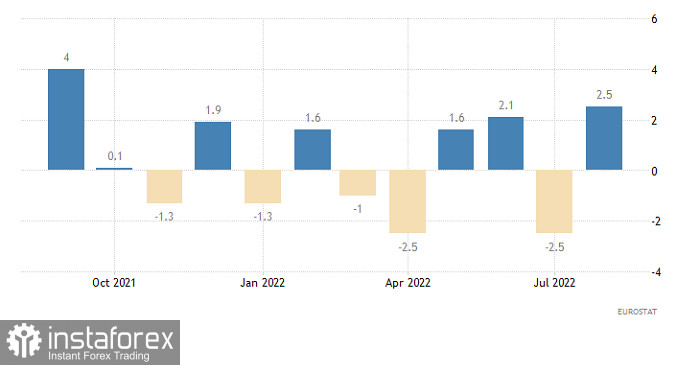

Unexpectedly strong data on the UK GDP and industrial production led to a further increase in the pound sterling and the euro. Thus, both currencies became even more overbought. In the recent week and a half, the euro has appreciated by more than 500 pips. That is why the market needs correction. However, today, it is hardly possible and the euro may go on rising. The fact is that the eurozone industrial production may climb to 3.3% from 2.5%. Notably, in recent days, the market has become sensitive to various statistical data, especially positive reports from Europe.

Eurozone Industrial Production

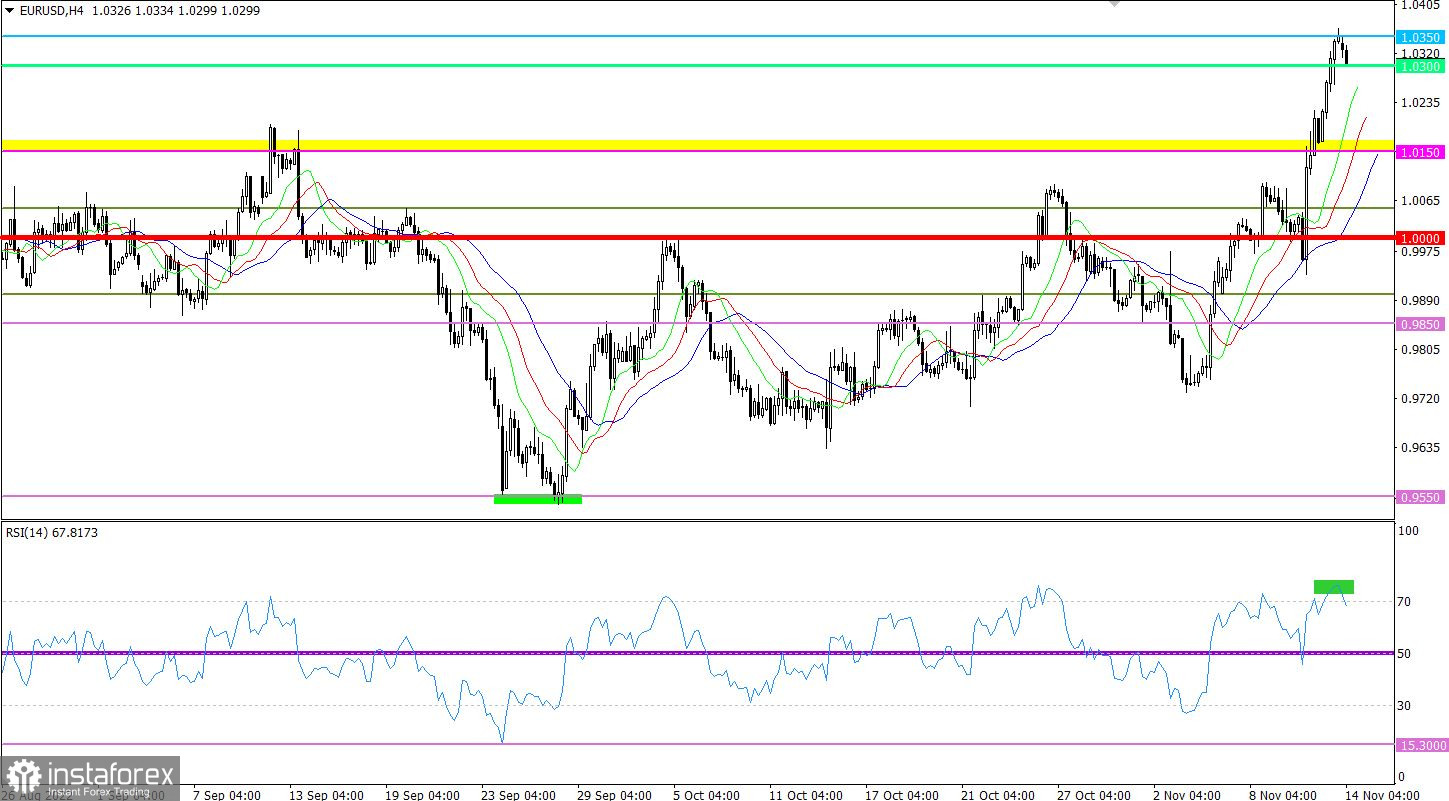

Last week, the euro gained more than 450 pips against the US dollar. This is one of the strongest inertial movements that allowed the pair to launch a new correctional cycle from the low of the downtrend. As a result, the euro reached the next resistance level of 1.0350.

On the four-hour chart, the RSI technical indicator entered the overbought area amid such an intensive upward movement. This technical signal proves that long positions on the euro are overheated.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, corresponding to the upward cycle.

Outlook

Since the euro is extremely overbought, the price may bounce off the resistance level of 1.0350. In this case, sellers will get local support, whereas buyers will have a chance to regroup the existing conditions.

The pair will rise higher if it consolidates above 1.0350 at least on the four-hour period. In this case, traders will receive a technical signal of the prolongation of the upward cycle.

In terms of the complex indicator analysis, we see that in the short-term period, the indicators are providing selling opportunities because of a bounce off the resistance level. In the intraday and mid-term periods, we see an upward signal amid a strong inertial movement.