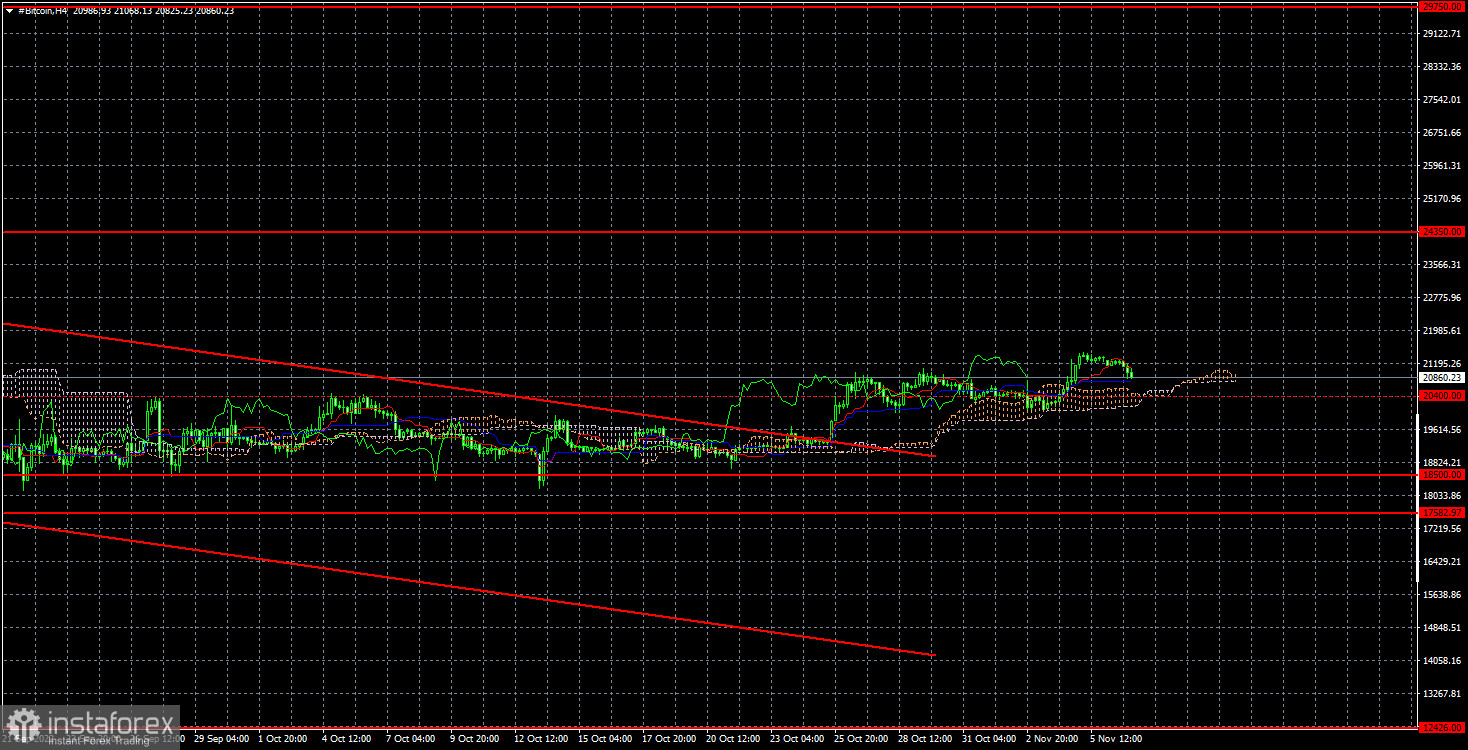

On the 24-hour TF, this movement is practically not visible. However, on the 4-hour chart, it can still be considered. If we switch to a more accurate estimate, bitcoin has grown by 2.5 thousand dollars over the past three weeks. It is obvious to everyone that such a movement cannot be called either trending or strong. The cryptocurrency remains inside the side channel of $18,500-$24,350 for almost five months, so all movements inside it are flat. We have a weak upward trend, within which bitcoin can crawl to $24,350, but traders must decide whether they want to try to work out this potential movement.

As we have already said, bitcoin resisted the temptation to return to the $18,500 level last week against another tightening of the Fed's monetary policy. Nevertheless, we did not see strong growth either, although there is still no reason for this. We believe that bitcoin will return to $18,500 rather than continue its groundless growth. Apart from the rebound from $18,500, there is no sensible signal. And even a rebound from $18,500 can already be worked out since this strong signal (the 15th in a row) is impossible to name.

Meanwhile, billionaire investor Tim Draper believes that bitcoin will grow to $250,000 per coin in early 2023. In 2018, he predicted the "bitcoin" explosive growth, which formally occurred, but was much weaker than Draper expected. He also noted that cryptocurrencies do not allow governments to control the population, and their popularity will grow over time. "In recent months, speculators have left the market. Bitcoin is an honest currency not tied to either central banks or governments. This is its main advantage," Draper believes. He also believes that the future of bitcoin is in the hands of women since they are the ones who make 80% of retail purchases. "While you can't buy food with bitcoin or pay for utilities, as soon as it becomes possible, there will be no more reasons to hold on to fiat currencies," the billionaire believes.

During the 4-hour timeframe, the quotes of the "bitcoin" continue to move inside the side channel. We believe the decline will resume in the medium term, but we must wait for the price to consolidate below the $17,582-$18,500 area. If this happens, the first target for the fall will be a level of $ 12,426. Bounces from $18,500 (or $17,582) can be used for small purchases, but be careful – we still have an absolute flat.