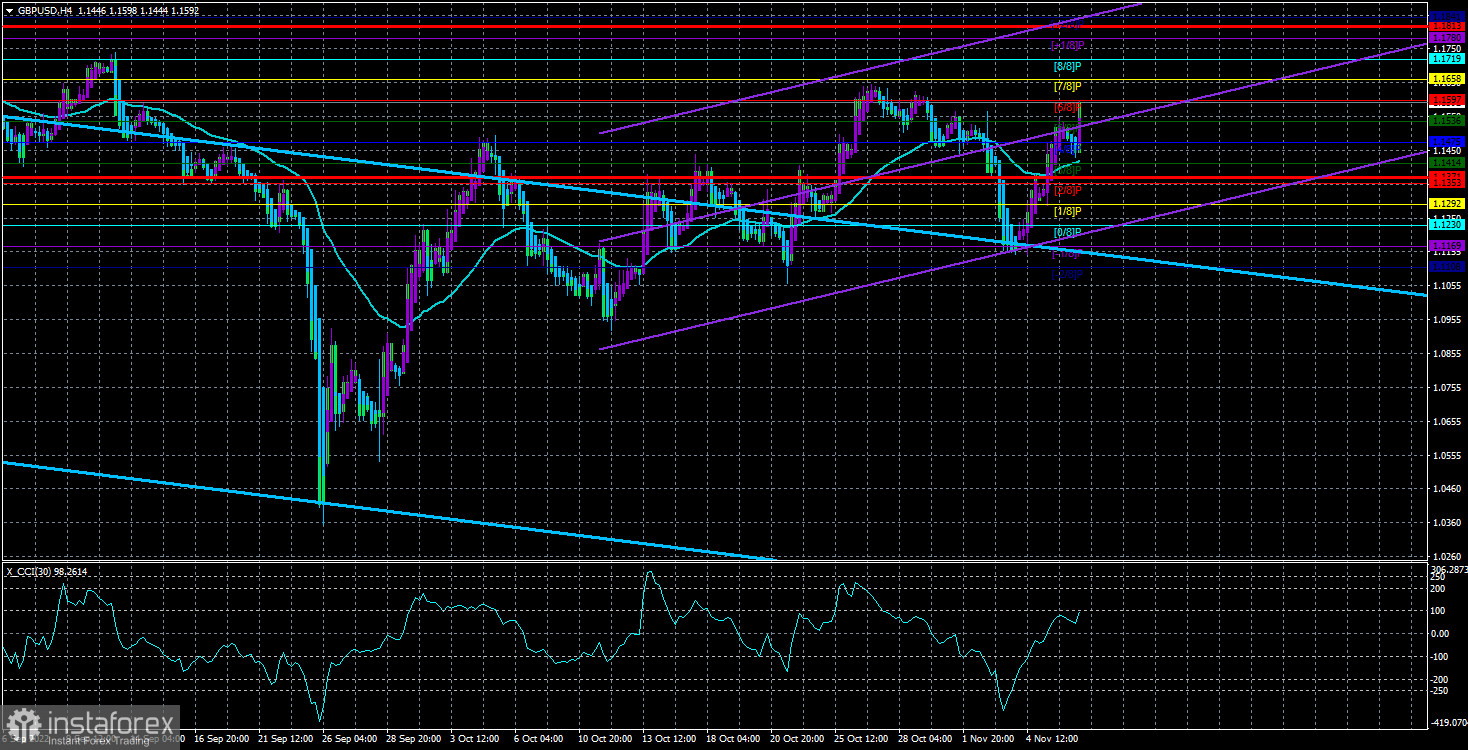

The GBP/USD currency pair started a weak downward correction on Tuesday. At the same time, it continued to be located above the moving average line, but even in the illustration above it is visible that in recent weeks it has constantly overcome it in one direction, then in the other. Thus, there is no clear trend now, although I would like to conclude that it is ascending. In the euro/dollar article, we talked about why the US dollar may remain extremely strong in 2023. Therefore, even an increase of 1300 points in the pound/dollar pair does not allow us to draw an unambiguous conclusion about the formation of a new long-term upward trend. Recall that geopolitics and the "foundation" remain unchanged in recent weeks. Yes, certain growth factors are beginning to appear in the British currency, but will they be enough for the pound to show a movement to the north over a long distance? We doubt it.

On the 24-hour TF, the pair also gained a foothold above the Ichimoku cloud, which slightly increases its chances of strengthening. Nevertheless, the British economy is, if not in a deplorable state, then in a very dangerous one. The market is waiting for a new financial plan from the UK government. The last one, we recall, failed miserably and cost the chair of Prime Minister Liz Truss. Finance Minister Kwasi Kwarteng also said goodbye to his post. Now it's up to Rishi Sunak and Jeremy Hunt. Instead of cutting taxes, they are going to raise them, which could lead to a decline in the popularity of conservatives among Britons. The next parliamentary elections will not take place soon, but in any case, the Conservative Party should understand what such a step will turn out for it: in the most difficult times for the British (Brexit, pandemic, rising energy prices, geopolitics) taxes will also rise. Yes, a compensation mechanism has been invented for the British population, which will reduce their energy bills. But at the same time, taxes will rise, and the pound sterling is depreciating at a rate of 10% per year, hence the real incomes of citizens are falling.

Huw Pill believes that a return to 2% inflation will not be painless.

After the Bank of England raised the key rate for the eighth time in a row, and Andrew Bailey "promised" the beginning of a recession in the third quarter, many began to look cautiously towards the British pound. Too many shocks have befallen in recent years. Even its last impressive growth turned out to be accidental, as it was a market reaction to the refusal of the Liz Truss government from the tax reduction plan. If Truss and Kwarteng had not initially presented this plan, the markets would not have collapsed and would not have dragged the pound down with them. Thus, if we "remove" these movements from the charts, then the pound remains near its 37-year lows and does not show any strong growth.

At the same time, the chief economist of the Bank of England, Huw Pill, said that the labor shortage in the UK remains very strong, although the economy is slowing down. This is a long-standing problem for Britain since, after its withdrawal from the EU, much less labor is sent to this country than before. And the British themselves are not used to working in "black" jobs, which is why there was a shortage. Pill also said that the regulator will do everything possible to return inflation to 2%, but at the same time BA should not be fixated only on inflation, it should try to avoid disruptions in the real economy. Pill also said that in reality, it is impossible to get "disinflation" without consequences. He understands the desire of many to blame the Bank of England for the recession, but in fact "other factors are to blame."

Based on this, we conclude that not everything is good in the British Kingdom. If the recession is strong, as is expected now, the pound may lose the positions won with such difficulty from the US dollar. Things are not going well in the States either, but there are noticeably fewer problems.

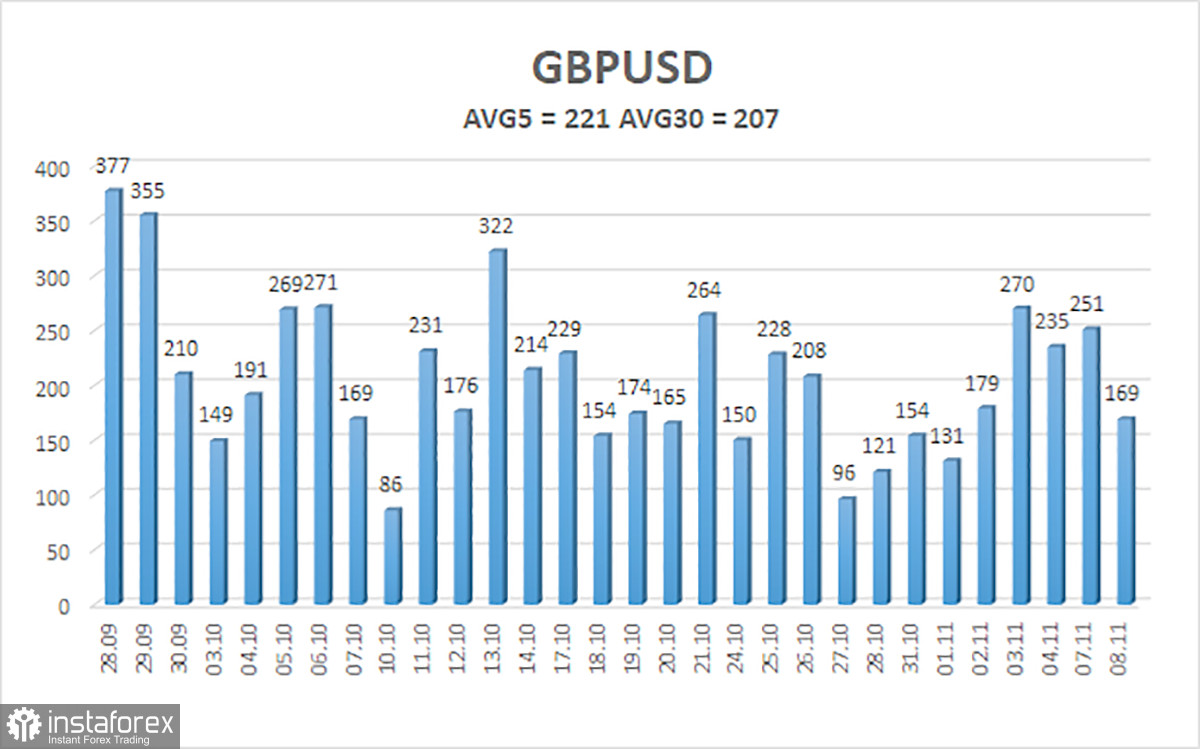

The average volatility of the GBP/USD pair over the last 5 trading days is 221 points. For the pound/dollar pair, this value is "high." On Wednesday, November 9, thus, we expect movement inside the channel, limited by the levels of 1.1371 and 1.1813. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction.

Nearest support levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The GBP/USD pair continues its upward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1719 and 1.1813 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1292 and 1.1230.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.