US inflation has disappointed dollar bulls. For the first time in many months, absolutely all components of the release came out in the red zone, falling short of the forecast levels. Perhaps now we can say with confidence that the aggressive policy of the Federal Reserve has begun to bear fruit. The consumer price index slowed down its growth, allowing the Fed to slow down at the end of this year.

The EUR/USD traders reacted to the release accordingly. The pair soared up and updated a two-month high, marking the level of 1.0186. Whereas ahead of the release of the report, the bears were confidently advancing: the low of the day was at around 0.9936. Such a sharp 250-point rise is quite understandable: for the first time this year, inflation "succumbed" to the onslaught of the US central bank and showed the first signs of a slowdown.

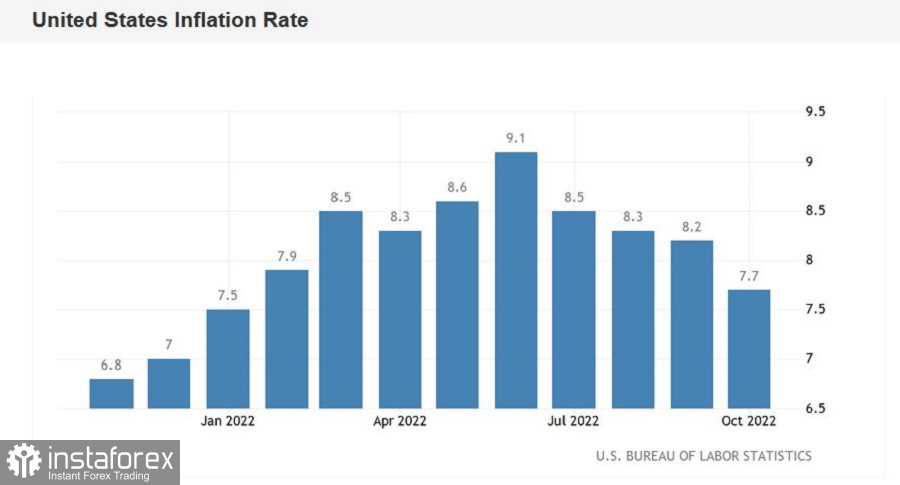

Speaking in the language of dry numbers, the situation is as follows. The general consumer price index in annual terms came out in October at the level of 7.7%, with the forecast of growth up to 7.9%. In this case, we can talk about a trend: the indicator has been declining for the fourth consecutive month, after reaching a peak at around 9.1% in summer. On a monthly basis, the overall CPI was also in the red, up 0.4% (0.6% expected).

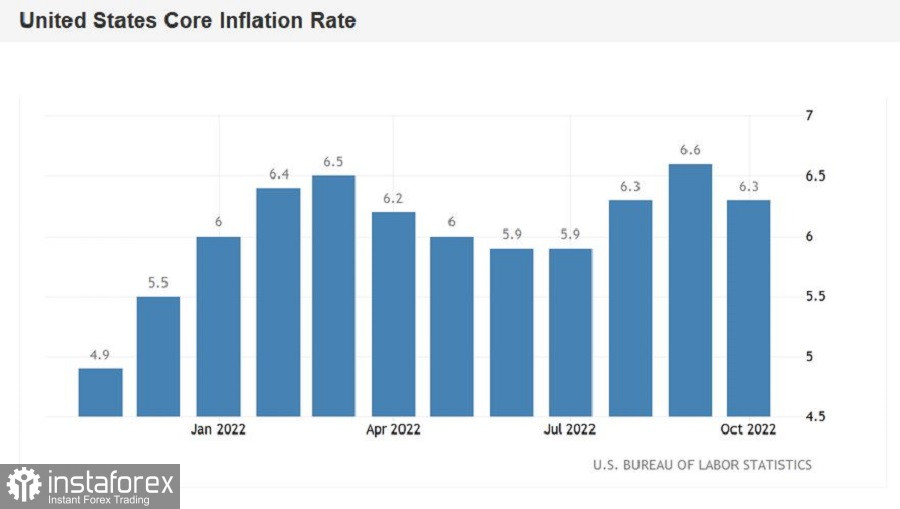

The core consumer price index, excluding food and energy prices, showed a similar trend. On an annualized basis, the core CPI rose 6.3% in October, while most experts predicted growth to 6.5%. At the same time, a 40-year high was recorded in September - the core index jumped to 6.6%. In monthly terms, the indicator also fell short of the forecast level, rising by 0.3% (forecast - 0.5%).

It is also necessary to recall here that key data on the growth of the US labor market were published last Friday. The nonfarm data was also not in favor of the US currency: the unemployment rate rose to 3.7% (from the previous value of 3.5%), and the growth rate of average hourly wages slowed down in annual terms to 4.7%, while since January this the indicator consistently exceeded or corresponded to the 5% level. The share of the economically active population in October was minimal, but still decreased, to 62.2%. All of the above indicators came out in the red zone, to the disappointment of the dollar bulls.

And if the controversial report on the growth of the US labor market reduced the hawkish mood of traders regarding the possible outcome of the Fed's December meeting, then the latest inflationary release brought down the hopes of dollar bulls for the implementation of the 75-point scenario.

Actually, this circumstance was the reason for the "upward rally" of EUR/USD.

According to the CME FedWatch Tool, there is now an 80% chance of a 50-point rate hike at the December meeting. Accordingly, the 75-point scenario has only a 20% chance. And here it should be noted that after the release of nonfarm (and after the announcement of the results of the November meeting), this ratio was at the level of 52/48. That is, traders still hesitated, allowing, in principle, both one and the second scenario. The US labor market did not play a decisive role in this regard, but inflation dotted the i's. We can now say with confidence that the Fed will slow down the pace of monetary tightening at the next (December) meeting, and not in February.

---

Of course, EUR/USD bulls have every reason for another upward rally. But here it is appropriate to warn the bulls of the pair that they should not fall into euphoria and not hope too much for a change in the downward trend. The dollar lost the battle, but at the strategic level, its position is strong, especially when paired with the euro. By the way, in September, in the wake of yet another "dovish rumor", EUR/USD bulls also tried to build on their success, but could only approach the limits of the second figure. After that, the price safely returned to the parity level, and then - under the 1.0000 mark.

After all, by and large, the latest inflation report only slightly shifted the start of the slowdown in the rate hike. But at the same time, we can't say that the Fed will abandon the hawkish course in the foreseeable future.

Moreover, Fed Chairman Jerome Powell, following the results of the November meeting, announced that the maximum level of the discount rate "will be higher than expected." He also spoke about the likely need for further rate hikes, "even if inflation starts to slow down." These are the key messages that will continue to support the dollar, and, accordingly, the EUR/USD bears - especially when the European Central Bank begins to gradually soften its rhetoric.

Thus, in my opinion, Thursday's events will not be the "beginning of the end" of the downward trend. The downward direction is still in force, and the upward pullbacks are still corrective. Indeed, by and large, the rate of increase is not so important if the peak of the completion of the current cycle is higher than the previously set (5%) target. If Powell or his colleagues will voice such verbal signals, the dollar will quickly regain lost ground.

Given the above disposition, it is not worth rushing with long positions yet. At the moment, the pair is trying to settle above the resistance level of 1.0150 (the upper line of the Bollinger Bands indicator on the daily chart). If bulls remain below this target, then shorts will be relevant again – at least to the level of 1.0050. However, at the moment it is best to take a wait-and-see attitude until the first emotions after the resonant release subside.