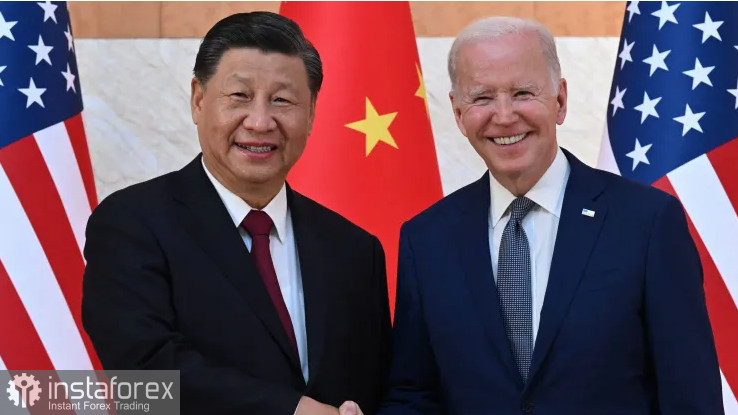

The market reacted calmly to the fact that US President Joe Biden and Chinese President Xi Jinping met for the first time since Biden took office. The dialogue was originally painted down to every word so that it could observe only the "shaking of the air."

"We need to chart the right course for Sino-American relations," Xi said at the opening of the meeting. "We also need to find the right direction for the development of bilateral relations and raise them to a new level." Xi stressed the need to learn from history by using it as a mirror. He also said that bilateral relations are not in a position to meet the interests of the people of the two countries and do not meet the international community's expectations.

According to Biden, the US and China can manage their differences and prevent competition from becoming a conflict.

Let me remind you that tensions between the United States and China have escalated at the moment: starting with the topic of Taiwan and the special military operation in Ukraine and ending with the ban on American companies selling technology to Chinese businesses.

Premarket:

Hasbro shares fell 5.2% in premarket trading after Bank of America's double downgrade to "worse market" from "buy." This move was made after BofA conducted a more in-depth study of the company's affairs and stated that Hasbro was destroying the long-term value of the business.

Oatly, the beverage maker, fell 11.8% in premarket trading after it reported larger-than-expected quarterly losses and weak earnings that fell short of forecast. Oatly said its results were influenced by several factors, including restrictions imposed by China due to COVID, production problems, and the strengthening of the US dollar.

Shares of AMD, the chipmaker, rose 3.2% in premarket trading after receiving new ratings from Baird and UBS. The companies referred to positive cyclical trends in the industry and high demand from data center equipment manufacturers for AMD Genoa chips.

Amazon securities fell by 1.7% in the premarket after Bank of America removed the shares from its "US 1" list, although it retained the "buy" recommendation.

Teva's rating was downgraded from "neutral" to "below market" at JP Morgan Securities, indicating continued growth challenges for the drugmaker. Teva's shares fell 2.3% in premarket trading.

As for the technical picture of the S&P 500, after Friday's growth, the bulls continue to hope for a new rally. The main task for buyers now is to protect the support of $ 3,968. While trading will be conducted above this level, we can expect continued demand for risky assets. This will create good prerequisites for strengthening the trading instrument and returning $4,000 to control. The level of $4,038 is located slightly higher. A break in this area will strengthen the hope for a further upward correction with an exit from the resistance of $4,064. The furthest target will be the area of $4,091. In a downward movement, buyers must declare themselves in the $3,968 range. A breakdown of this range will quickly push the trading instrument to $3,942 and open up the opportunity to update the support at $3,905.