The dollar felt the ground under its feet at the beginning of the week. Investors turned back to the US currency after the Fed's new statements. What does it mean? Are we heading for highs again or is this just a pause in the decline, which the dollar provided by one of the voting representatives of the committee?

As Christopher Waller said on Sunday, the slower pace of rate hikes in the coming months does not mean that the central bank will soften its commitment to lower inflation. The official also advised traders and investors to focus more on the final rate hike, which is still far away.

Meanwhile, inflation expectations are rising again. The figure rose to 5.9% from the previous 5.4% after three consecutive months of slowdown. The average expected change in gas prices rose to 4.8%, the largest single-month increase on record.

Be that as it may, market players understand that they are in the process of reaching an inflationary peak, and the rate hike is already sufficiently priced in.

"Since the price of the dollar is high, the main question will be what happens next - a soft landing for the global economy or a harder one. The harder the landing, the more volatile and dangerous the dollar will turn around, but a soft landing is a sweet spot market scenario in which credit, emerging markets, and growth-sensitive currencies can thrive," SocGen comments.

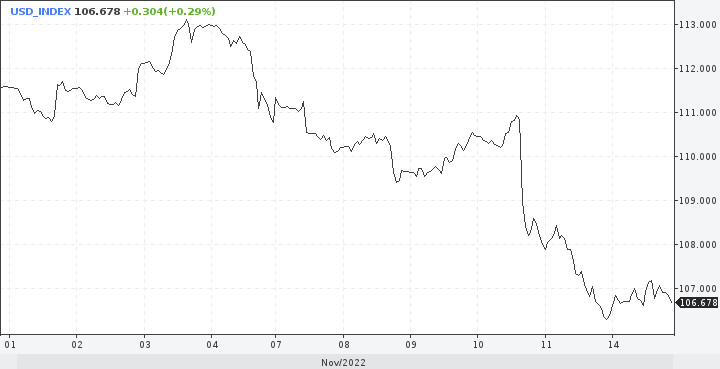

As for a more foreseeable future, now it is important to understand that the sell-off of the US currency index met some resistance around 106.30.

If the bulls show that they are stronger, then the indicator may reach the level of 109.40, where it will meet the first resistance. Going up beyond its limits will allow the dollar to resume growth on a more sustainable basis.

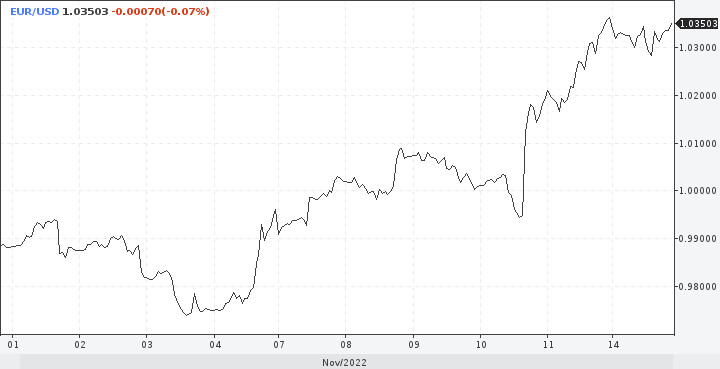

The euro showed some weakness on Monday, as the dollar again made itself felt. In general, the EUR/USD pair has recovered well in recent sessions, gaining 4%. A short-term recovery is also not ruled out in the coming week. Although some strategists still believe that the market is witnessing a technical liquidation of the position and not necessarily the beginning of a long-term increase.

Meanwhile, a serious correction of the euro, which at the moment was able not only to climb beyond the parity, but also to stay above the third figure, took many traders by surprise, including the analysts themselves. It seems that now there is an awareness and the adjustment function will be enabled, including in forecasts.

The euro still has a white streak; on Monday, the growth of industrial production in the eurozone provided support. The index rose 0.9% m/m in September and 4.9% y/y.

Despite high energy costs and the European Central Bank's sharp rate hike, the region's downturn may not be as deep as feared a few months ago. Commodity prices have cooled somewhat in recent months, and a relatively strong economy as the tightening cycle begins will create more room for the ECB to fight inflation. This should please the euro.

The marks observed for the EUR/USD pair now are probably the highest at the moment, it will be difficult to rise further. Therefore, the 1.0400-1.0430 area will act as resistance. The quote in this place runs the risk of colliding with local profit-taking. In this case, you will have to watch a tense tug of war between dollar bulls and bears.

The risk for those looking for a stronger euro is that the recent rally is mostly technical in nature. The dollar is already starting to rise as investors heed the Federal Reserve's warnings about the still-unfinished cycle of rate hikes.

"Further declines cannot be ruled out in the short term as markets reduce long dollar positions. But, let's be clear, one data point does not mean a reversal or a change in Fed policy, "comment Equals Money strategists.

Optimistic data on inflation is an isolated case, not a slowdown put on stream.

Many are now beginning to have doubts that the euro will be able to stay above 1.0300. The EUR/USD pair could trade at 1.0500 if everything falls into place, but so far this has not happened. In the long term, it will remain under pressure.

Given the depth, conviction and one-sided nature of the dollar's long positioning, one still needs to be careful not to prematurely end this correction, according to ING.

The situation should clear up after a series of speeches by Fed representatives this week. Responsible days with reports are on Monday, Wednesday and Thursday. These days, volatility may increase depending on the rhetoric of high-ranking representatives of the central bank.

Fed speakers are likely to present sobering content in exchange for euphoric moves after the release of inflation. The dollar will be happy.

Wells Fargo believes that the US currency will maintain support until 2023. A more stable depreciation will not occur until the second half of the year.