GBP/USD

Brief analysis:

The direction of the short-term trend of the British pound sterling since September 26 is set by an upward wave. In its structure, the final part (C) started on November 4. Quotes reached the boundaries of the potential reversal zone of the weekly scale of the chart. Before the trend continues, the price needs to be adjusted.

Forecast for the week:

The beginning of the upcoming week is expected to be flat. The pound's price movements are most likely to occur in the lateral plane, between the nearest zones of the opposite direction with a descending vector. At the end of the week, you can count on activating and resuming the upward course of the pair's movement.

Potential reversal zones

Resistance:

- 1.1880/1.1930

Support:

- 1.1650/1.1600

Recommendations

Sales: possible in fractional lots within separate sessions after the appearance of your vehicle signals in the area of the resistance zone.

Purchases: pending completion of the upcoming correction is not recommended.

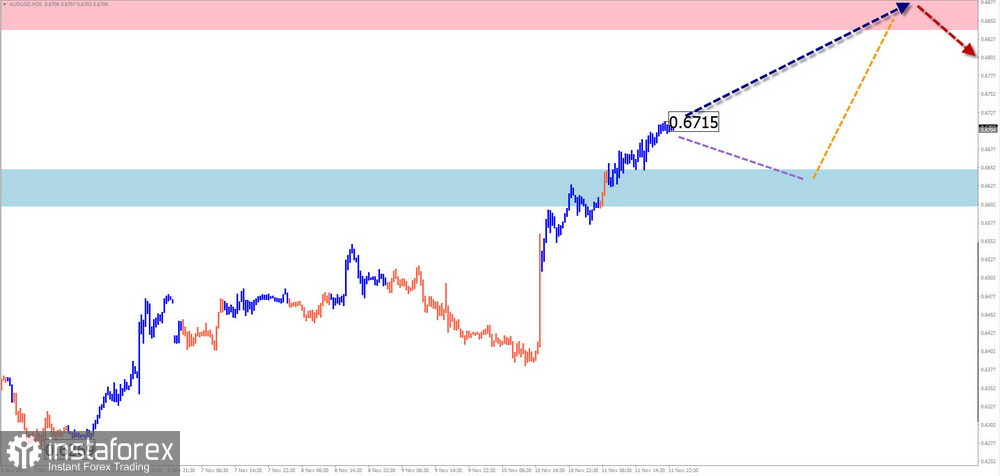

AUD/USD

Brief analysis:

Within the dominant bearish trend framework, the quotes of the Australian dollar have been forming a corrective movement section since mid-October. Its scope exceeded the correction scale of the last section of the main wave. The level of wave movement is approaching a reversal.

Forecast for the week:

The lateral vector of price movement is more likely at the beginning of the upcoming week. The decline is expected to go no further than the boundaries of settlement support. The increase in volatility and the resumption of the price rise can be expected closer to the weekend. The resistance level shows the lower boundary of the preliminary target zone.

Potential reversal zones

Resistance:

- 0.6840/0.6890

Support:

- 0.6650/0.6600

Recommendations

Sales: due to the small potential of the downward move, the probability of a loss of the deposit is high.

Purchases: will become relevant after the appearance of the corresponding signals of your used vehicles in the area of the support zone.

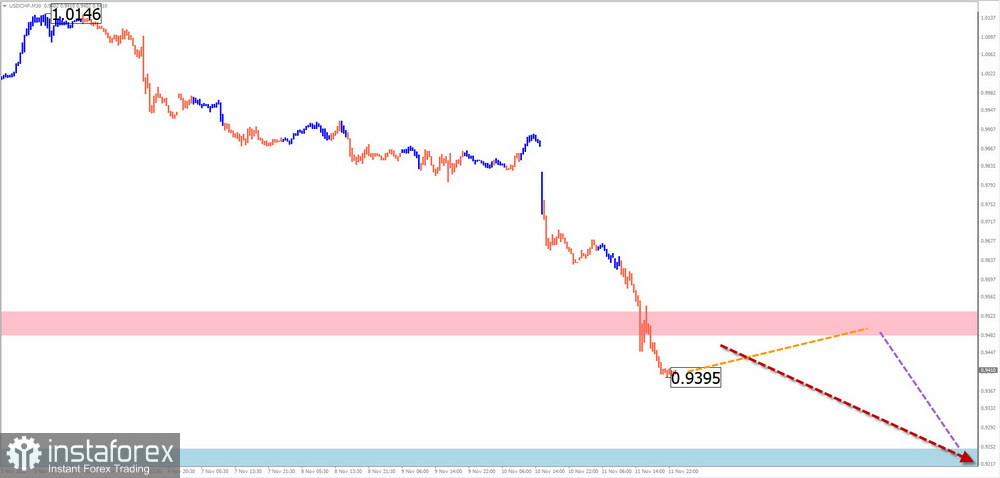

USD/CHF

Brief analysis:

Analysis of the daily scale of the Swiss franc chart shows the formation of a downward wave since May 16. Launched on November 3, the downward momentum forms this wave's final part (C). The immediate target of this wave is the preliminary target zone, the upper limit of which is indicated by the level of calculated support.

Forecast for the week:

During the current week, the pair's price is expected to decline up to making contact with the support zone. A short-term flat and a price pullback to the upper resistance zone are excluded at the beginning of the week. The greatest activity can be expected in the second half of the week.

Potential reversal zones

Resistance:

- 0.9480/0.9530

Support:

- 0.9250/0.9200

Recommendations

Purchases: in the coming days, they will be irrelevant.

Sales: can be recommended after a statement in the resistance zone of confirmed signals.

EUR/JPY

Brief analysis:

The unfinished wave construction of the euro cross chart against the Japanese yen is directed upward and has been counting since September 26. During the last month, the price formed the middle part of wave (B). This movement has entered the final phase.

Forecast for the week:

In the next couple of days, you can count on a continued decline in the pair's price. A breakthrough beyond the lower limit of the support zone is unlikely. By the end of the week, amid rising volatility, a change of direction and a resumption of price recovery are expected. The calculated resistance shows the upper limit of the expected weekly move.

Potential reversal zones

Resistance:

- 146.80/147.30

Support:

- 142.70/142.20

Recommendations

Sales: carry a high degree of risk and can lead to losses.

Purchases: recommended after the appearance of reversal signals in the area of the support zone of your used trading systems.

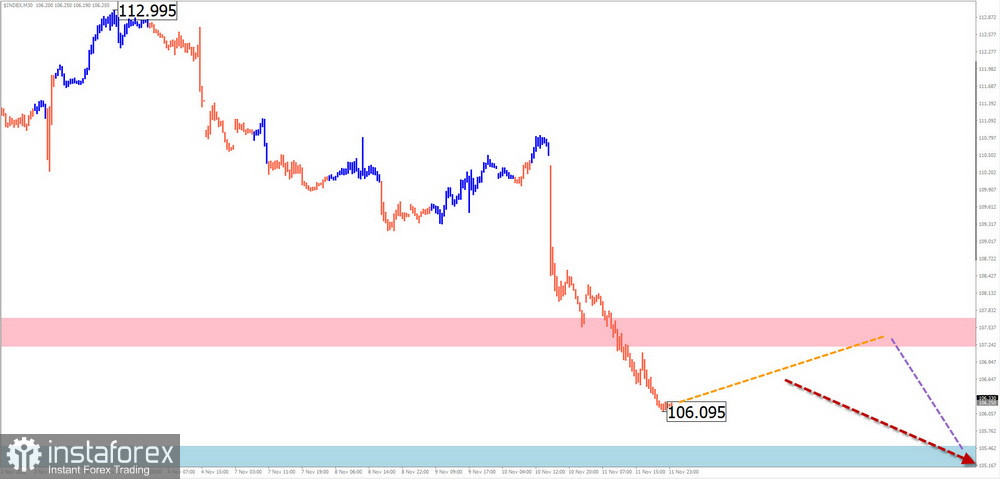

US dollar index

Brief analysis:

The rising trend has pushed US dollar quotes to all-time highs at the turn of the century. Since September 25, the index values have formed a downward wave with reversal potential from a powerful resistance zone. Before the dollar continues to decline, we can wait for a correction phase.

Forecast for the week:

In the next few days, the index quotes will continue their decline up to the settlement support. After that, a "sideways movement" is expected along its borders, the formation of a reversal and a rollback of the index values upwards. The maximum lifting zone is the calculated resistance.

Potential reversal zones

Resistance:

- 107.20/107.70

Support:

- 105.50/105.00

Recommendations

Sales: the sale of national currencies in major pairs is possible with a reduced lot within the framework of individual sessions.

Purchases: purchases of national currencies will become relevant after the completion of the upcoming index correction.

Explanations: In simplified wave analysis (UVA), all waves consist of 3 parts (A-B-C). At each TF, the last incomplete wave is analyzed. The dotted line shows the expected movements.

Attention: The wave algorithm does not consider the duration of the movements of the instruments in time!