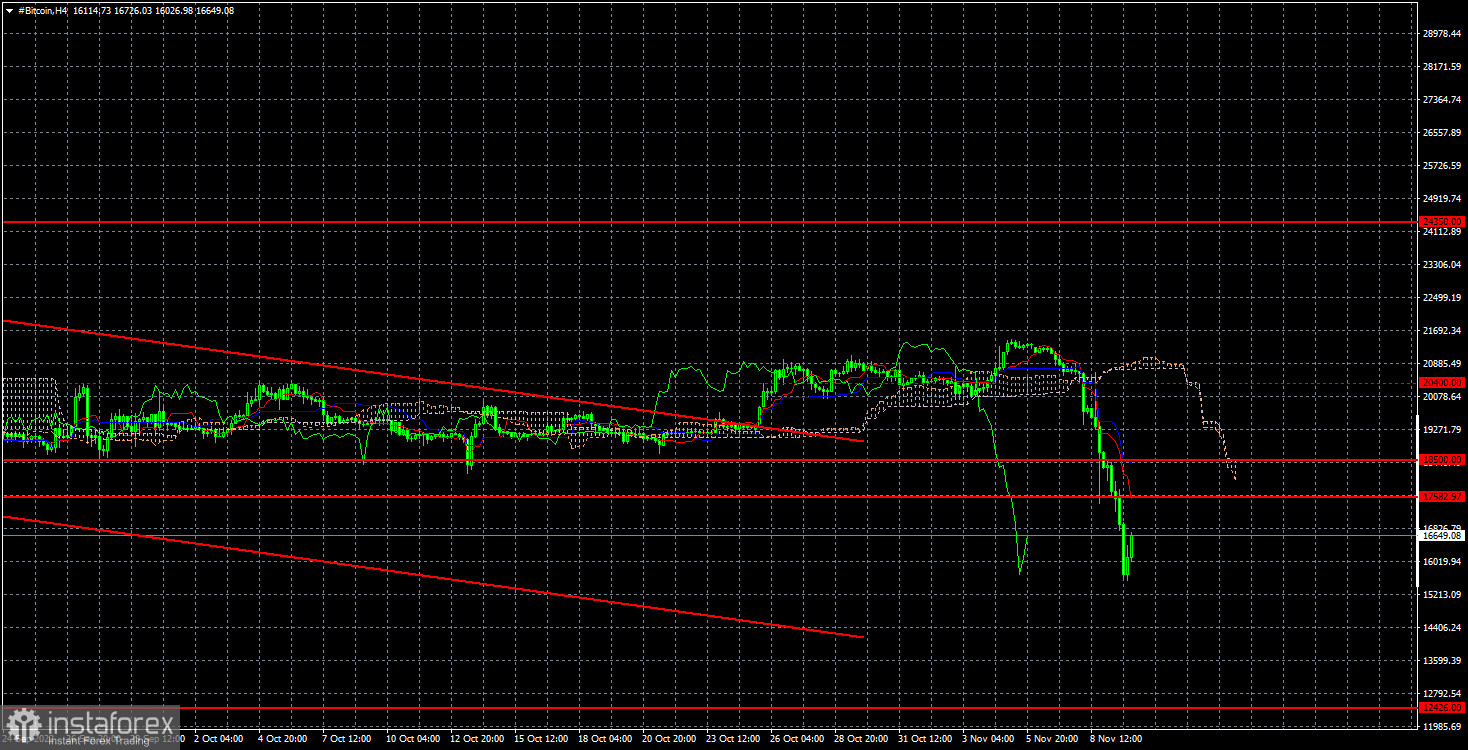

At the 4-hour TF, bitcoin began a new collapse, which can be associated with anything and explained in any way. The price has overcome the $18,500 and $17,582, which have been strong support levels for a long time. These two levels prevented bitcoin from continuing to fall for five months. But everything comes to an end sooner or later. We said the longer the price tries to overcome this or that level, the higher the probability of its final overcoming. So it turned out, but I had to wait for five months. Now the nearest target of the fall is the level of $12,426.

We believe that the fall of bitcoin has been brewing for a long time. Investors were in no hurry to buy the coin "at a very favorable rate," as many "crypto experts" advised. The Fed rate continues to rise, which increases the demand for safe assets. Therefore, the fundamental background and market sentiment did not contribute to the growth of the first cryptocurrency in the world. In addition, FTX, the fourth largest crypto exchange in the world, announced a liquidity problem this weekend.

Simply put, the exchange is in a pre-bankruptcy state. And this is far from the first exchange and crypto company to experience similar problems in 2022. At this time, FTX can be bought by Binance, the largest crypto exchange in the world, controlled by Changpeng Zhao. He said his company would buy out the troubled exchange to protect investors from losses. However, this is just a beautiful statement because investors have already lost enough due to the fall of the entire cryptocurrency market.

Managing crypto companies are trying to save their offspring during the "crypto winter," but it will be very difficult if there is no demand for cryptocurrencies or decreases. As soon as investors become aware of liquidity problems, they immediately withdraw money from the problematic exchange, which leads to massive sales of cryptocurrencies and a market collapse. Therefore, we will not be surprised if we will observe more than one similar story. Bitcoin can count on growth only when the Fed stops tightening monetary policy. And it may happen no earlier than March 2023. But even in this case, the rate will remain high for at least a year.

In the 4-hour timeframe, the quotes of the "bitcoin" finally left the side channel in which they spent five months. Both important levels of $18,500 and $17,582 have been overcome, so we expect the fall to continue with a target of $12,426. Trend lines and channels are no longer relevant, but the downward trend persists. Bitcoin is trying to stay afloat, but the fundamental background regularly drowns it. After falling to $12,426, we may see a few more months of flat.