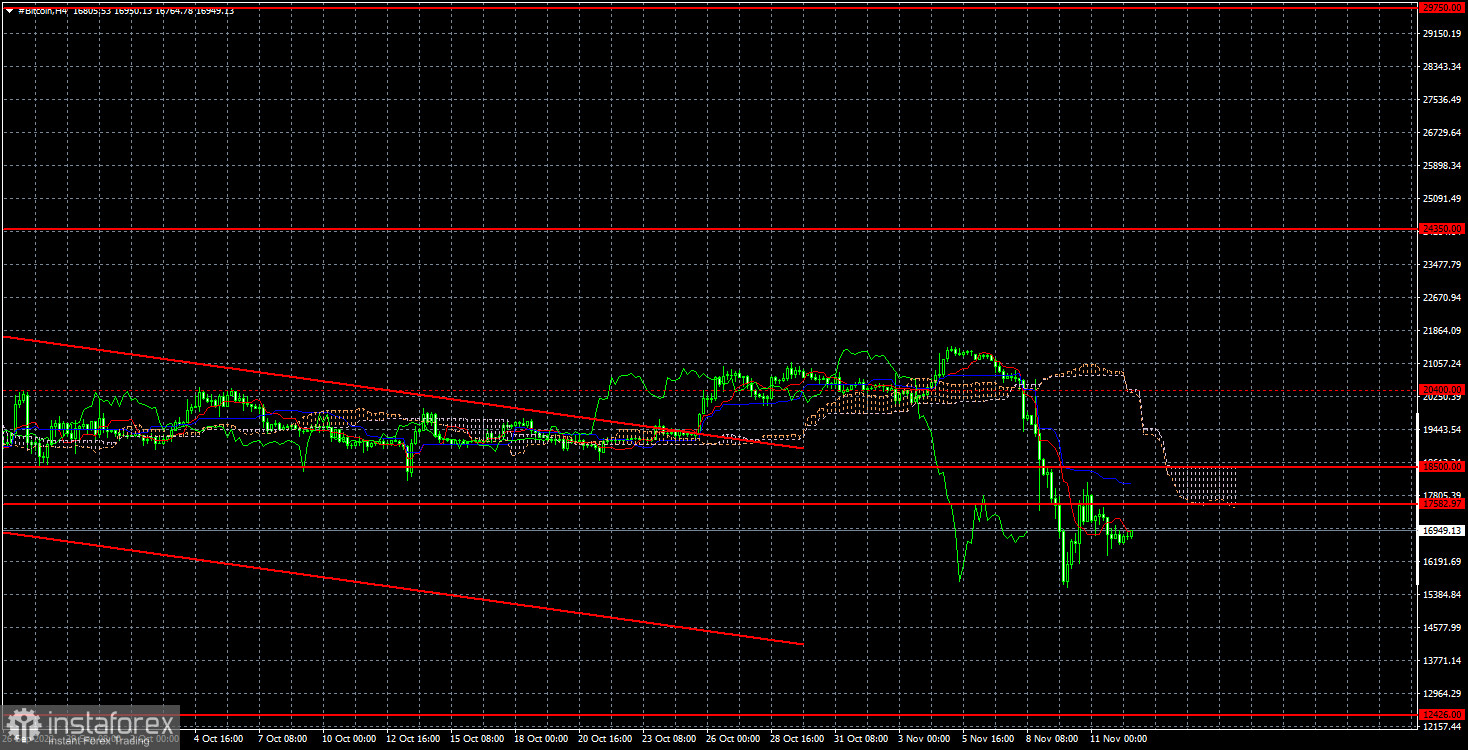

This week's collapse of bitcoin is also clearly visible on the 4-hour TF. We did not expect such news as the bankruptcy of the FTX crypto exchange to arrive, so the current drop is in some way accidental and unexpected. Nevertheless, behind this randomness, it is quite possible to consider a certain trend. The problem with "bitcoin" is as follows. While cryptocurrency is growing, it is constantly "fueled" by more and more new investors, which provokes even stronger growth. "A vicious circle." As soon as it becomes clear to everyone that the bull market is over, bitcoin immediately ceases to interest everyone. Naturally, this provokes more and more collapses because no one is interested in an asset characterized by fantastic instability, which cannot guarantee high profits at high risks. In addition, bitcoin has a certain cost price. The cost of mining cryptocurrencies determines it. Since electricity has become very expensive worldwide over the past year, the cost of mining all cryptocurrencies has increased. Costs have increased, and the price of bitcoin has fallen, so miners are beginning to incur losses by continuing their activities.

Experts believe that the current cost of "bitcoin" is already lower than the cost of production. In this mode, mining companies can work for a month, two, three, or six months, but if the cryptocurrency does not grow in price again, they will slowly wind down their business. Naturally, we will discuss decreasing production volumes because the belief that one-day bitcoin will cost $100,000 or more will remain. However, the following picture turns out: the longer bitcoin is traded at current levels, the more likely it is to fall even lower. And bitcoin can trade at the same levels for a long time, as the last five months have shown us perfectly.

In general, if a week ago we thought that bitcoin would fall to $12,426, now the confidence in this has increased even more. Investors still do not run to the market for "cheap bits," although many "experts" continue to chant that there is nowhere to fall lower. As you can see, there is a lot to do. Along with the bankrupt FTX, another 130 affiliated companies will go bankrupt. The entire cryptocurrency sphere is shrinking, reacting to the low cost of bitcoin.

On the 4-hour timeframe, the quotes of the "bitcoin" finally left the side channel in which they spent five months. Both important levels of $18,500 and $17,582 have been overcome, so we expect the fall to continue with a target of $12,426. Trend lines and channels are no longer relevant, but the downward trend persists. Bitcoin is trying to stay afloat, but the fundamental background regularly drowns it. After falling to $12,426, we may see a few more months of flat.