The US labor market for October showed only one thing-the Federal Reserve did not achieve anything with it tightening the monetary policy. The US central bank has a lot of work, and the American economy has a lot of pain. But investors threw aside logic. They acted on emotions, forcing the EUR/USD pair to jump as if it were scalded. As a result, the euro managed to test parity in relation to the US dollar, but was frightened by its own agility.

If it were not for the unexpected reaction to American employment, which grew by 261,000 with a forecast of +200,000, this event would remain behind the scenes of the meetings of the largest central banks in the world. If the statements by European Central bank President Christine Lagarde on the slowdown in the economic activity of the eurozone and the Bank of England with the words of BoE Governor Andrew Bailey about inflated market expectations for the rate signaled a dovish reversal, then the Fed chose to act differently. Fed Chairman Jerome Powell puzzled the investors with the phrase that the peak of the federal funds rate would be higher than currently expected. A clear bullish signal for the US dollar, and it began to win it back. But then there was light in the form of the US labor market report.

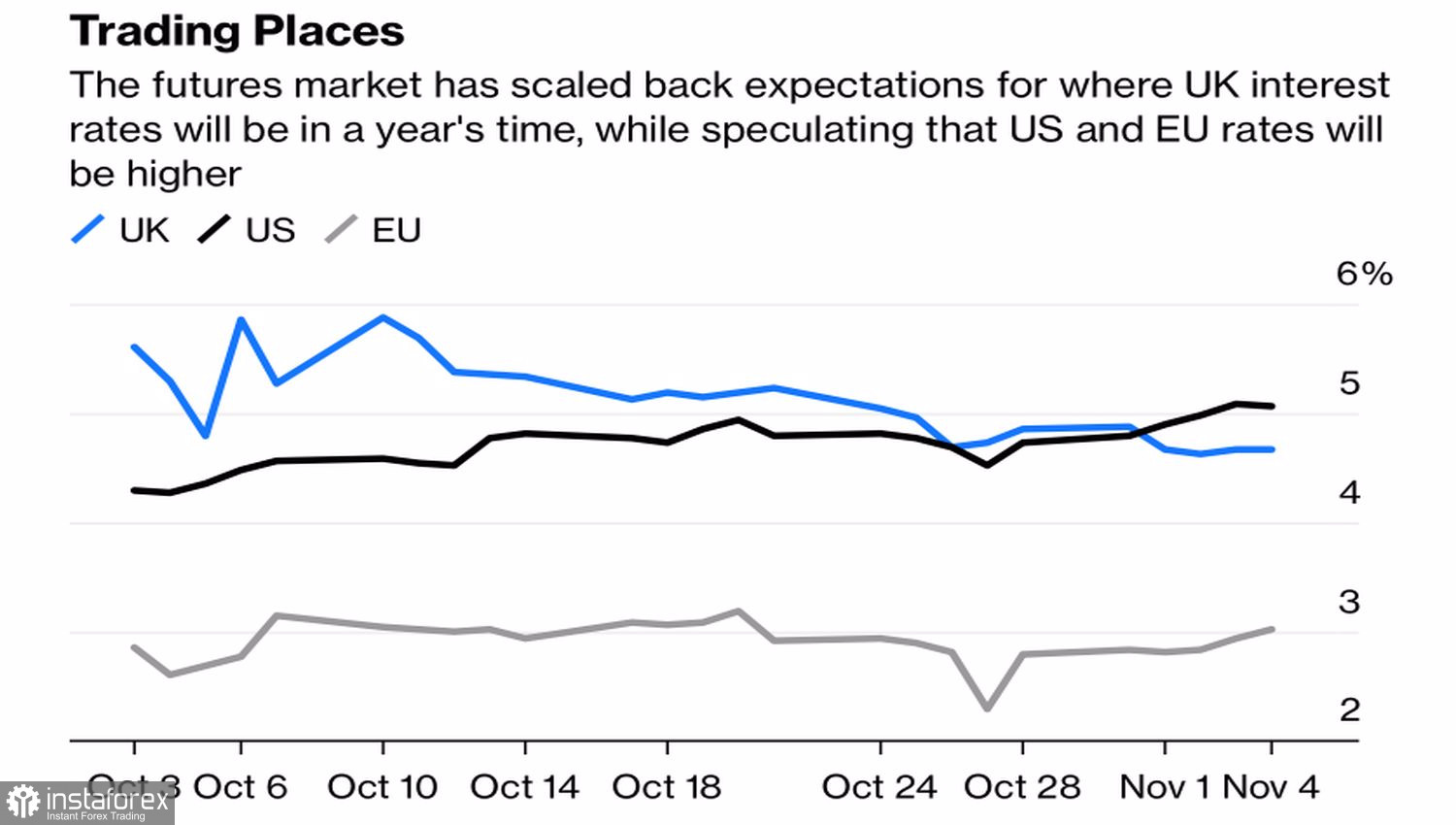

Dynamics of expectations for central banks

The fall in the USD index turned out to be much more significant than the decline in the yield of treasury bonds or the growth of the S&P 500. Let the hope for a soft landing of the US economy return to American securities after strong employment statistics, but what happened to the dollar? For sure, it was not without closing long positions in the US currency, however, as of November 1, they had already fallen to more than a one-year low.

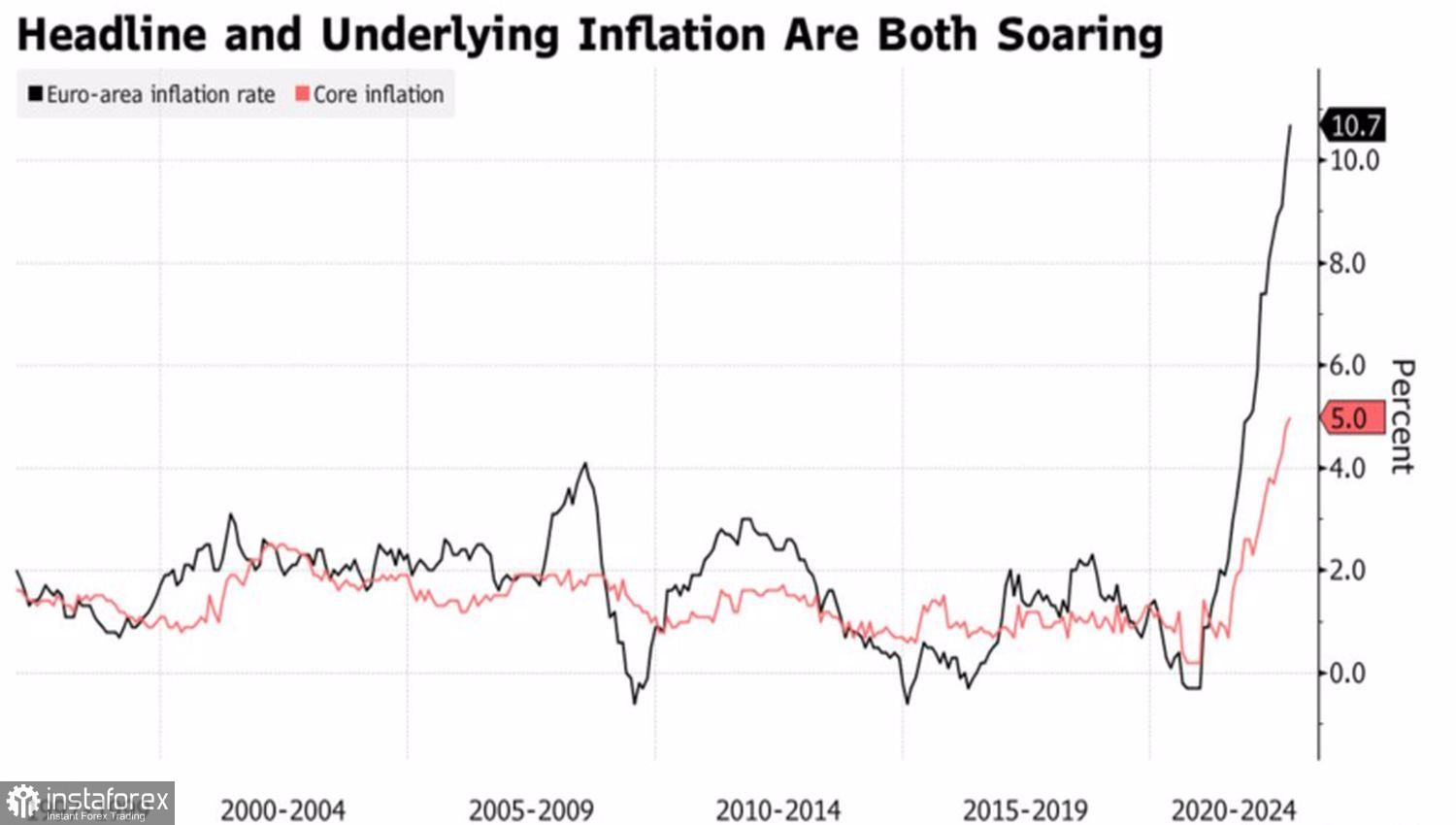

At the beginning of the week, EURUSD continued to rally towards November 11, thanks to a stronger growth in industrial production in Germany by 0.6% m/m in September compared to the +0.2% forecast by Bloomberg analysts, as well as due to the hawkish rhetoric of Francois Villaroy de Galo. The head of the Bank of France said that the ECB will raise rates until core inflation in the eurozone peaks.

Dynamics of European inflation

At the same time, these events could hardly have had a significant impact on the euro if they had taken place in a calm market. And now Forex is restless. The midterm elections in the US and the high probability of a Republican victory in them keep investors on their toes.

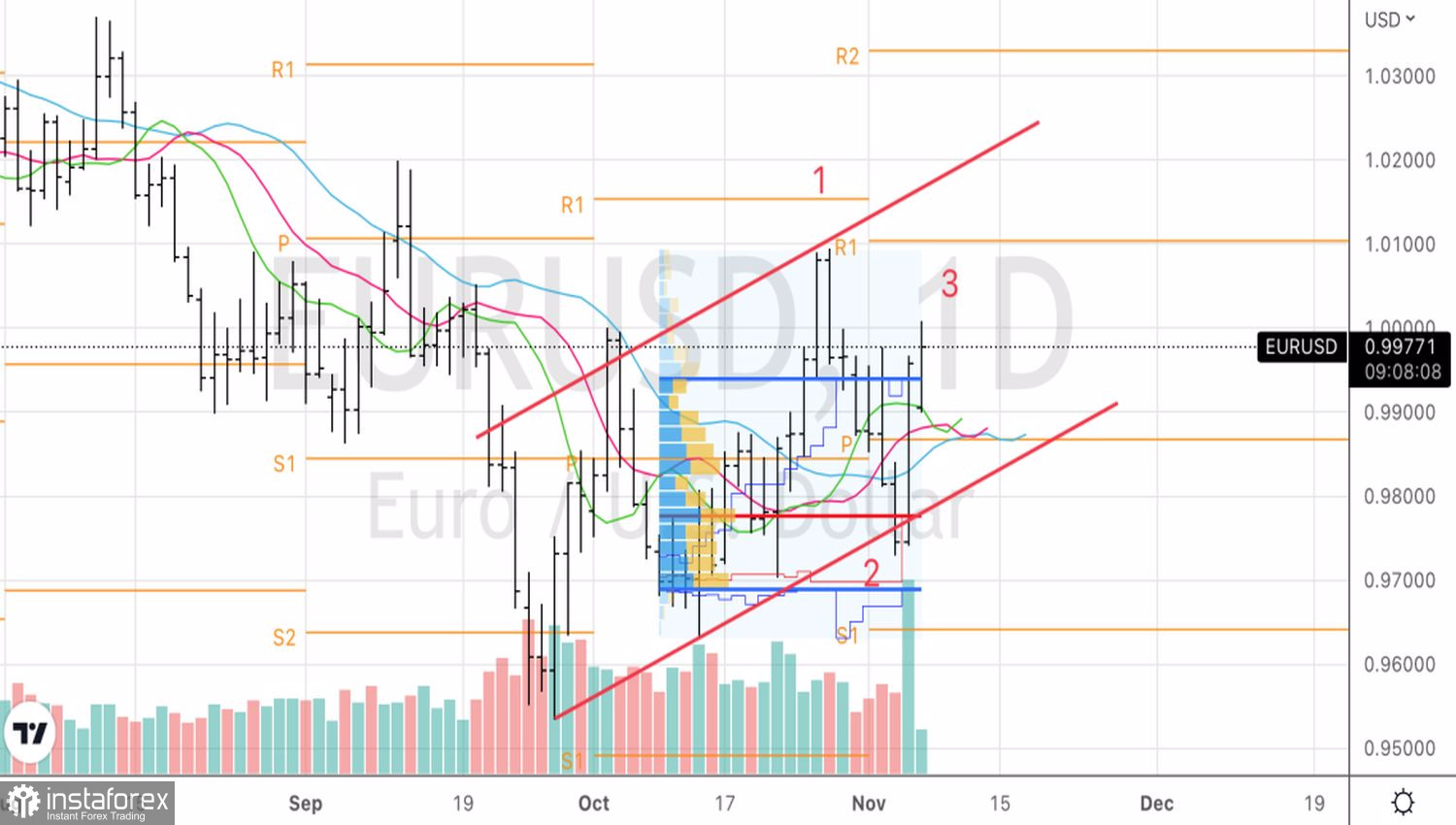

The market has yet to figure out what happened on November 4, but if, as I assume, it was a speculative bull attack, then the EURUSD rally will not last long. Every serious movement must have its own foundation. If it is not there, then the pairs, as a rule, return to their original positions.

Technically, the fall of EURUSD below the upper limit of the fair value range of 0.969-0.994 will increase the risks of activating the 1-2-3 reversal pattern, followed by a return to the lower limit of the upward corrective channel. Thus, a successful assault on support at 0.994 will be a reason to open short positions on the euro against the US dollar.