Overview of trading and tips on trading GBP/USD

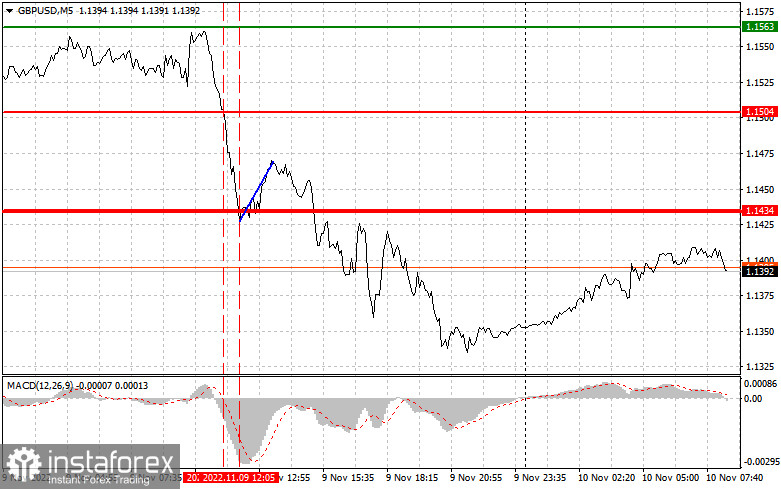

The level of 1.1504 was tested at the moment when the MACD had declined considerably from the zero mark which capped the downward potential of the pair. For this reason, I didn't sell the pound sterling. I recommended buying GBP/USD immediately at a dip after the level of 1.1434 had been updated. So, after I had bought the instrument, the price moved almost 35 pips upward. Then, the pair came under selling pressure again. No other signals were generated.

The economic calendar today contains no reports on the UK economy. Investors will be alert to remarks from Deputy Governor for Markets and Banking at the Bank of England David Ramsden and MPC member Silvana Tenreyro. The sterling is likely to remain under selling pressure in the first half of the day. The British currency has been weighed down by protracted soaring inflation and the ailing economy. The Bank of England has to deal with all these headwinds through a cycle of aggressive monetary tightening.

The second half of the day will be more interesting. The US CPI for October and the core CPI excluding food and energy prices will determine a further trajectory for the US dollar in the short term. In case consumer inflation shows signs of a slowdown, it will be bearish for the US dollar. Hence, GBP/USD will grow in favor of the British pound. Alternatively, if the headline inflation accelerates, demand for the US dollar will increase and we will see another sell-off of GBP/USD. FOMC policymakers Patrick Harker, Loretta Mester, and Esther George are due to speak tonight. They will shed light on the Fed's agenda for monetary policy, thus arousing interest among market participants. The weekly update on US unemployment claims will be neglected by the market.

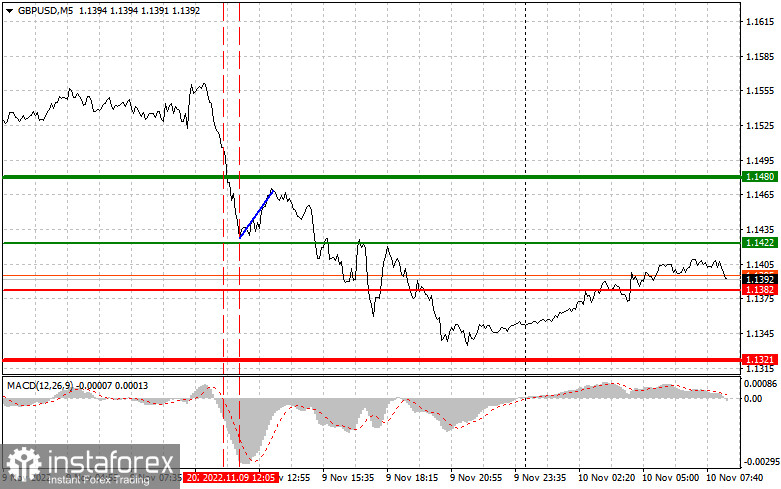

Buy signal

Scenario 1. We can buy GBP today if the price reaches the market entry point at 1.1422 plotted by the green line in the chart. The upward target is seen at 1.1480 plotted by the thick green line in the chart. I would recommend exiting long positions at 1.1480 and opening short positions in the opposite direction, bearing in mind a 30-35-pips decline from this level. We could reckon on the sterling's growth on condition of weak US inflation data. Importantly, before opening long positions, make sure the MACD has settled above the zero mark and beginning its climb from it.

Scenario 2. We could also buy GBP today after the price reaches 1.1382, but the MACD should be in the oversold zone at this moment. It would subdue the downward potential of the pair and cause the price reversal in the opposite direction. We could expect the price growth to the levels of 1.1422 and 1.1480.

Sell signal

Scenario 1. We could sell GBP today only after the price sinks lower than 1.1382 plotted by the red line in the chart. This will enable a rapid decline of the pair. The sellers' key target will be 1.1321 where I recommend leaving short positions and opening long positions in the opposite direction, bearing in mind a 20-25-pips upward move from this level. GBP will come under pressure again if the US CPI rises in October. Importantly, before selling GBP/USD, make sure the MACD has settled below the zero mark and is beginning its decline from it.

Scenario 2. We could also sell GBP today in case the currency pair reaches 1.1422, but the MACD should enter the overbought zone at that moment which will subdue the upward potential of the pair and enable the opposite downward reversal of the trajectory. We could expect a fall to the levels of 1.1382 and 1.1321.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.