Risk appetite noticeably fell this Thursday morning. The S&P 500 already lost more than 2% the previous day, while stock markets in Asia-Pacific countries traded in the red zone. Europe is also likely to open lower, which can not be said to government bond yields as it showed somewhat higher stability. 10-year US Treasures stayed above 4%, confidently indicating an increase in the risk of stagflation.

Part of the reason why risk appetite decreased is the preliminary results of the US elections, according to which the Republicans will receive a majority in the House of Representatives and thus be able to influence the government's budgetary policy. There is still no clarity on the Senate, as the state of Georgia will hold a second round, scheduled for December 6.

The second factor is the increase in the number of Covid patients in China, which reduces the likelihood of lifting restrictions.

Today, the focus will be on the US inflation report, which has a base rate forecast of +6.5%, slightly below September's 6.5%. It is very important because if inflation does not show at least some signs of slowing down, then Fed rate forecasts could rise to 6% for 2023, which will increase panic and push up demand for dollar. Conversely, a data release of 6.5% or lower could dampen anti-risk sentiment slightly and boost demand for commodity currencies.

NZD/USD

Inflationary momentum in New Zealand remains strong and there is no slowdown yet. But the labor market is very stable, thanks to the very large decrease in the number of workers dropping out of the labor force. Another record performance for the 3rd quarter is the growth in average hourly wages, which in the private sector grew by 8.6% y/y. It is expected that by the end of the year, this figure will exceed 9%, which leaves the RBNZ no choice but to raise rates higher.

The latest RBNZ survey on inflation expectations showed that inflation is expected to reach 5.08% in 1 year versus 4.86% in September. Then, it will return to 3.62% in 2 years versus 3.07% earlier.

Obviously, inflation expectations continue to rise even though the RBNZ is raising rates quite aggressively. The ANZ Bank predicts that the rate will be raised to 5% in February, then peak in the end of 2023, which looks more aggressive than the Fed's policy, and will contribute to the growth of the yield spread in favor of the kiwi.

But if prices for dairy products continue to drop, NZD will halt growth. That, however, is quite unlikely as a peak in stocks of dairy products has been formed and a reduction in production is expected, which will help support prices.

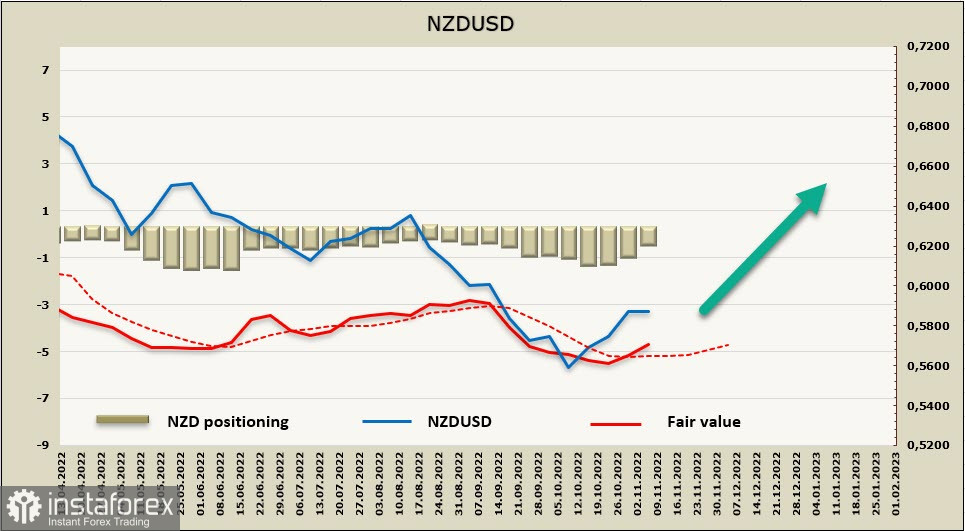

According to reports, NZD net short position decreased for the second week in a row. There is a bearish advantage of -0.22 billion, but the estimated price turned up, increasing the probability of a bullish correction.

Kiwi broke through the resistance level of 0.5866. In case of a rebound, support will be found in 0.5810/20, while resistance will be in 0.5960 (23.6% retracement level of the fall since February 2021).

AUD/USD

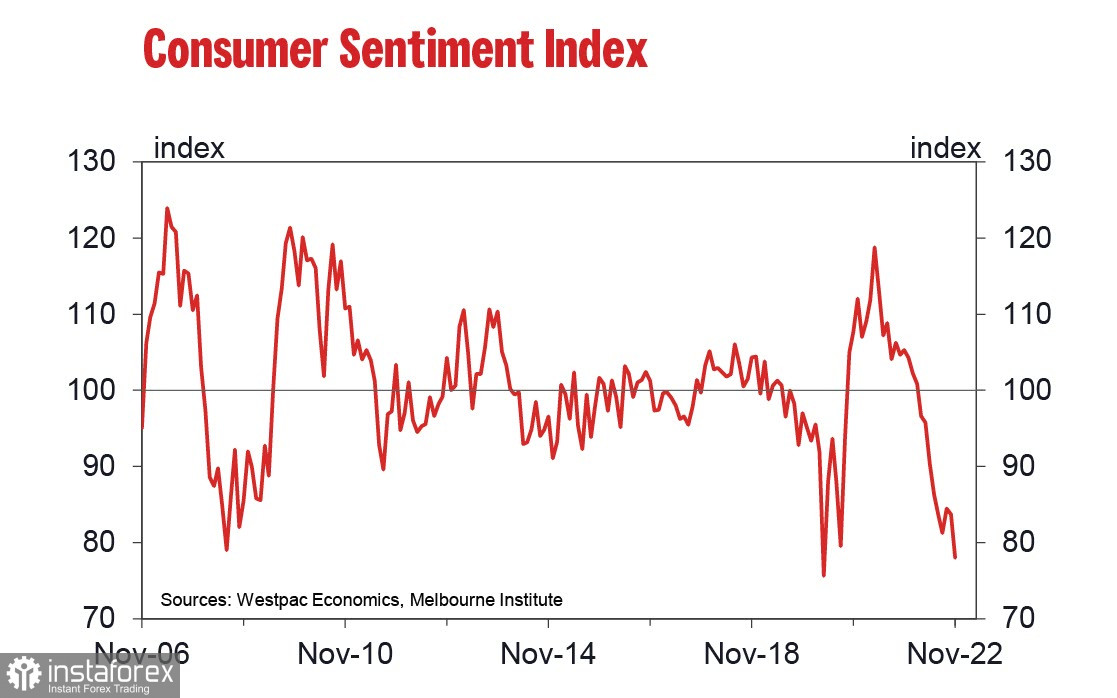

The consumer sentiment index reportedly fell 6.9%, from 83.7 in October to 78.0 in November. Obviously, inflation in Australia continues to grow, reaching 7.3% in the 3rd quarter against 6.1% earlier. Forecasts suggest further inflation growth.

This is why the Australian government is very careful in making changes to tax policy. Rate forecasts are also rising to a higher level, which leads to a drop in consumer spending. There is also a marked decrease in labor market confidence, as well as in the possibility of buying a home.

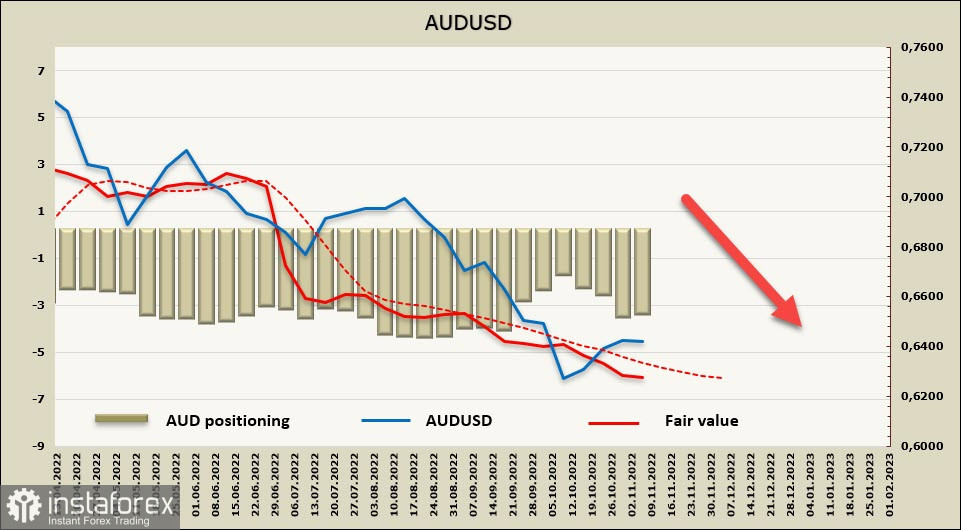

In terms of positioning, the latest data says net short position in AUD decreased by 0.1 billion over the reporting week. The bearish advantage remains, with the estimated price being below the long-term average and is directed downwards. Although the trend is bearish, there will be attempts of upward correction.

Support is at 0.6320/30, while resistance is at 0.6510/30. But trading will move into a side channel, the exit from which is more likely down. When trying to grow to 0.6510/30, traders must sell first in order to return the quote to 0.6320/30. However, there is no reason yet to expect a full-fledged bullish reversal.