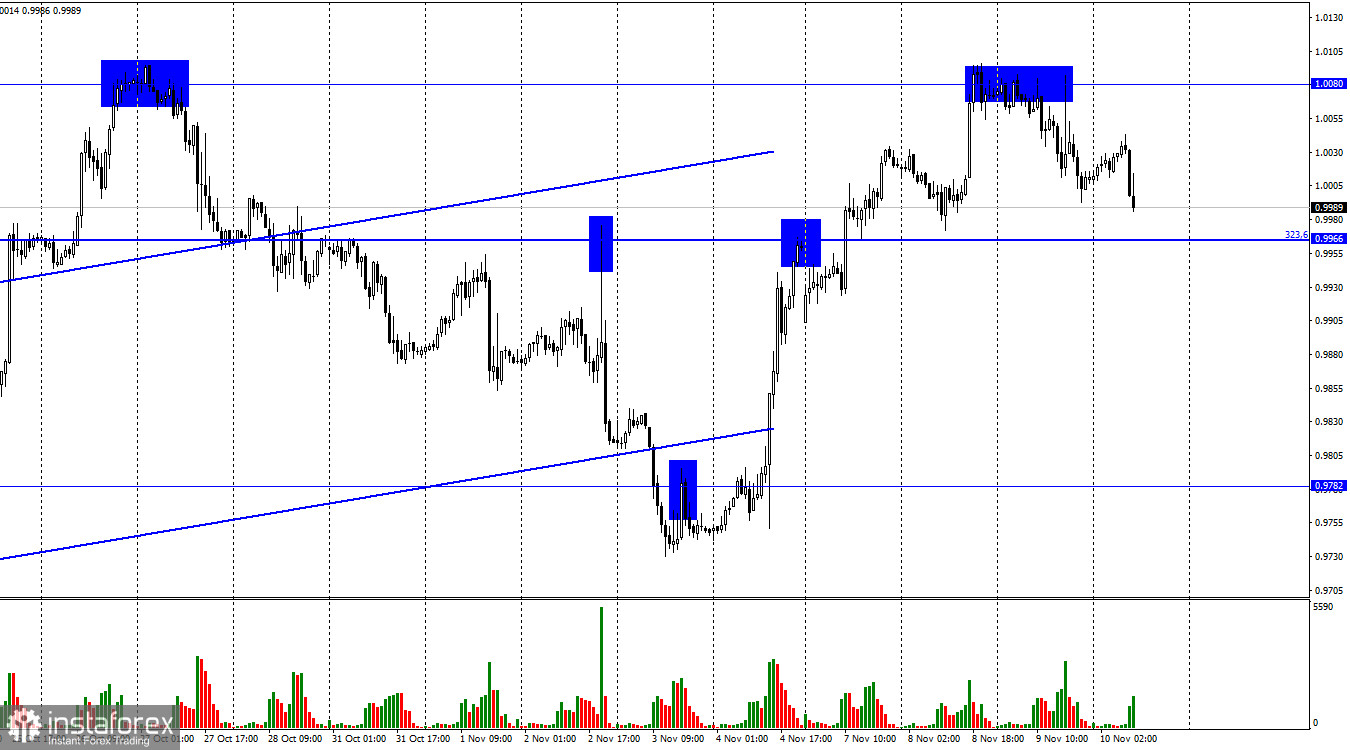

Hello, dear traders! Yesterday, the EUR/USD pair bounced off 1.0080, and a bearish reversal occurred. The price is now heading towards the 323.6% retracement level of 0.9966. If the quote rebounds from the mark, it may then rise to 1.0080. Meanwhile, consolidation below 0.9966 may lead to a downtrend continuation, with a target at 0.9782.

On Thursday, traders will see the release of important macro data for the first time in the whole week. The US inflation report will be released in the second half of the day. These figures are now almost of the same significance as FOMC meetings. In fact, the previous report triggered a reaction unseen even after the Fed's monetary policy meetings. It makes no sense to analyze either the reaction of traders to the report or the results themselves. Currently, inflation is estimated to slow down to 8.1%. It remains to be seen how traders take these figures. In my view, any reaction may follow, especially if actual data comes in line with the forecast.

The pace of future tightening depends on the pace of a near-term slowdown in consumer prices. Last week, Fed Chairman Jerome Powell said there was more tightening to come. Analysts now see the interest rate at 5%. However, it does not mean that the regulator would stop there. The target interest rate in the United States is now seen as floating, meaning it is constantly adjusted to the upside. Thus, if inflation goes down slowly or stops falling at all, we may see interest rates at 5.25% and even 5.50% next year.

If inflation shows a barely noticeable decrease today, the greenback is likely to surge. As a reminder, there is still a chance that the Fed announces a 0.75% rate hike at the next meeting. Nevertheless, it is widely expected that the pace will be reduced from December on.

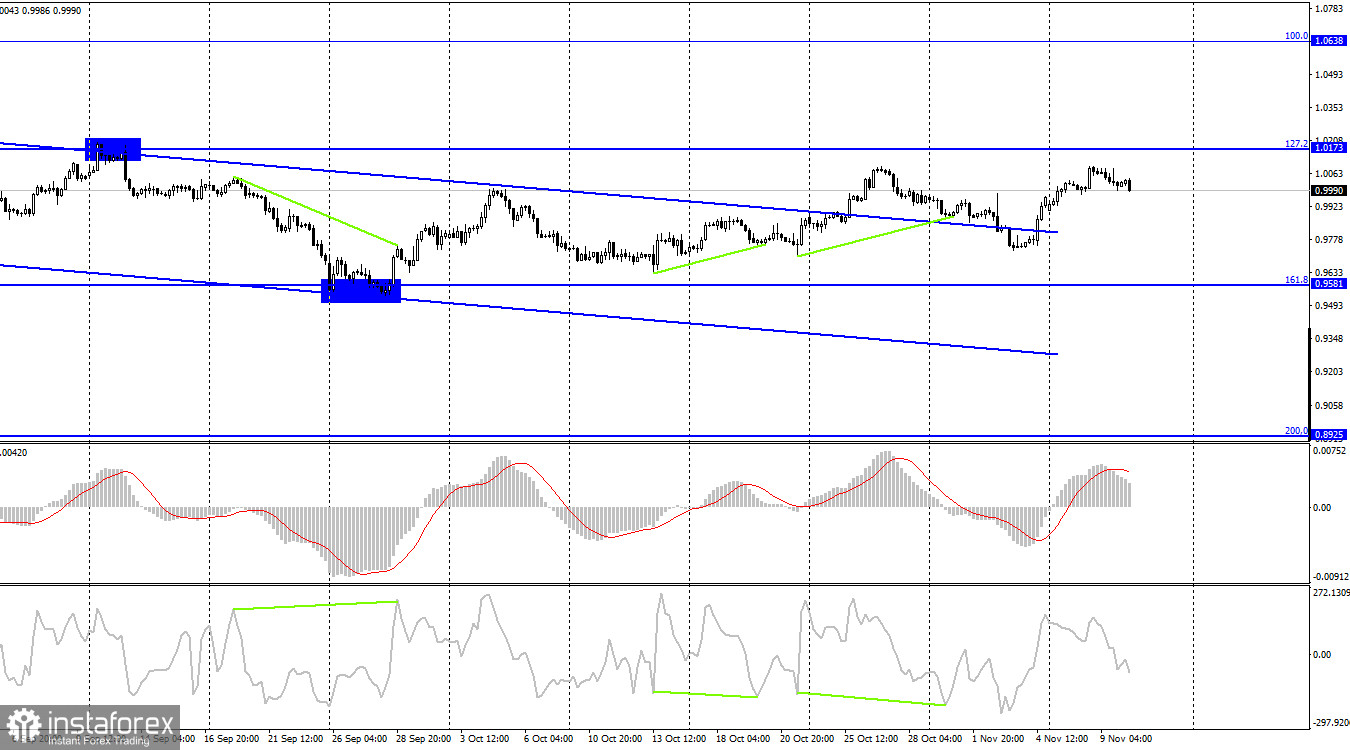

On the H4 chart, the pair reversed to the upside and headed towards the 127.2% retracement level of 1.0173. It consolidated above the descending corridor right beforehand, which is extremely important, as trader sentiment is turning bullish. Still, the pair may pull back from the 1.0173 mark and go down.

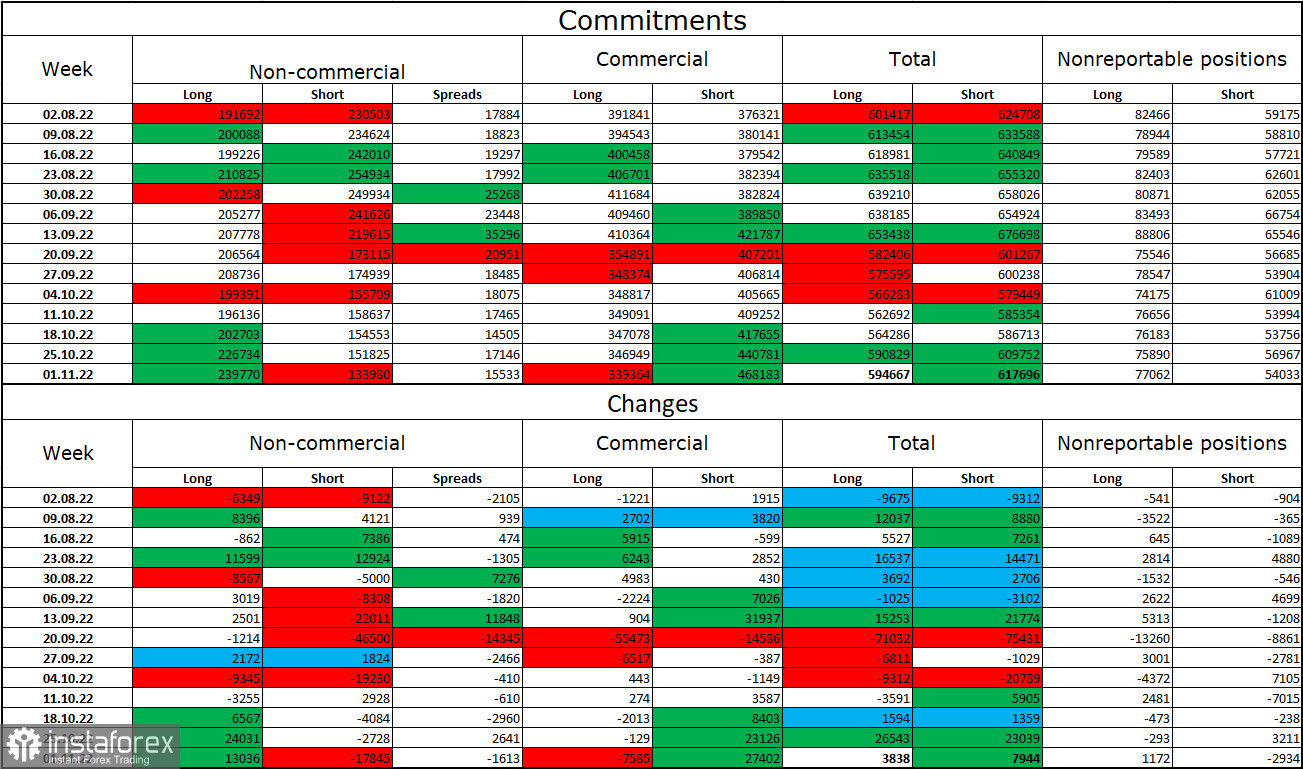

Commitments of Traders:

Last week, speculators opened 13,036 new long positions and closed 17,845 short positions, which marks an increase in bullish sentiment. Overall, speculators now hold around 239,000 long positions and 133,000 short ones. The euro is still struggling to grow. Over the past several weeks, the currency has had more growth prospects. However, traders are not ready to give up USD purchases. Therefore, I think it is now wiser to focus on the descending corridor on the H4 chart, above which the price managed to close. Consequently, we may see the extension of the uptrend. Still, the euro is unable to rise sharply despite bullish market sentiment.

Scheduled macro events in the United States and the eurozone:

US Inflation Rate (13-30 UTC) and US Initial Jobless Claims (13-30 UTC).

On November 10th, the eurozone's macroeconomic calendar is empty. Meanwhile, the United States will see the release of two important reports, with a focus on inflation. Fundamentals are likely to influence trader sentiment considerably in the second half of the day.

Outlook for EUR/USD:

It will become possible to open short positions after a pullback from 1.0080 on the H1 chart, with a target at 0.9782, and to hold them after the close below 0.9966. Long positions could be considered after a rebound from 0.9966 on the H1 chart, with a target at 1.0080.