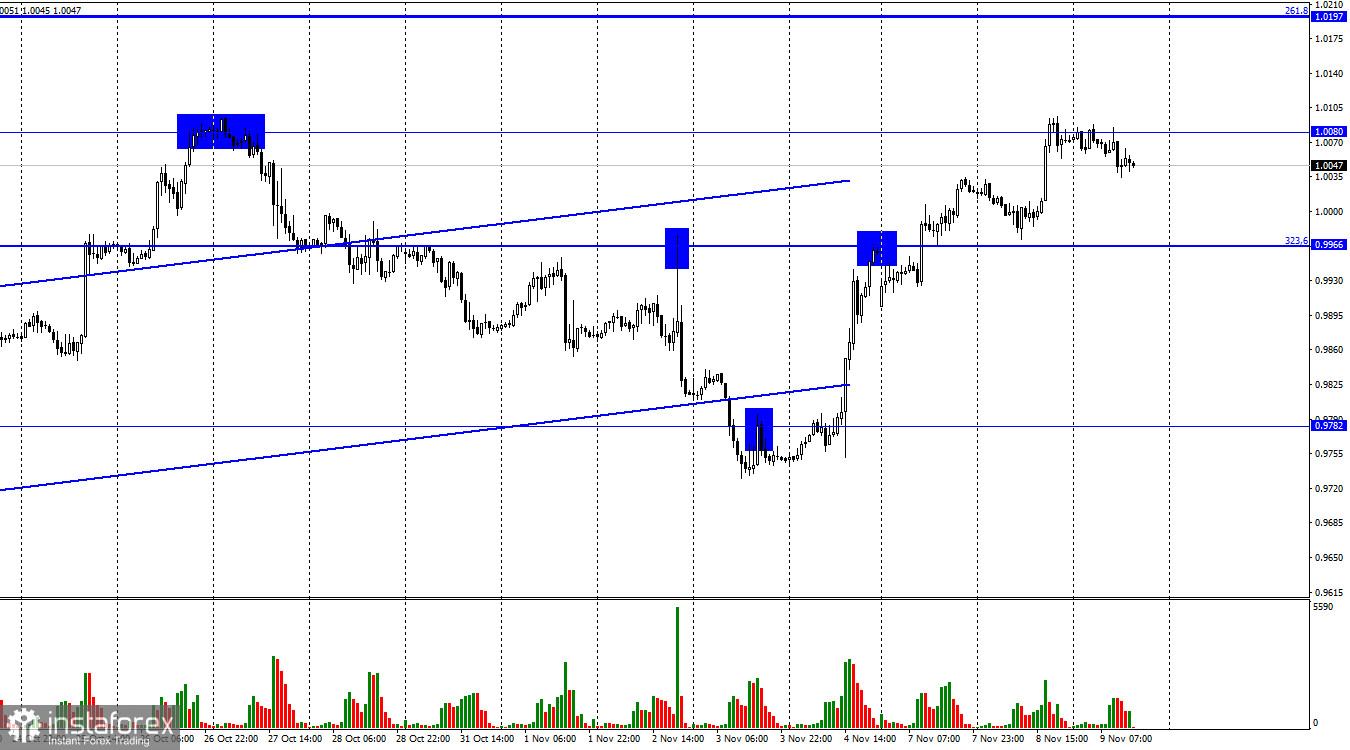

The EUR/USD pair continued the growth on Tuesday and reached 1.0080. The rebound from this level worked in favor of the US currency and began to fall toward the corrective level of 323.6% (0.9966). Closing the pair's rate above the level of 1.0080 will increase the probability of further growth towards the next Fibo level of 261.8% (1.0197).

Thus, the European currency has grown for four full days, which puzzles me a lot. The fact is that this week there has not yet been a single important economic event for the euro to show such strong growth. Perhaps the most interesting event of the first three days of the week were the midterm elections to the Senate and the US Parliament, in which the Republicans are leading so far. Remember that before the elections, Democrats held the leadership in both chambers. Still, President Joe Biden and his party were repeatedly criticized, so it seems that power is passing into the hands of their competitors. There are no final results yet, and the Democrats can keep the Senate for themselves. So far, there is complete equality between them and representatives of the Republican Party, but it was like that before the elections, just the deciding vote in such cases is given to the vice president of the country. That is, Kamala Harris, who is a representative of the Democratic Party. Thus, in the best case, the Democrats will retain the Senate but give the Republicans the lower house.

Part of the fall in the dollar may be related to this event, but I don't believe it. This is just a midterm election, and even if there is a significant reshuffle in Parliament, why is the dollar falling? Will the Republicans come to power? No. Joe Biden will remain president, and they will not have a majority in the Senate. Thus, changes may follow in some areas, but not instantaneous and not fast. And for the dollar, it is unlikely that anything will change, since its fate is more in the hands of the Fed, which is an independent body.

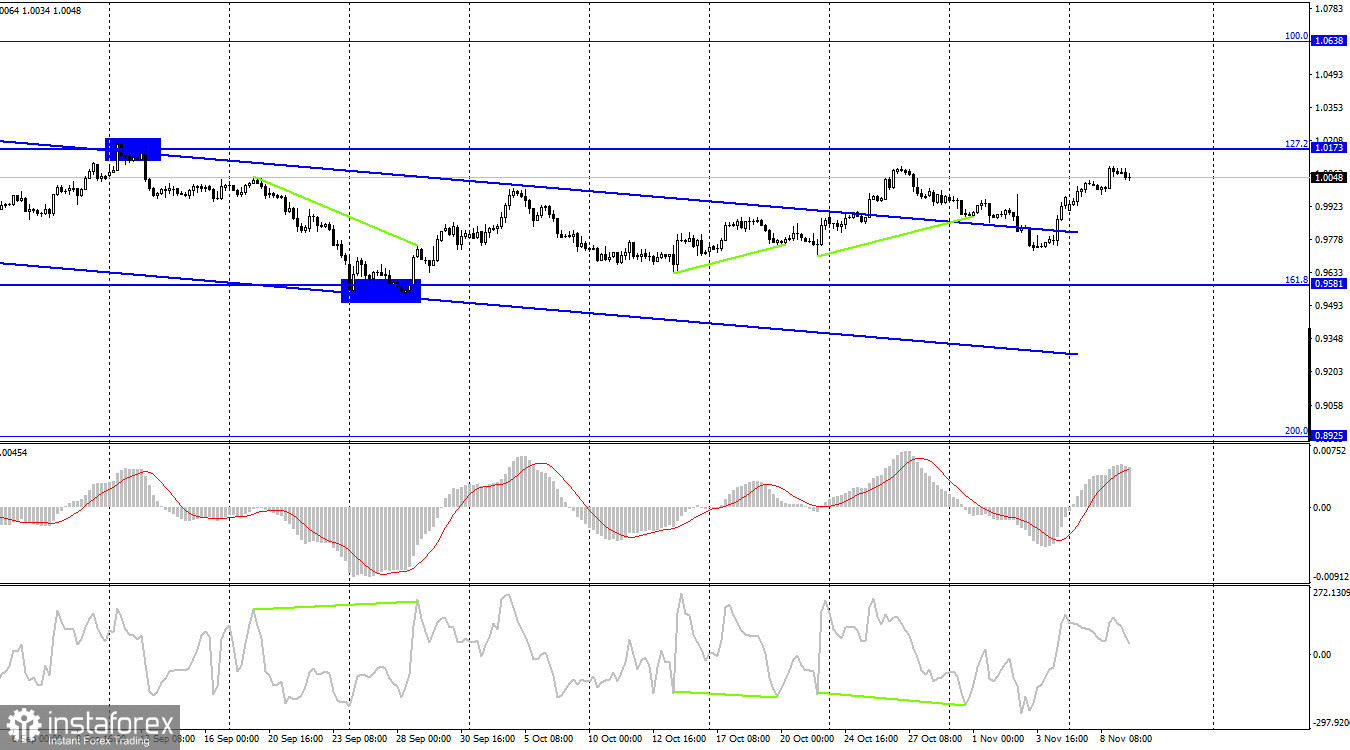

On the 4-hour chart, the pair performed a new reversal in favor of the EU currency and resumed the growth process towards the corrective level of 127.2% (1.0173). Earlier, the pair performed a consolidation over the descending trend corridor, which is an extremely important moment, since it changes the mood of traders to "bullish." A rebound from the 1.0173 level may work in favor of some fall.

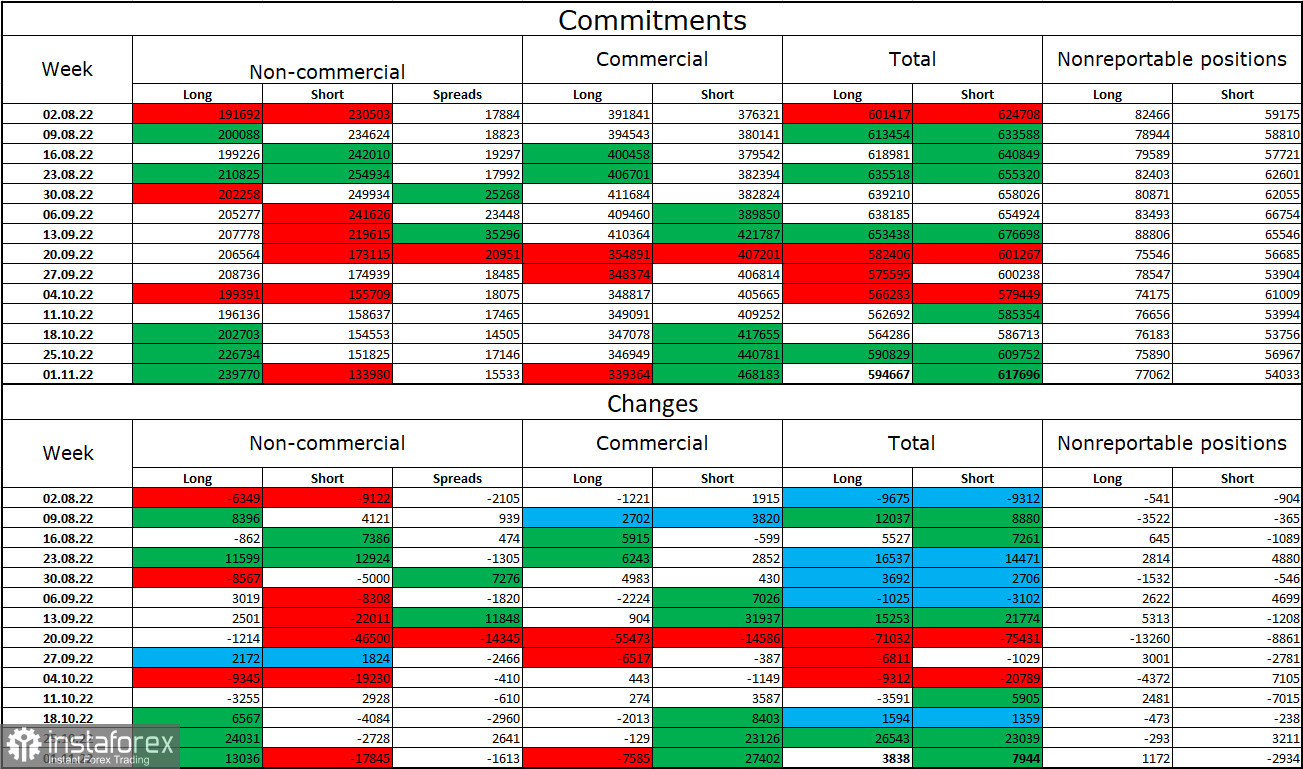

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 13,036 long contracts and closed 17,845 short contracts. This means that the mood of large traders has become much more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 239 thousand, and short contracts – 133 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not ready to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, even the bullish mood of major players does not allow the euro currency to show strong growth.

News calendar for the USA and the European Union:

On November 9, the calendars of economic events in the United States and the European Union are empty. The influence of the information background on the mood of traders in the rest of the day will be absent.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when rebounding from the 1.0080 level on the hourly chart with a target of 0.9782. Or when rebounding from 1.0173 on the 4-hour chart. I recommended buying the euro currency when fixing above the level of 0.9966 on the hourly chart with targets of 1.0080 and 1.0173. The first goal has been fulfilled. The second one can be worked out only if it is closed over the first one.