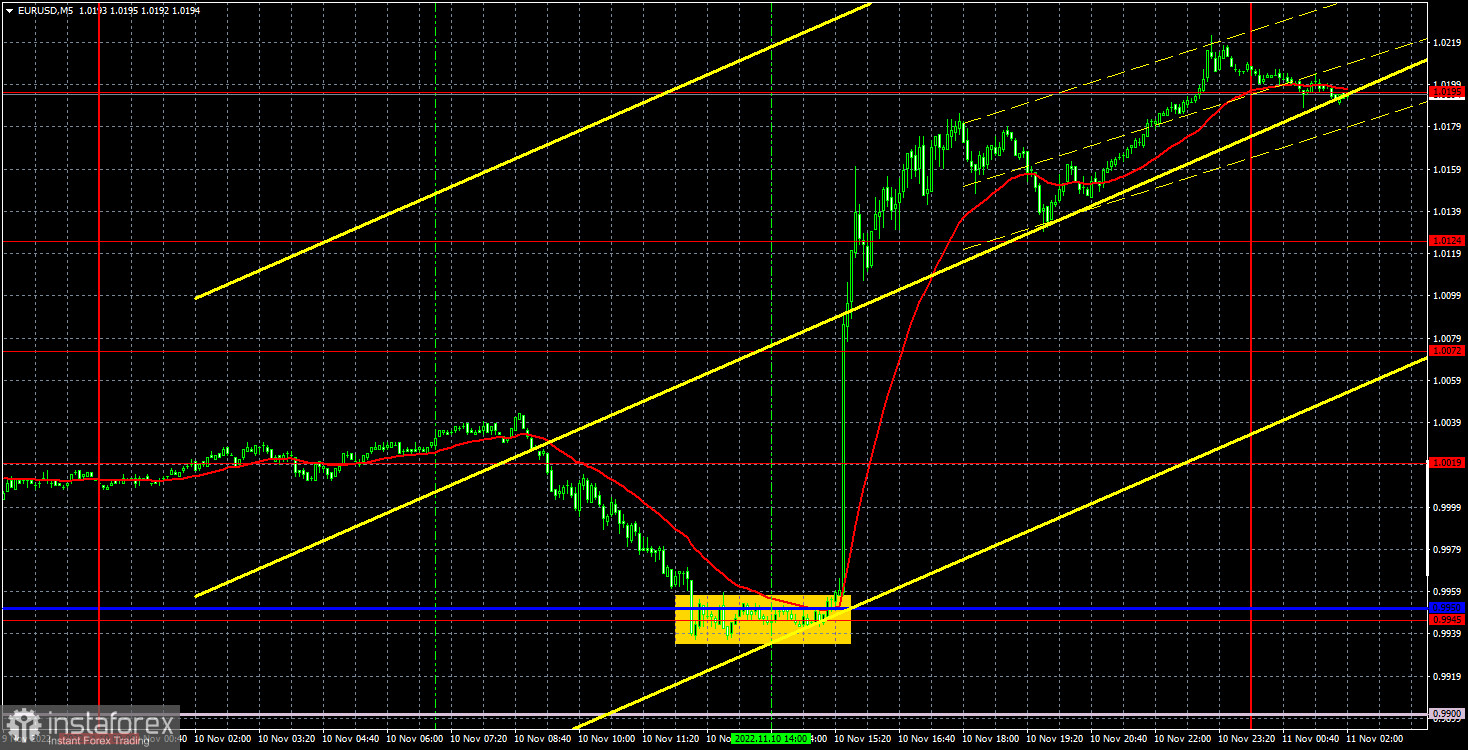

Analysis of EUR/USD, 5-minute chart

Yesterday, the euro/dollar pair continued to fall quietly until the US inflation report was released. In principle, there is nothing to analyze on Thursday other than this report. The consumer price index in America slowed down to 7.7% y/y from 8.2%. Thus, the slowdown was 0.5%, which is quite a lot. We have reiterated that the more and faster inflation slows down, the less reason the Federal Reserve has to continue aggressively raising rates. After all, the rate is being raised precisely in order to curb inflation! Of course, 7.7% is still too far from the target 2%, but inflation should not only come down in the event of continuous Fed rate hikes. At this time, the rate exceeds the "neutral" level, so monetary policy will in any case have a "cooling" effect on the economy. Therefore inflation in any case should fall. The only question is at what speed. And the Fed's succeeding decisions depend on this speed.

In regards to trading signals, the picture on Thursday was simply amazing. One signal was formed during the day, available for processing, but with one big "but". It was formed exactly 5 minutes before the release of the inflation report. We usually recommend not entering the market before important events, but experienced traders could try to work out this signal by placing Stop Loss at a distance of 20-30 points. In this case, it was possible to make a profit of up to 200 points. But remember that the price could easily go in the opposite direction, as the market does not always react logically.

COT report

In 2022, the Commitment of Traders (COT) report for the euro is becoming more and more interesting. In the first part of the year, the reports were pointing to the bullish sentiment among professional traders. However, the euro was confidently losing value. Then, for several months, reports were reflecting bearish sentiment and the euro was also falling. Now, the net position of non-commercial traders is bullish again. The euro managed to rise above its 20-year low, adding 500 pips. This could be explained by the high demand for the US dollar amid the difficult geopolitical situation in the world. Even if demand for the euro is rising, high demand for the greenback prevents the euro from growing.

In the given period, the number of long positions initiated by non-commercial traders increased by 13,000, whereas the number of short orders declined by 17,000. As a result, the net position increased by 30,000 contracts. However, this could hardly affect the situation since the euro is still at the bottom. The second indicator in the chart above shows that the net position is now quite high, but a little higher there is a chart of the pair's movement itself and we can see that the euro again cannot benefit from this seemingly bullish factor. The number of longs exceeds the number of shorts by 106,000, but the euro is still trading low. Thus, the net position of non-commercial traders may go on rising without changing the market situation. If we look at the overall indicators of open longs and shorts across all categories of traders, then there are 23,000 more shorts (617,000 vs 594,000).

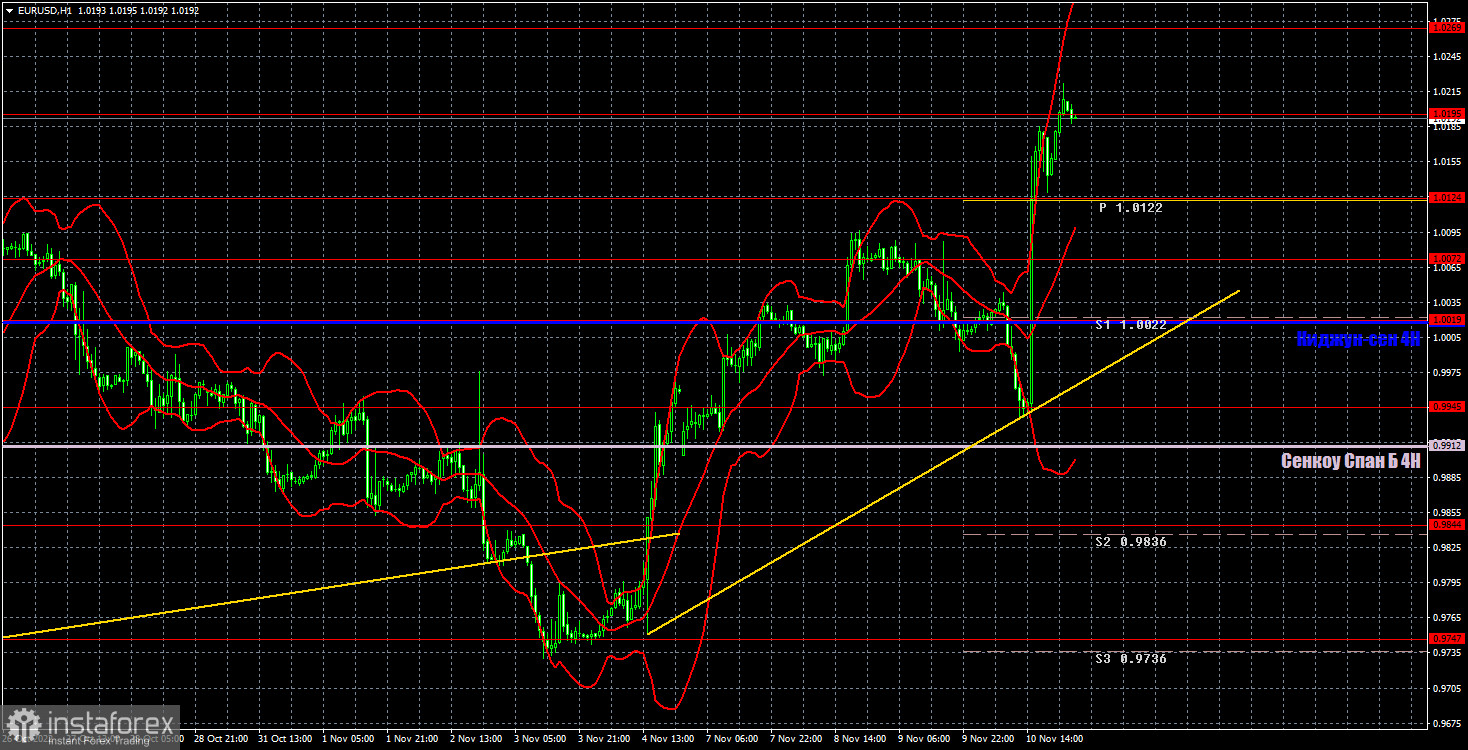

Analysis of EUR/USD, 1-hour chart

You can see that the pair continues to rise on the one-hour chart, has overcome the Ichimoku cloud on the 24-hour timeframe, as well as all the Ichimoku lines on the 4-hour timeframe. Yesterday, naturally, the inflation report was the reason for the growth. If it weren't there or if it turned out to be weak, then the dollar could continue its growth and we would see a reverse movement. Therefore, it is not worth making loud conclusions about the euro's strength based on yesterday. On Friday, the pair may trade at the following levels: 0.9945, 1.0019, 1.0072, 1.0124, 1.0195, 1.0269, 1.0340-1.0366, as well as Senkou Span B (0.9912) and Kijun-sen (1.0019). Lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. There are also support and resistance levels, but signals are not formed near these levels. Bounces and breakouts of the extreme levels and lines could act as signals. Don't forget about stop-loss orders, if the price covers 15 pips in the right direction. This will prevent you from losses in case of a false signal. No important events are planned again in the European Union, and a report on consumer sentiment will be released in America today. However, today the pair may continue to trade in a volatile manner.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.