In previous reviews, I have already said that the key report of the week is the US inflation report for October. Market expectations are already 8-8.1% y/y. If they come true, it will mean that inflation has slowed by 0.1-0.2%, which is very little. The Fed is counting on a faster decline in the consumer price index, and such a meager decline may disappoint FOMC members. Now everything depends on the inflation reports, because the US labor market remains very strong, no matter how the market interprets Friday's report. Let me remind you that the number of new jobs outside agriculture in October amounted to 261 thousand, and the previous value was revised upward to 315 thousand. In my opinion, these are very decent values that could not be the basis for the decline of the US currency. But in any case, even if they were the reason, the US labor market did not become weaker from this. This means that the Fed can safely continue to raise the interest rate without fear of a sharp drop in the economy and a severe recession.

In this context, the speeches of the FOMC representatives this week will also be important. A total of eight members of the PEPP committee will speak, including Thomas Barkin, Patrick Harker, and Christopher Waller. Unfortunately for us, the speakers this week will not be the most eloquent speakers from the Fed, who rarely make resonant statements. It would be much more interesting to listen to James Bullard or Mary Daly. However, there is no doubt that they will perform in due time. It should be remembered that the rhetoric of some FOMC members may differ from the rhetoric of other members. For example, James Bullard is known for his "hawkish" position, and Mary Daly was the first to start talking a few weeks ago about the need to reduce the pace of rate hikes. Thus, even if this week several officials from the Fed announce their readiness to slow down the pace of tightening the PEPP, I will not consider that this decision has already been made.

This issue is still open for discussion, and the opinions of individual FOMC members are just opinions that will be announced a month and a half before the next meeting. As I said before, it all depends on inflation in the US. If the next two reports show a slight slowdown, then the rhetoric of FOMC members may change markedly. And for the US dollar, in accordance with the current wave markup, the tougher the rhetoric and the more negative the inflation reports, the better. After the demand for the dollar has been growing for many months, it is now physically difficult for the market to buy it. Therefore, good reasons are needed to build a new downward trend segment. I'm still counting on wave analysis, which says that the construction of the ascending section will not last long. However, will the market have enough strength and desire to build an impulse downward section after?

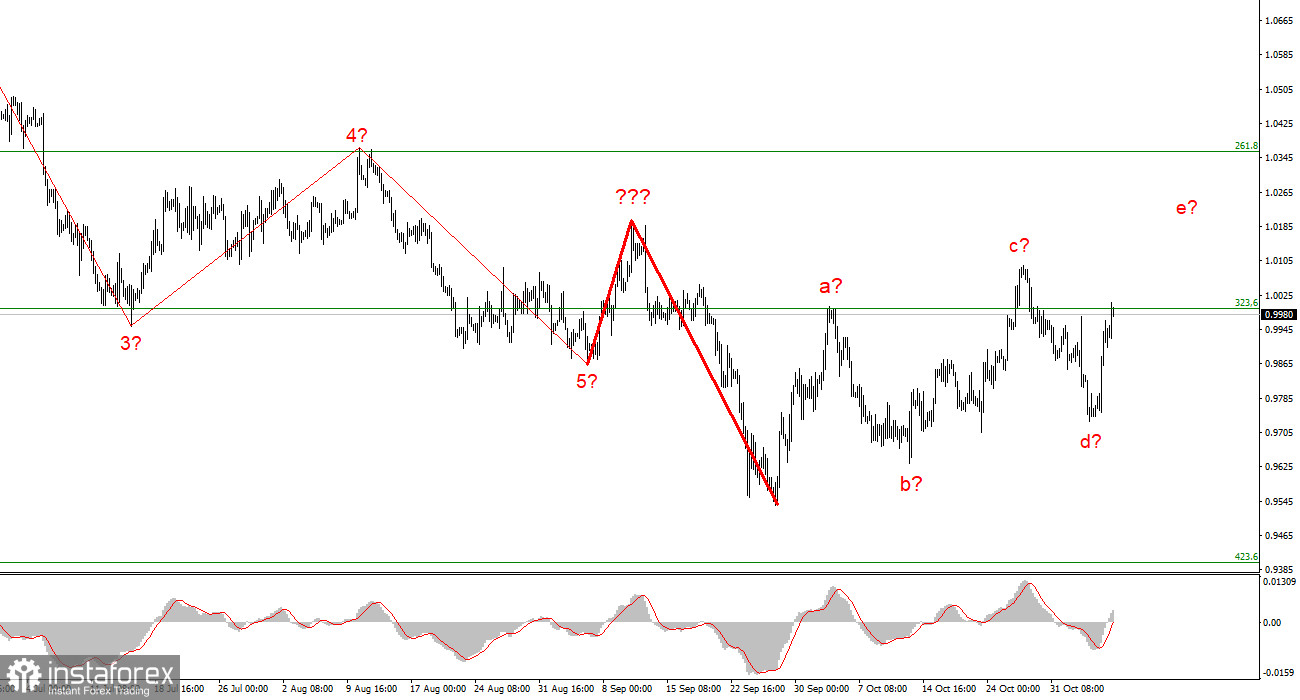

Based on the analysis, I conclude that the construction of an upward trend section will become more complicated than a five-wave one. At this time, the instrument could start building the fifth wave of this section, so I advise buying with targets located above the peak of wave c, according to the MACD reversals "up." The entire trend segment originating after September 28 takes the form a-b-c-d-e, but after its completion, a new downward trend segment can begin to build.