Yesterday's report on the consumer price index was well below expectations, even below the inflation forecast of the Federal Reserve Bank of Cleveland. The forecasting tool of the Federal Reserve Bank of Cleveland the day before yesterday showed that the consumer price index for October will be 8.09%. On Thursday, the BLS reported that the October consumer price index rose 7.7% year-on-year.

"The CPI for all urban consumers (CPI-U) rose seasonally by 0.4 percent in October, the same increase as in September," the US Bureau of Labor Statistics said.

The housing index contributed more than half of the monthly gain, while the gasoline and food indices also rose. As the gasoline and electricity index rose, the energy index increased by 1.8% in a month. And the natural gas index fell. The food index rose 0.6% on the month, while the food index rose 0.4%.

Yesterday's report immediately had a profound effect on market sentiment, affecting all asset classes. Gold is trading at $1,757, up 2.71% or $46.50.

The US dollar fell sharply by 2.45%, with the dollar index currently fixed at 107.61.

The largest percentage decline yesterday occurred with government debt instruments such as treasury bonds and bills. The futures contract for 10-year bonds decreased by 7.76%. Futures for 30-year Treasury bonds fell 5.53%.

US stock markets saw a strong rally, with the Dow Jones Industrial Average gaining 3.7% or 1201.43 points:

S&P 500 added 5.53%:

NASDAQ Composite Index added 7.35%:

The sharp gains seen in equities and precious metals, as well as the sharp sell-off in US debt and the dollar, were shaped by the perception that inflation below estimates suggests a more accommodative Federal Reserve at this year's last meeting in December.

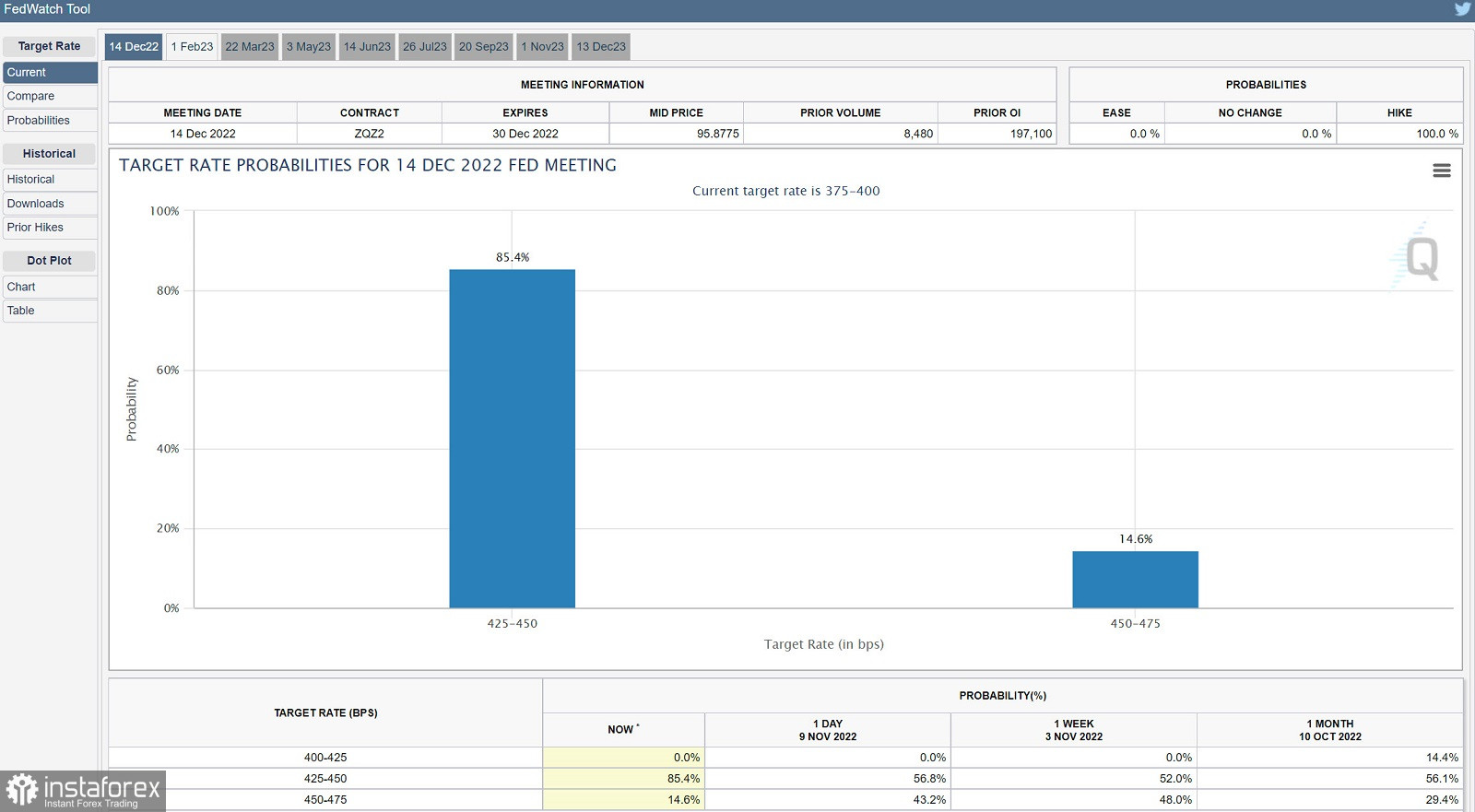

According to the CME FedWatch tool, there is an 80.6% chance that the Fed will raise rates by 50 basis points in December rather than 75 basis points, compared to only 19.4% now.

Most notable is the net change in the probability of a 50 basis point rate hike in December, which was 56.8% the day before yesterday and over 80% yesterday.

What is most important in yesterday's inflation report is that inflation is still at an extremely high 7.7%. Now, when the perception and market sentiment suggest a more dovish position of the Fed, and inflation is still at a high level, this is an ideal environment for the growth of the value of gold. It was the aggressive interest rate hike by the Federal Reserve System that kept gold from rising, and not the sharp drop observed in March of this year. Even in the face of a rapid increase in inflation, market participants focused on the effect of an increase in interest rates, not on the growth of inflation. This will certainly change the focus of market participants from higher rates to high inflation.