The situation in the cryptocurrency market continues to worsen due to a series of negative events that have formed as a result of the probable bankruptcy of FTX. Market capitalization fell by 5% over the past day and reached $840 billion.

Pandora's Box

The situation around FTX has become a Pandora's box for the crypto market and provoked further outflow of funds from most exchanges. Over the past day, $1 billion in ETH, $950 million in USDC, $400 million in USDT and $195 million in BUSD have been withdrawn from centralized platforms.

Binance also confirmed its exit from the deal to buy FTX, which caused the altcoin Solana to drop to $12. More than $300 million is expected to be withdrawn from SOL staking today, which is highly likely to be sent to the order book.

In addition, Bitcoin has finally consolidated below $17k, and as of November 10, it is trading near the level of $16.7k. Over the past day, the asset has lost 6.5% of capitalization, which brings the asset closer to the cost price level.

JPMorgan experts say that the price of BTC is approaching the average value for the cost of production. A fall in Bitcoin quotes below this indicator can cause a cascade of margin calls from large investors and mining companies.

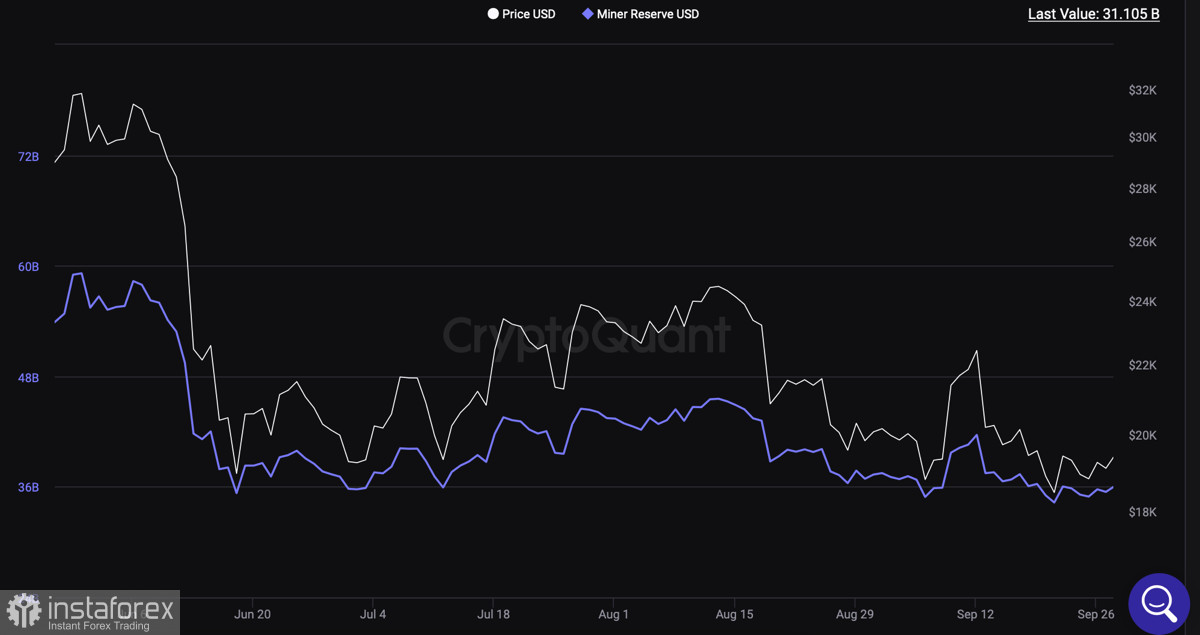

Crypto mining companies are also going through hard times after BTC falls below $20k. It is likely that soon we will see the resumption of the process of capitulation of miners and the bankruptcy of some companies.

The total losses of the crypto market over the past three days exceed $1 billion. Some crypto influencers are confident that the FTX bankruptcy will be the starting point for the industry in a series of bankruptcies of large companies. First of all, we will see the completion of the history of a number of mining companies and decentralized crypto platforms.

Inflation statistics

On November 10, monthly statistics on the dynamics of the consumer price index will be published. Despite the harsh rhetoric of the Fed, experts from leading US banks said that a more rapid fall in inflation is expected in the coming months.

Given the likelihood of a favorable outcome for the CPI, today may be a necessary recovery pause for the market. At the same time, it is important to understand that the inflation data will cause additional unrest in the market; therefore, the movement of quotes of fixed assets will become unpredictable.

Despite the deplorable nature of the current situation, the markets see light at the end of the tunnel in the spring of 2023. According to expectations, the Fed will raise the rate by 0.5% in December and February, followed by monetary policy easing.

BTC/USD Analysis

Bitcoin finally said goodbye to the main range of fluctuations of the last five months and consolidated below $17k. Given the tension of the situation and a lot of negative factors, there is every reason to expect a further fall in the price of BTC.

Among the most likely targets, it is worth highlighting the $15.8k level, which the price has already tested. In the coming days, we should expect a retest of this indicator, followed by a pullback. Looking back at the 2018 fractal, there is every reason to believe that Bitcoin will find a bottom below $12.5k.

In the short term, we see signs of buying activity. The technical metrics on the daily chart point to an increase in bullish sentiment and an attempt to gain a foothold above $17k. The Stochastic has formed a bullish crossover, while the RSI has rebounded from the lower border of the bullish zone and continues to move up.

Results

It is not worth expecting a recovery movement of BTC without an admixture of manipulation in the coming weeks. The crypto market is entering the final phase of the correction, which will confirm the cyclical fall in Bitcoin quotes by 85%.

As of November 10, the asset has fallen by 77%, and therefore there is room for further decline. Given this, the $15.8k level is unlikely to be the bottom of the current cycle. The combination of negative factors and historical accuracy suggest that BTC will form a bottom near $11k–$12.5k.