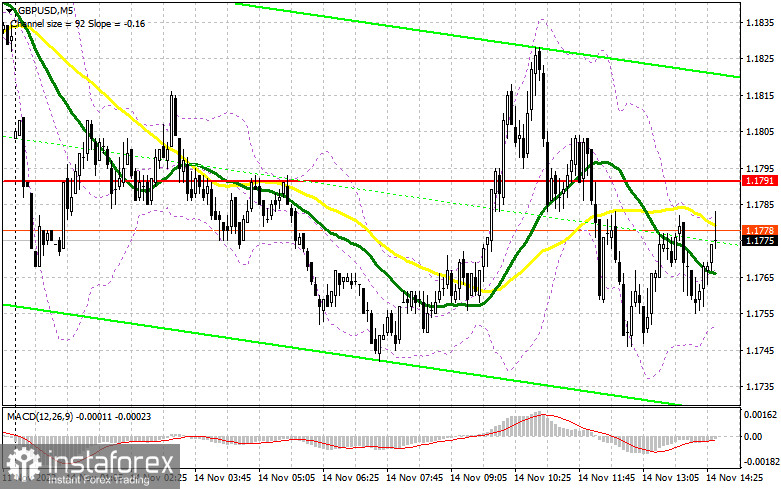

In my morning forecast, I paid attention to the 1.1791 level and recommended deciding on entering the market there. Let's look at the 5-minute chart and figure out what happened. Bulls easily broke above 1.1791 in the first half of the day, but it did not come to the reverse test from top to bottom – there is no buy signal. After the failure of 1.1791 by the middle of the European session, there was no sell signal because even then, the bears drove the pound quickly to the bottom without updating from the bottom up. As a result, the technical picture was completely revised for the second half of the day.

To open long positions on GBP/USD, you need the following:

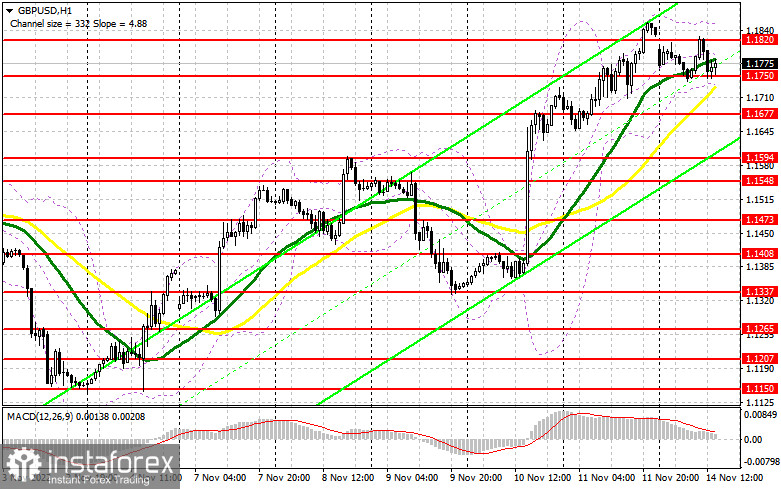

The absence of news from the US will allow bulls to remain optimistic and control the market. Most likely, trading in the side channel will continue in the afternoon, with some attempts to break the daily maximum in the area of 1.1820. Of course, the best option for opening long positions will be a decline and the formation of a false breakdown in the area of the new support 1.1750, where the moving averages are located, playing on the side of the bulls. This will give a buy signal to restore and update the resistance of 1.1820, revised at the end of the first half of the day. A breakout and a top-down test of this range will keep the situation on the bulls' side, allowing for building a more powerful trend with the prospect of updating 1.1899. The furthest goal will be 1.1972, where I recommend fixing the profits. If the bulls fail to meet their objectives in the afternoon and miss 1.1750, a larger profit-taking will begin. This will reverse the pressure on the pair and open the way to 1.1677. In this case, you should only buy there if there is a false breakdown. I recommend immediately opening long positions on GBP/USD for a rebound from 1.1594 or even lower – around 1.1548, to correct 30-35 points within a day.

To open short positions on GBP/USD, you need the following:

Sellers are fighting back as best they can, but the inability to drag the pair to new local lows has returned buyers to the desire to build up long positions, which they actively used in the first half of the day. Now the bears need to think about how to defend the resistance of 1.1820 since there are no statistics on the US, and they will have nothing to rely on. Only the formation of a false breakdown at 1.1820 will be a good signal to open short positions. This will push the pound to 1.1750 – the support formed in the first half of the day. A breakout and a reverse test from the bottom up of 1.1750 will give an entry point based on a return to 1.1677, where the moving averages were playing on the side of the bulls pass. The farthest target will be the 1.1594 area, where I recommend fixing the profits. A test of this area will negate all bullish prospects for the pound. With the option of GBP/USD growth and the absence of bears at 1.1820, the bulls will continue to return to the market in the expectation of a new wave of growth and the continuation of the upward trend. This will push GBP/USD to the area of 1.1899. Only a false breakout on this level will provide an entry point into short positions to move down. In case of a lack of activity, I advise you to sell GBP/USD immediately at 1.1972, counting on the pair's rebounding down by 30-35 points within a day.

Signals of indicators:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, which indicates further growth of the pound.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.1845 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.