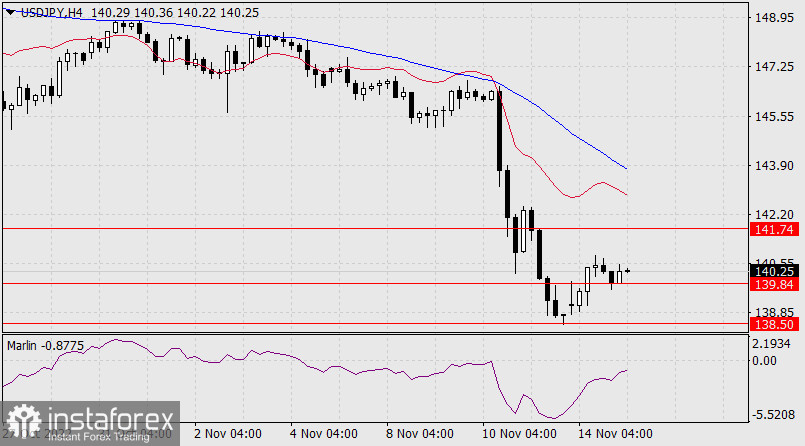

Yesterday and this morning, USD/JPY continues to bounce off the embedded price channel line support at 138.50. Since the growth is not strong, the Marlin Oscillator is in the downward trend, the price is deep below the indicator lines, then we are seeing a correction. Growth prospect at 141.74 is the nearest embedded line of the price channel. But if external markets put pressure on the price, the correction may end earlier.

Weak data on Japan came out this morning. The decline in GDP for the 3rd quarter exceeded forecasts: -0.3% (forecast assumed growth by 0.3% q/q), and on an annualized basis, GDP amounted to -1.2% vs. 1.1% expected y/y .

In China, the data also came out weak: retail sales fell from 2.5% y/y to -0.5% y/y, industrial production slowed from 6.3% y/y to 5.0% y/y. The Chinese stock index China A50 is falling by 0.14%, the Japanese Nikkei 225 manages to show growth by 0.08%, while yesterday the US S&P 500 fell by 0.89%. Japanese speculators are still a little confused, we are waiting for developments. Our main scenario is a decline.

The price is settling at the support of 139.84 on the four-hour chart. The signal line of the Marlin Oscillator is approaching the zero line, from which it can turn down with a high degree of probability and pull the price along with it. After the end of the correction, with the price settling under the level of 139.84, we are waiting for a movement to 138.50.