 111.40, 111.55, 113.10, 114.00, 114.74, 115.00