The price of gold crashed in the last hours and now is trading at 1,956 at the time of writing far below today's high of 1,970. Technically, the price action signaled that the upside movement could be over and that the sellers could take the lead again. DXY's rally forced XAU/USD to come back down. USD's further appreciation should bring more sellers of the yellow metal.

Fundamentally, XAU/USD registered sharp movements in both directions around the BOC. I told you yesterday that the BOC Rate Statement represents a high-impact event. Surprisingly, the BOC increased the Overnight Rate from 4.50% to 4.75%. Also, XAU/USD took a hit from the US Trade Balance and Canadian Trade Balance. The economic indicators came in better than expected.

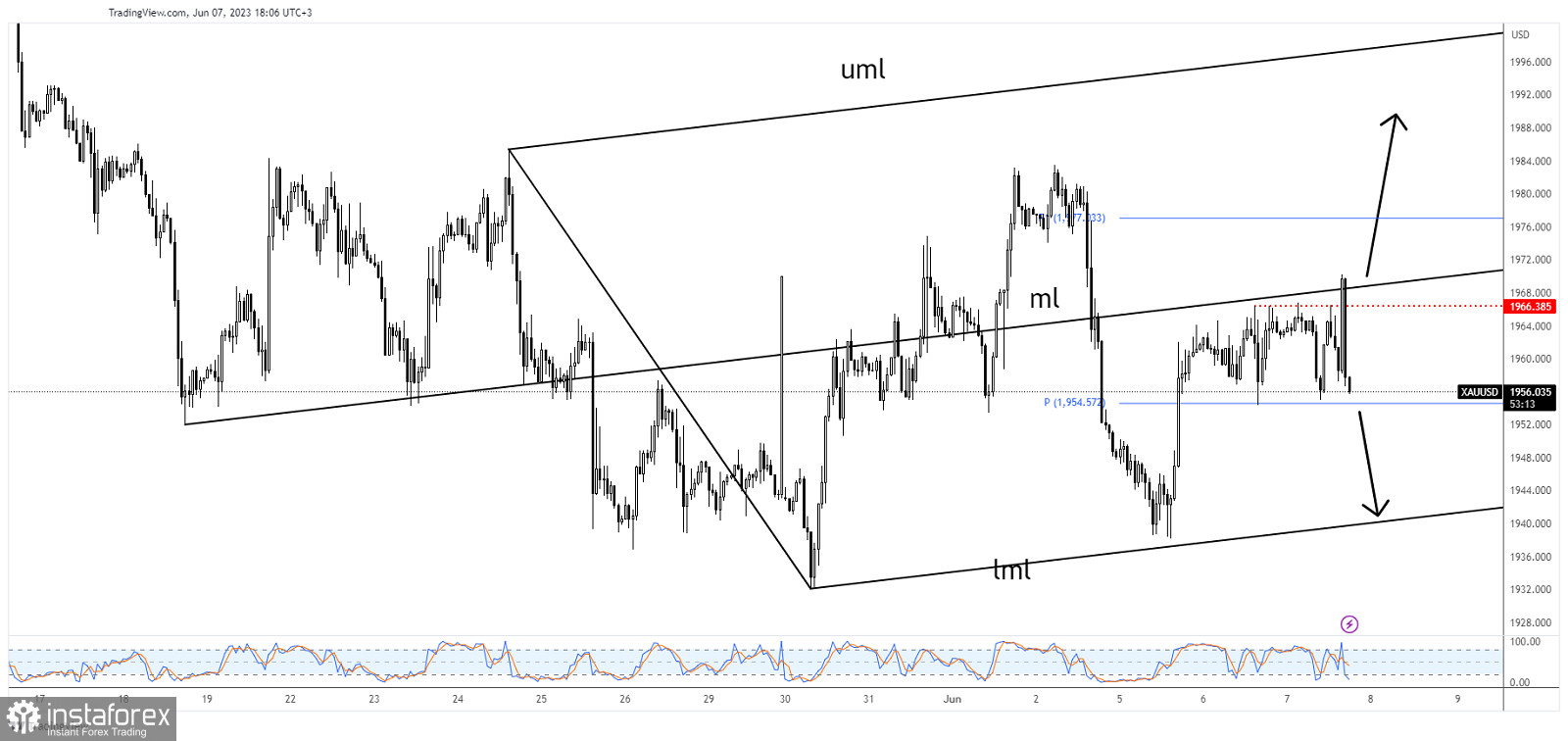

XAU/USD 1,954 As Support!

Technically, XAU/USD registered a false breakout through the median line (ml) and above 1,966 confirming exhausted buyers and invalidating an upside continuation. You knew from my yesterday's analysis that only a valid breakout above these obstacles may announce a larger growth.

Now, it could challenge the weekly pivot point of 1,954. This represents static support. False breakdowns and failing to make a new lower low could announce a potential rebound.

XAU/USD Outlook!

A valid breakdown below the pivot point (1,954) is seen as a bearish signal. The lower median line (lml) represents a potential downside target.