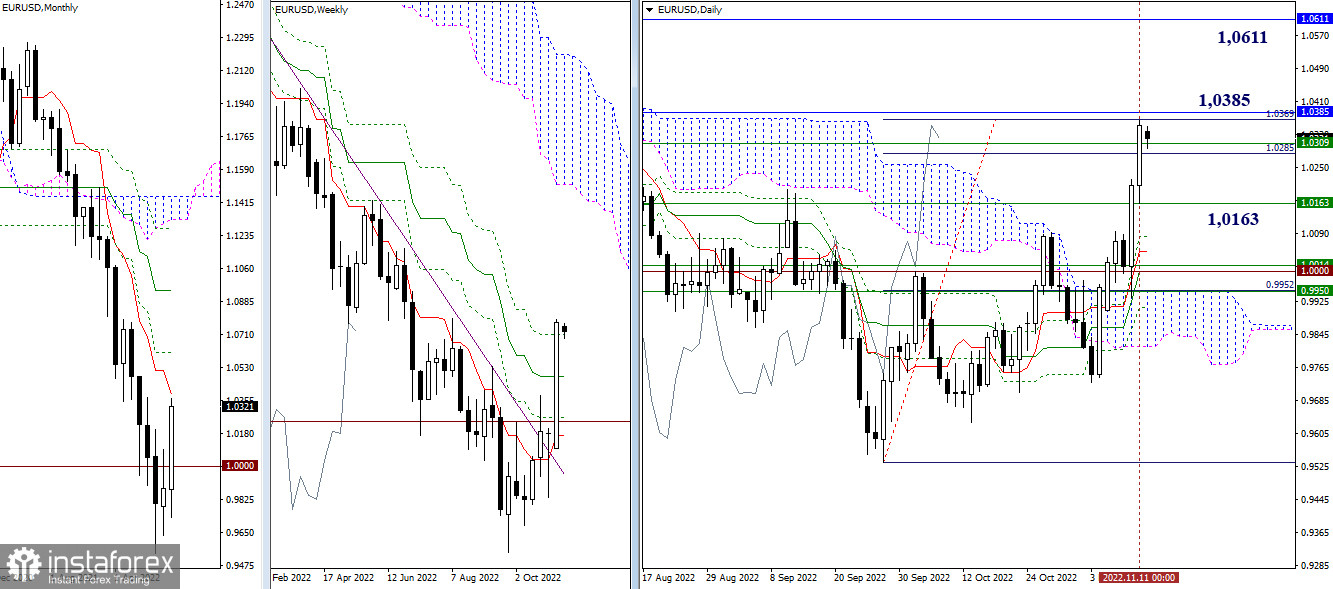

EUR/USD

Higher timeframes

Last week was marked by the activity of bulls, who managed to realize a large-scale rise. As a result, several important targets were achieved at once. The outcome of the interaction will determine the further development of events. So, the daily upward target for the breakdown of the Ichimoku cloud (1.0285 - 1.0369) has been worked out, the final resistance of the weekly death cross (1.0309) has been reached, the pair is in the zone of influence of the monthly short-term trend (1.0385). If bulls manage to eliminate the weekly death cross and enlist the support of the monthly short-term trend (1.0385), then the balance of power in the higher timeframes will shift in support of bullish sentiment, and new upside prospects will open: for example, attention will be directed to the weekly cloud and monthly resistance at 1.0611.

H4 – H1

Bulls now have the advantage. Further upward benchmarks within the day are the resistance of the classic pivot points (1.0424 – 1.0494 – 1.0625). As of writing, the pair is consolidating on the support of the central pivot point of the day (1.0293). If a correction develops, attention will be on the support of the weekly long-term trend (1.0108). This is a key level, the possession of which determines the advantage of the current balance of power. The nearest support on this path today can be provided by the first support of the classic pivot points (1.0223).

***

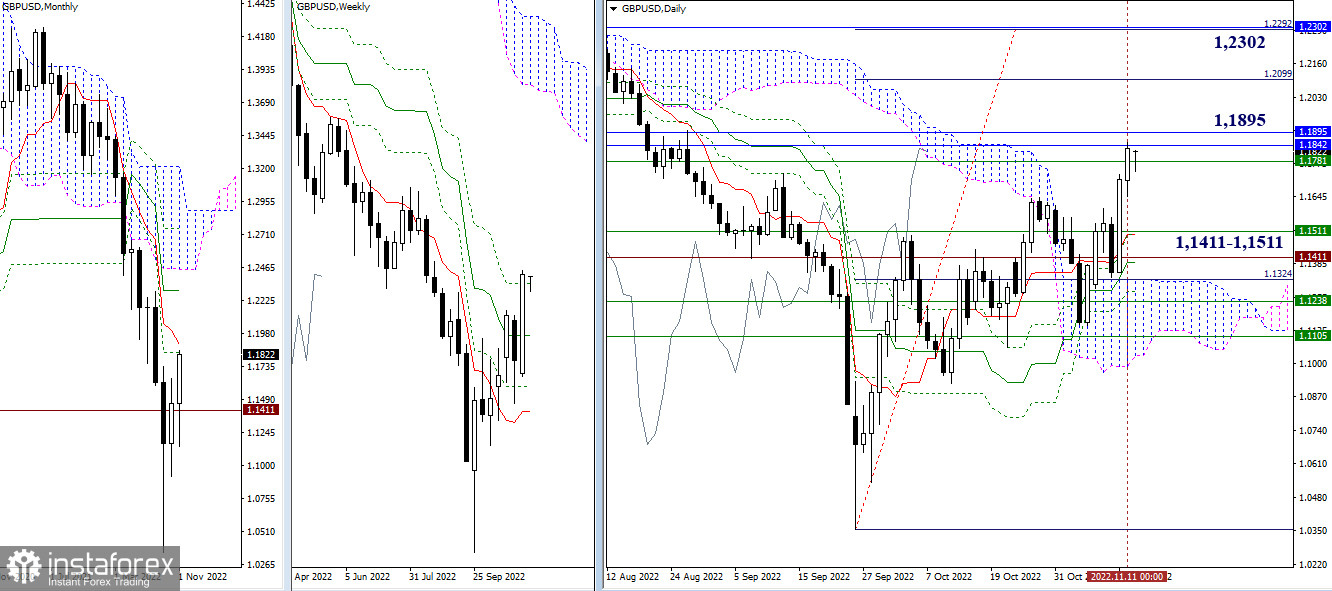

GBP/USD

Higher timeframes

Bulls dominated last week. They managed to make an ascent to the resistance zone, which unites several important levels at once 1.1781 - 1.1842 - 1.1895. Now the task is to eliminate the weekly death cross (1.1781) and gain support for the monthly short-term trend (1.1895). After these resistances go over to the bulls' side, the benchmarcks for continuing the rise will be the daily target for the breakdown of the cloud (1.2099 - 1.2292), reinforced by the monthly medium-term trend (1.2302). The levels 1.1411 – 1.1511, passed the day before, now play the role of supports.

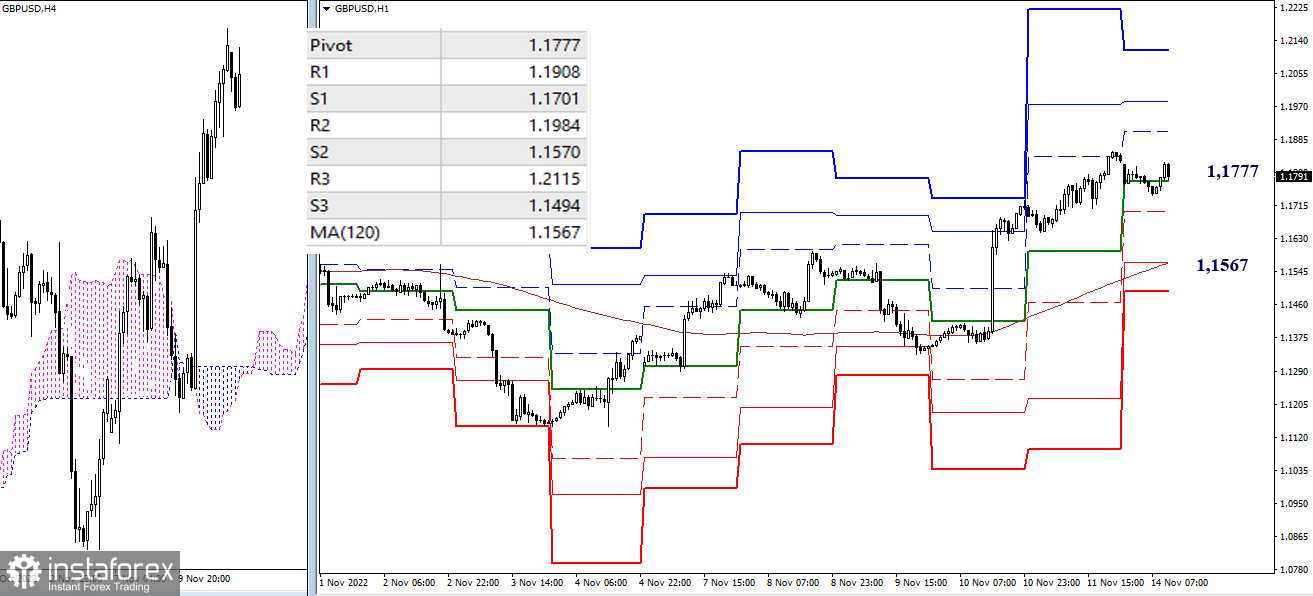

H4 – H1

On the lower timeframes, bulls have the advantage. Further benchmarks within the day are the classic pivot points 1.1908 - 1.1984 - 1.2115. If the bears take the initiative, then the levels of 1.1701 (first support of the classic pivot points) and 1.1567 (weekly long-term trend) can be marked for decline. Consolidation below will change the current balance of power in the lower timeframes. In this case, it would be better to evaluate the situation again.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)