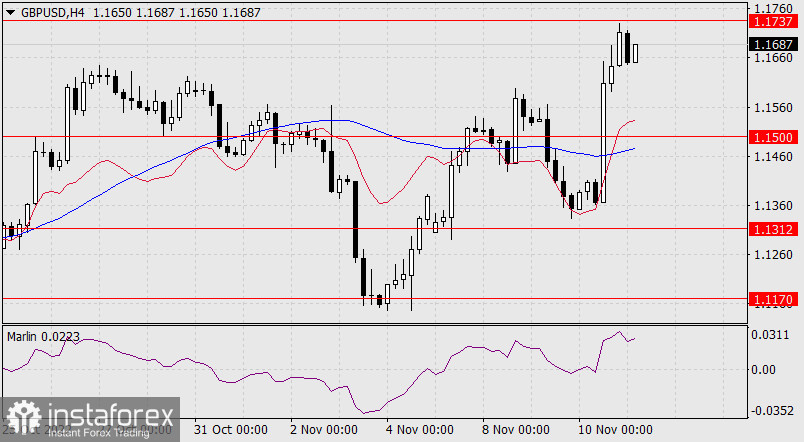

The pound jumped 357 points on Thursday, almost hitting the September 13 high of 1.1737. Now the price is pulling back from yesterday's peak. With this rollback, a divergence begins to form with the Marlin Oscillator on the daily chart. If the divergence is completed, then the wedge-shaped graphic structure will also be completed, the exit from which will strengthen the downward movement for the pound, at least to the target level of 1.0780.

The first such reason may be today's data on British GDP for the third quarter. The forecast for it assumes a contraction of GDP by -0.5% (-0.4% in September). Industrial production for September is projected at -0.2%.

The price is not yet thinking of turning around on the four-hour chart - all indicators point to the prospect of growth. Therefore, we are waiting for the release of economic data and monitoring the price reaction after the fact. The indicators in the current situation seem to be in a position driven by the price. The reversal will be confirmed when the price settles under the MACD line, under the level of 1.1500.