Over the past week and a half, the situation on the crypto market has deteriorated significantly. The collapse of FTX in terms of its scale and consequences is comparable to the fall of Luna, and therefore carries a loud negative context far beyond the crypto market.

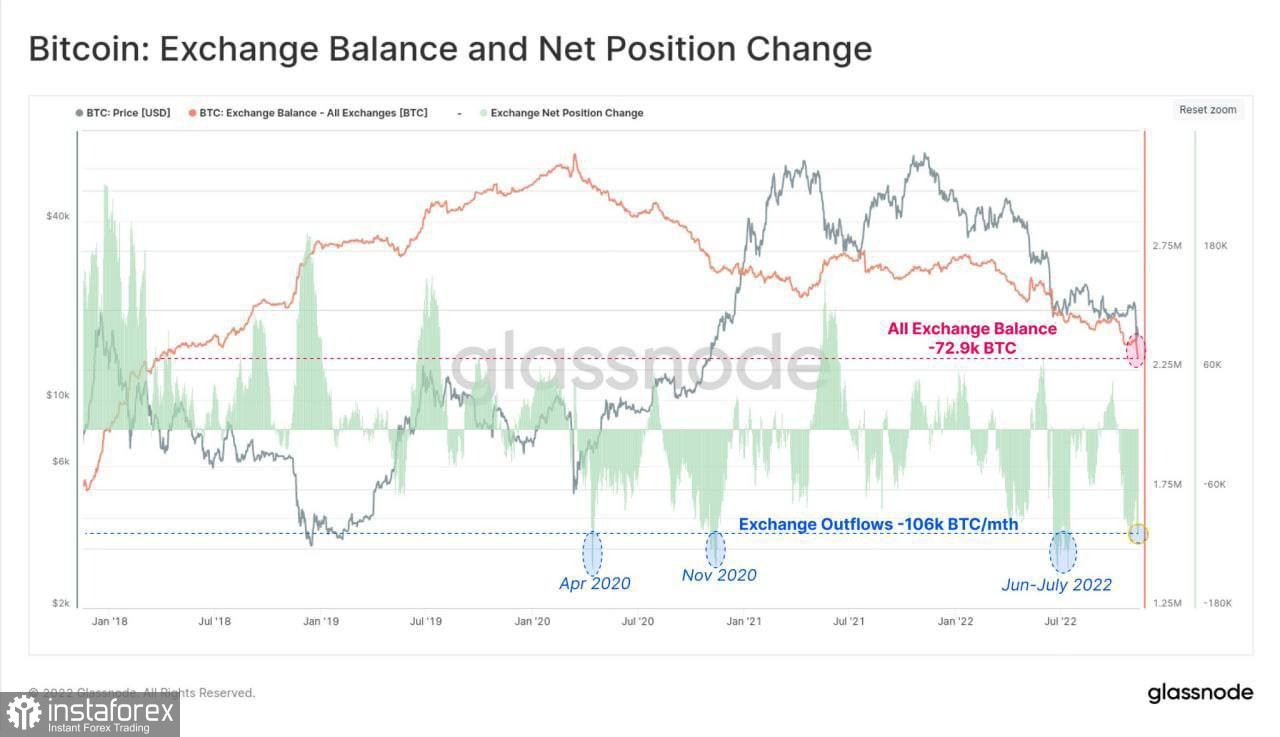

Cryptocurrency market capitalization has fallen to $830 billion due to a record outflow of funds from centralized platforms. According to research by Glassnode, more than 106,000 BTC have been withdrawn from crypto exchanges in the last month. Such large outflows of funds have occurred three times in history: in April and November 2020, and also in June/July 2022.

Bloomberg claims that the situation with FTX has negatively affected the reputation of the cryptocurrency market. The publication analyzed the balance sheet of the exchange and concluded that customers have little chance of returning their deposits.

Analysts also suggest that the collapse of the crypto exchange has undermined the prospects for digital assets to become a mainstay of institutional investors' portfolios.

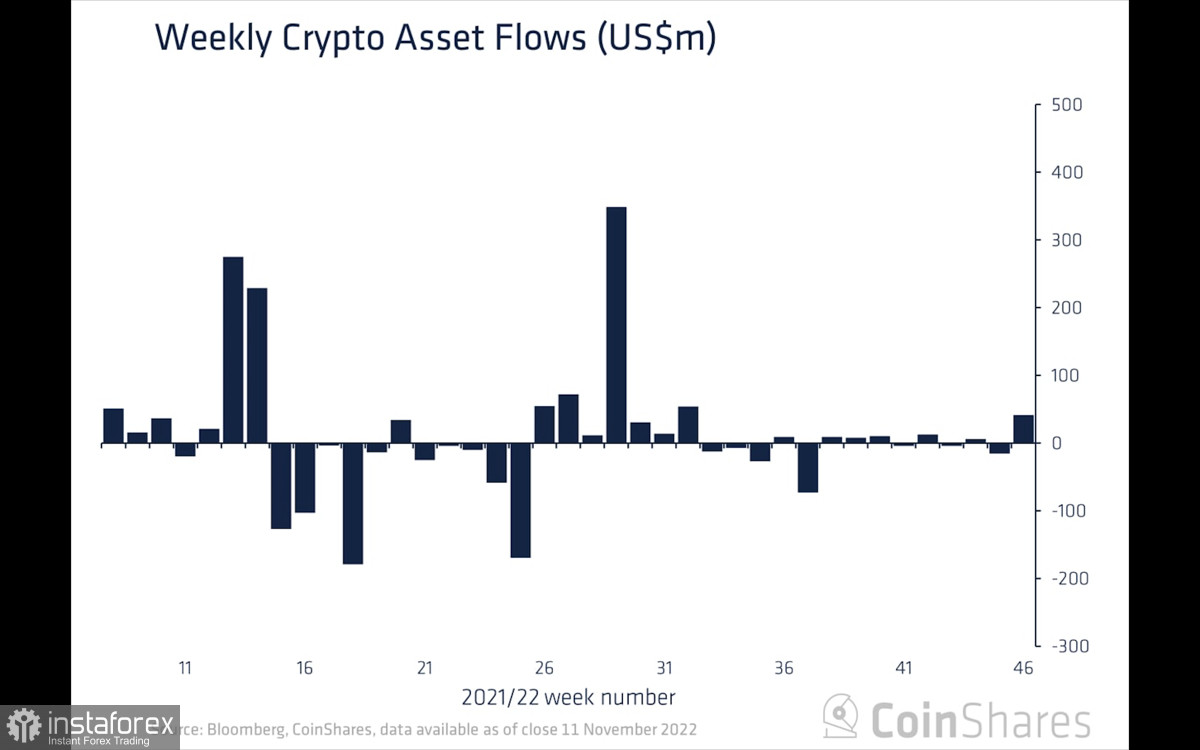

At the same time, CoinShares recorded $46 million inflows to crypto funds last week during the FTX crash. This directly refutes Bloomberg's suggestion and suggests that investors see the price drop as an opportunity.

It's not that bad

Not everyone panics and falls into total despondency against the background of what has happened over the past few weeks. Glassnode believes that the collapse of FTX was the reason, not the reason for the fall of the crypto market. Experts believe that in a more favorable situation, the collapse of the crypto exchange would attract much less attention.

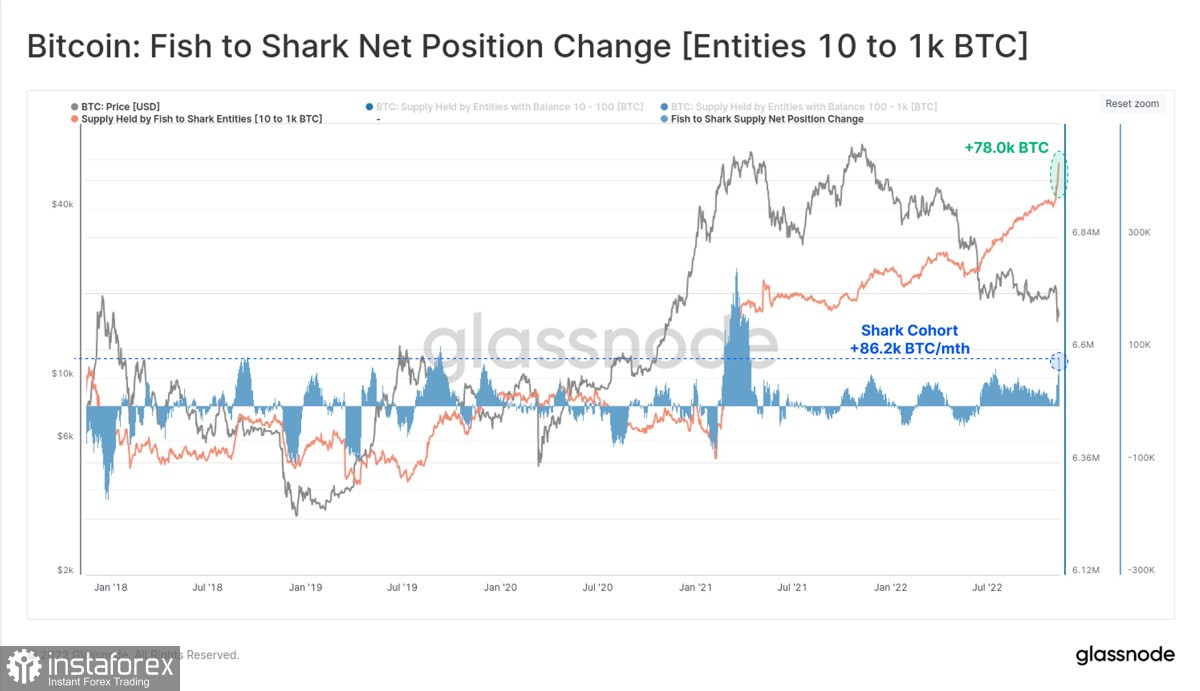

Glassnode noted that the next collapse of the crypto market fully corresponds to the process of market recovery and the flow of capital to long-term owners. Given this, analysts believe that the consequences of the FTX fall will be short-term.

JPMorgan experts also assess the situation as stable and see no signs of an industry collapse. At the same time, analysts predict a fall in Bitcoin quotes to the cost of $13,000. Earlier, the bank noted that a fall in the price of BTC to this level could cause a series of margin calls and, as a result, the bankruptcy of a number of companies.

In order to prevent the situation from worsening, the Binance crypto exchange announced the creation of an industry recovery fund. The structure will help strong projects solve the liquidity problem and survive a difficult market period. Tron founder Justin Sun also joined the initiative.

BTC/USD Analysis

After the publication of a tweet by the CEO of Binance, Bitcoin quotes recovered above $16.5k. Despite this, the situation on BTC is developing according to the scenario of the bears. The cryptocurrency has finally consolidated below the level of the previous local bottom and every day of trading costs the market big losses.

Over the past five days, the price of Bitcoin has fallen below $16k three times, which may indicate a continuation of the downward trend to the $14k–$15k range. Despite the negative trend, there are signs of a rebound on the daily BTC/USD chart. The RSI and Stochastics rebounded from the lower border of the bullish zone, which indicates the activation of buyers and an attempt to break through the $17.3k–$17.6k zone.

Fundamental factors

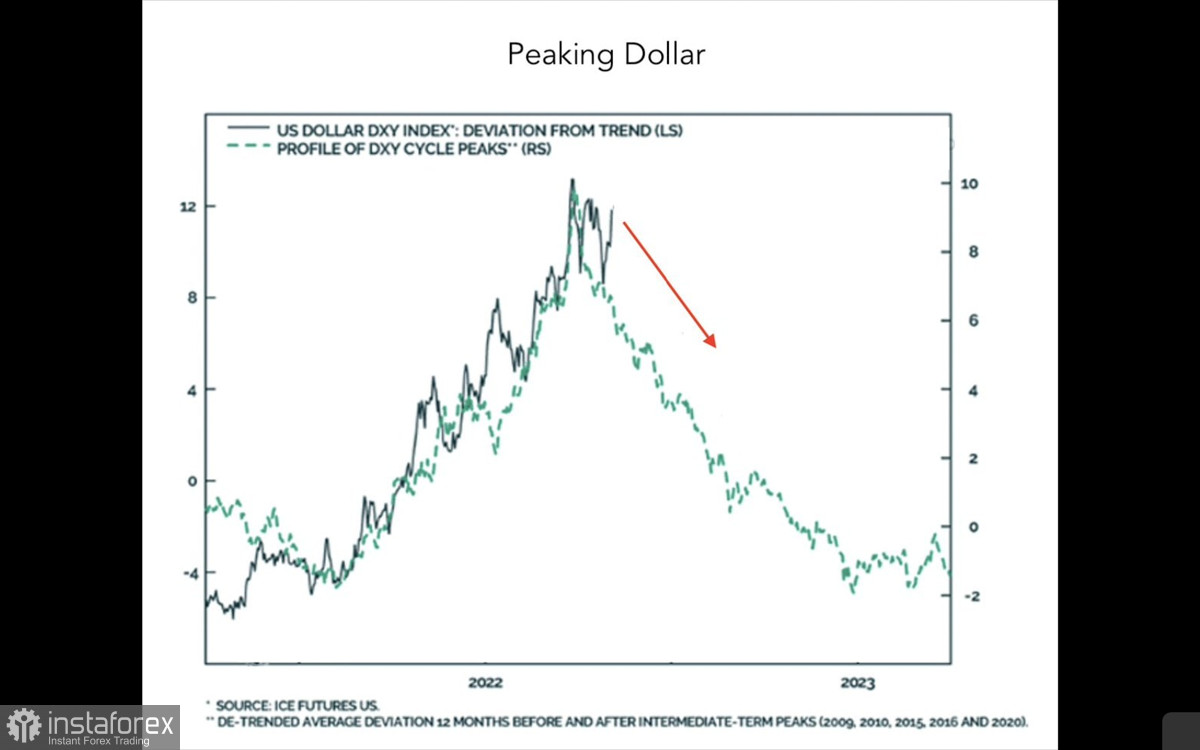

At the same time, fundamental positive signals are visible on the chart of the US dollar index. The asset has reached a cyclical peak, which may indicate the end of the DXY upward trend. For high-risk assets, this can be a catalyst for growth.

The current market cycle has presented us with many new patterns that run counter to past cycles. However, the accelerating fall in inflation, the readiness of the Fed to ease monetary policy and the approaching New Year holidays give arguments to believe that the December–February period will be a turning point and the global crisis will subside.

Results

Most likely, we should expect an update of the local Bitcoin bottom below the $15.5k level. The fall of the main cryptocurrency will provoke a series of bankruptcies and another market collapse. However, in general, the process of forming a local bottom and improving the market is coming to an end, and the macroeconomic situation is stabilizing.