The GBP/USD currency pair first fell on Thursday, then soared by 250 points in just half an hour. Naturally, the growth of the British currency, or rather the fall of the American currency, was due solely to the report on inflation in the United States, which is now of great importance for the foreign exchange market and the dollar. Simply put, the Fed's further monetary policy depends on inflation. If inflation declines rapidly, the Fed will no longer have any reason to raise the rate. And yesterday's report showed exactly that: inflation accelerated in its slowdown. Of course, it's too early to sum up, and the Fed will certainly raise the rate in December by 0.5%, but in any case, a rapid decline in inflation is a negative for the US currency. Even if the Fed goes according to plan and raises the rate to 5%, as everyone is waiting, for now, if inflation moves quickly to the target level, the Fed will start lowering the rate much earlier, which is again negative for the dollar. Thus, yesterday's fall in the US currency was logical, and the pound/dollar pair showed almost the first reasonable movement in the last 5-6 days.

However, on this occasion, we would not open the champagne. As already mentioned, the reaction to such an important report can be observed for up to 24 hours, and today the pair can easily fall back down. The upward trend in the pound remains, but if you remove the flight down by 1000 points and then rise by 1100 points, we get a rather weak trend, perfectly visualized by the junior linear regression channel. In addition, you won't get far on one inflation report. The dollar will fall by 300-400 points now, and then what? Due to what further will the pair continue its growth? No matter how much anyone wants, both European currencies remain in the risk zone.

Interim results of the US congressional elections.

Yesterday, we already talked about the midterm results of the congressional elections. Today, information can be updated, and there is something to update. First, it should be noted that Republicans, not Democrats, will now represent the House of Representatives since they have already gained more than 218 mandates. Second, there is a high probability that a "Republican majority" will be formed in the Senate since they already have 48 mandates. In contrast, the Democrats have only 46, and the results remain unknown in 4 states, two of which are led by Republicans. Thus, the Democrats could lose their majority in both houses of Congress, which would be a complete failure. The loss of one chamber is not terrible since Republicans will not be able to advance their bills without the approval of Democrats. In particular, the Senate. The loss of two chambers will lead to Joe Biden simply having to sign all the laws that Republicans will pass.

Moreover, in two years, the presidential election, in which Donald Trump will run. He has already managed to take credit for the victory of the Republicans and said that he will win in 2024. It's hard to say whether Americans will vote for Trump. One thing is the Republican Party, and another is Donald Trump, who was remembered more for scandals and outright insults to everyone and everyone who came under his arm during his presidency. Are Americans ready to re-elect him as their president? Maybe Biden is not the best president in the history of America but is Donald Trump better than him, whom even social networks have banned for his constant false statements? Recall that at one time in America, it was even counted how many times a day Trump makes false or unconfirmed statements. The counter reached 15 times. In general, the Democrats have made life very difficult for themselves, but, in our opinion, Trump's victory in 2 years is far from obvious. It is his name that can play against him. At the same time, Biden may win since inflation has declined, and it may already return to 2% in two years.

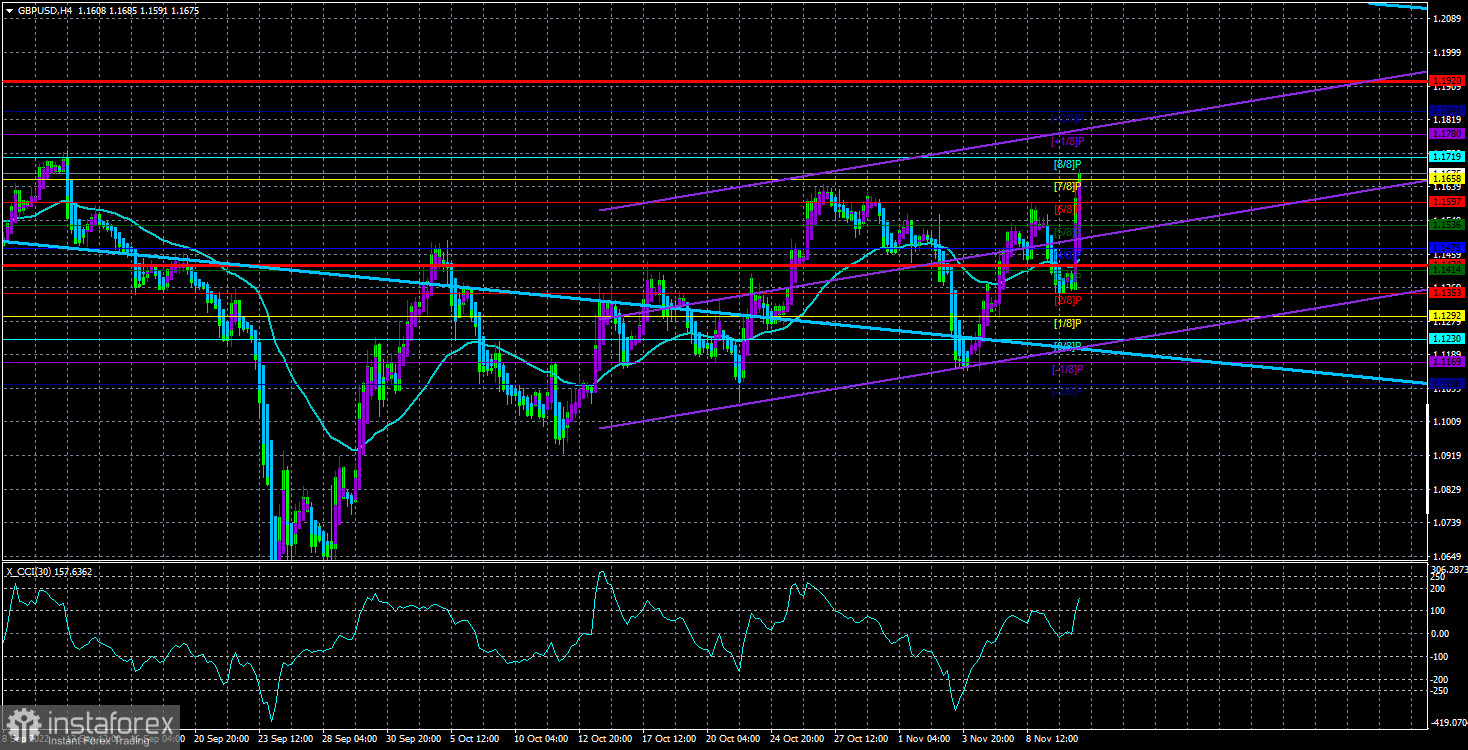

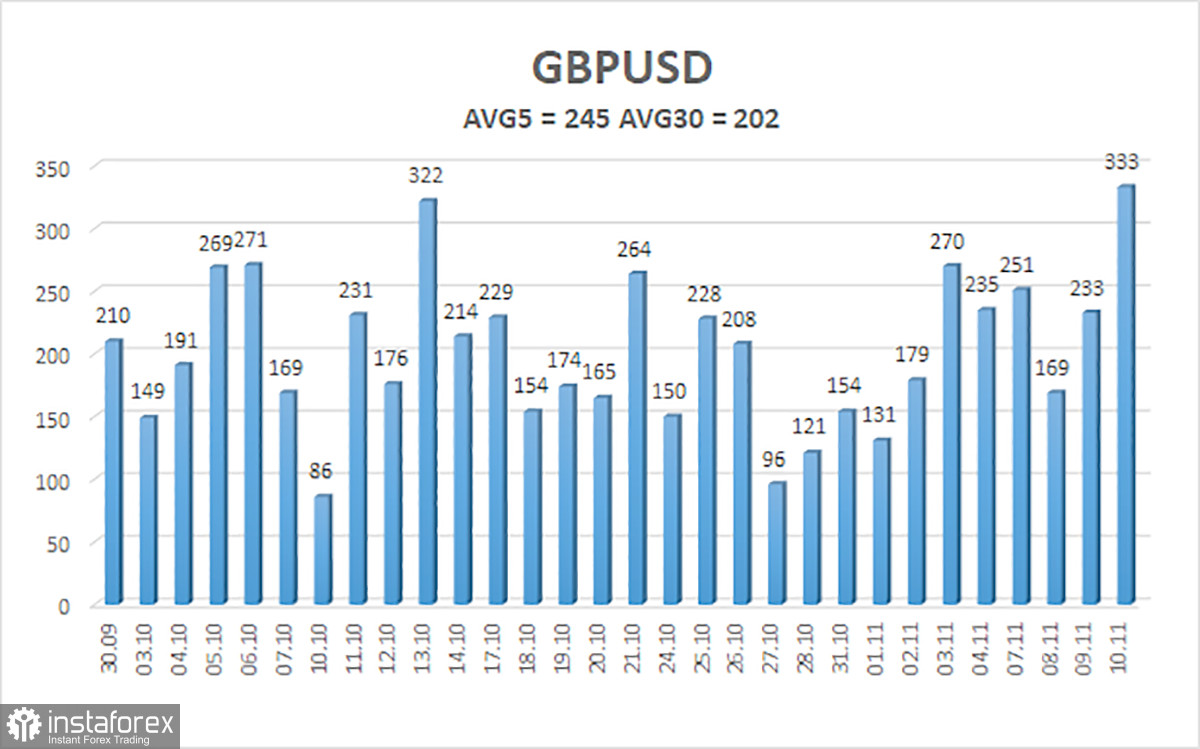

The average volatility of the GBP/USD pair over the last five trading days is 245 points. For the pound/dollar pair, this value is "very high." On Friday, November 11, thus, we expect movement inside the channel, limited by the levels of 1.1430 and 1.1920. A downward reversal of the Heiken Ashi indicator will signal a round of corrective movement.

Nearest support levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The GBP/USD pair has started a new upward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in buy orders with targets of 1.1780 and 1.1920 until the Heiken Ashi indicator turns down. Open sell orders should be fixed below the moving average with targets of 1.1292 and 1.1230.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.