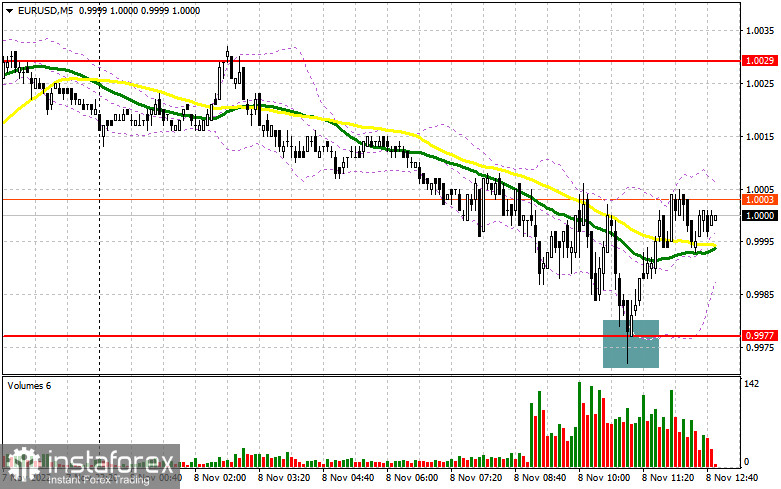

In the morning article, I turned your attention to 0.9977 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A decline and a false breakout of 0.9977 offered a buying opportunity. However, the pair was unable to climb higher. Bulls lost steam as large traders did not enter the market. Macro stats were also negative. So, after a 25 pip increase, the pair stalled. Nevertheless, there is a probability of further upward movement. For the second half of the day, the technical picture as well as the trading strategy remained unchanged.

When to open long positions on EUR/USD:

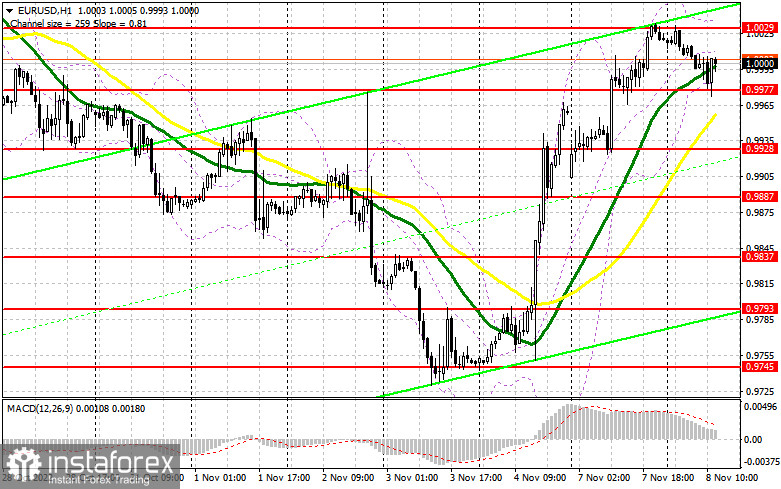

Today, there will be no crucial economic report from the US. This s why traders are mainly focused on Loretta Mister's speech and the NFIB Small Business Optimism Index. If the pair does not advance following these events, it is better to postpone long positions. If the euro drops amid the positive report, it is likely to reach the support level of 0.9977. Only a false breakout of this level, similar to the one I have mentioned above, will give a buy signal. Should this scenario come true, a further upward correction may take place. The euro could return to the resistance level of 1.0029. A breakout and a downward test of this level will open the way to 1.0090. As a result, the pair may consolidate above the parity level. if so, the price is likely to touch 1.0136 where I recommend locking in profits. A more distant target will be the 1.0182 level. If EUR/USD declines during the American session and bulls show no activity at 0.9977, the pressure on the pair will only increase. In this case, only a false breakout of the support level of 0.9928 will give a new buy signal. You can buy on EUR/USD immediately at a bounce from the support level of 0.9887 or 0.9837, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers have tried really hard today to regain control but they have failed to push the pair below 0.9977. A false breakout of the resistance level of 1.0029 will generate a good sell signal. It will indicate the presence of large traders in the market. They are likely to try to push EUR /USD down before the release of the US CPI report, which is on tap this week. In this case, a decrease and test of 0.9977 may take place. If the pair drops below this level and make an upward test, it will provide an additional sell signal. Bulls will have to close their Stop Loss orders. The euro could slide down to 0.9928 where I recommend locking in profits. The pair may decrease lower only amid the news about the US midterm election. If EUR/USD rises during the US session and bears show no energy at 1.0029, bears will be forced to close their Stop Loss orders. The pair is likely to rebound to 1.0090. At this level, the bears may again enter the market. If this scenario does not come true, it is better not to rush with short positions until a breakout of 1.0136 takes place. You can sell EUR/USD immediately at a bounce from 1.0182, keeping in mind a downward intraday correction of 30-35 pips.

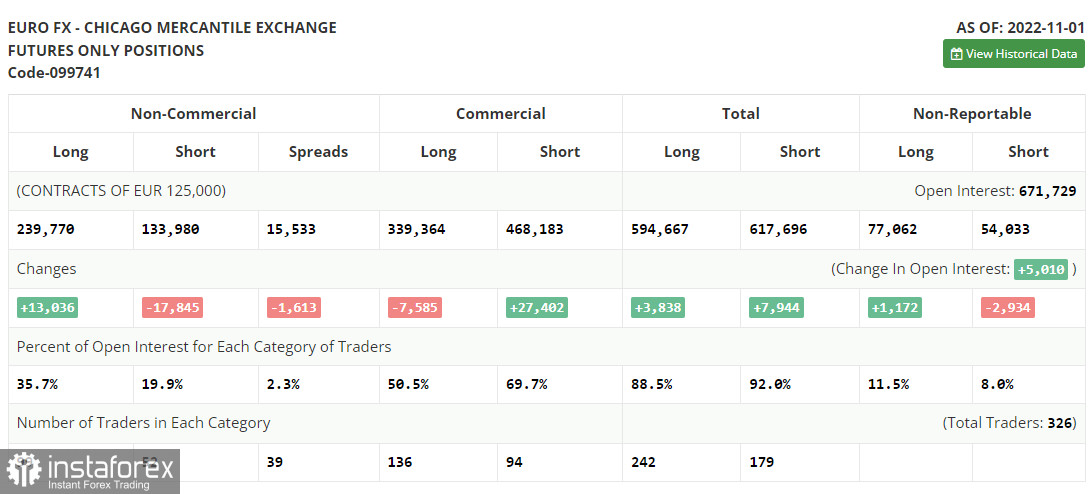

COT report

The COT report (Commitment of Traders) for November 1 logged a drop in short positions and an increase in long ones. The US dollar is losing ground against risky assets even though the Fed sticks to a hawkish stance. Many traders expect the central bank to slow down aggressive tightening in the spring of next year. After that, the regulator could move to monetary easing. If so, the euro is highly likely to soar to new highs. This week, the euro could jump amid US inflation data, which the Fed primarily takes into account when making monetary policy decisions. If inflation drops, the US dollar will weaken even more and the euro will be able to consolidate above the parity level. However, the upside potential of the euro is also limited. The ECB has recently announced it could revise its stance in the near future if the eurozone economy continues to shrink at a rapid pace. The COT report revealed that the number of long non-commercial positions increased by 13,036 to 239,770, while the number of short non-commercial positions declined by 17,845 to 133,980. At the end of the week, the total non-commercial net position remained positive and amounted to 105,790 against 74,909. It indicates that investors continue to buy up the cheap euro below the parity level. They are also accumulating long positions betting on long-term recovery. The weekly closing price rose to 0.9918 against 1.0000.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages. It indicates that the pair is moving in the sideways channel.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 0.9977 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.