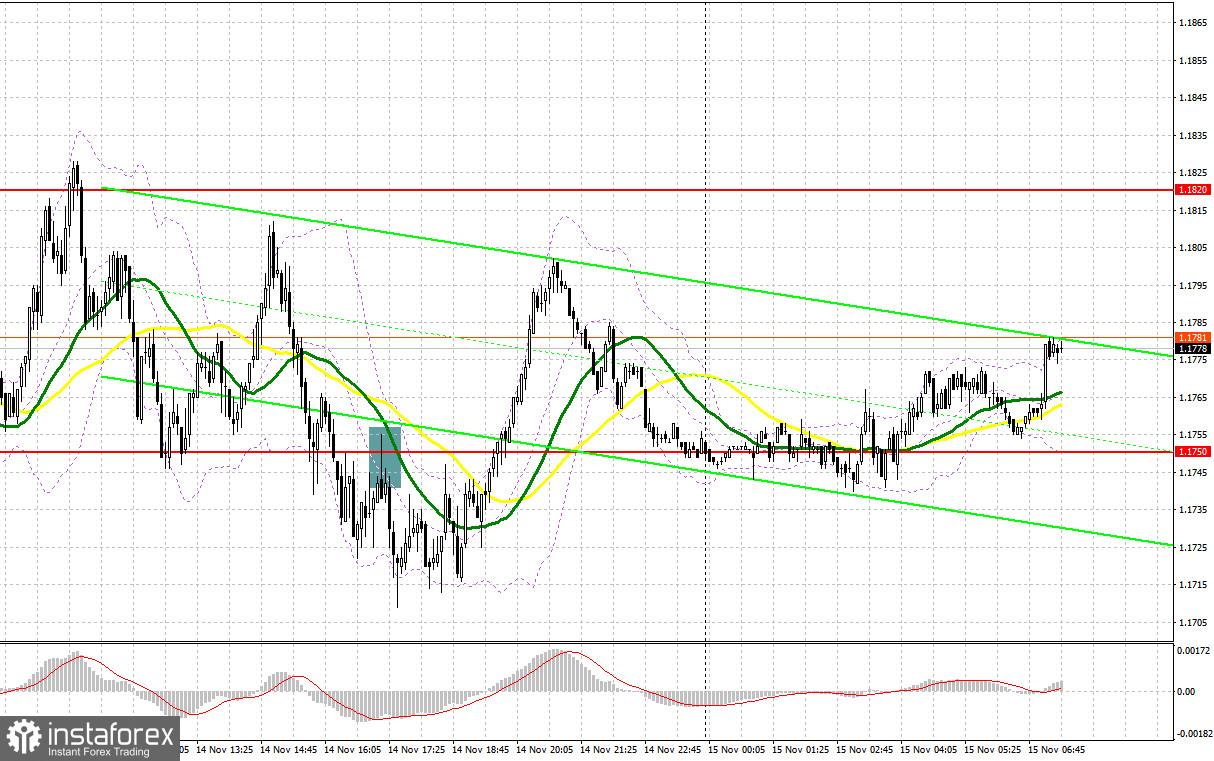

Yesterday there was only one signal to enter the market. Let's take a look at the 5-minute chart and see what happened. Earlier, I asked you to pay attention to the 1.1791 level to decide when to enter the market. The bulls rose above 1.1791 without any problems in the morning, but it did not result in a reverse test downwards - there is no buy signal. After the failure of 1.1791 by the middle of the European session, there was no signal to sell, as here the bears drove the pound quickly to the bottom, without an update. After settling below 1.1750 and a reverse test of this level in the afternoon, it was possible to see a good entry point for selling, which resulted in a downward movement by 30 points. It did not result in a larger sell-off and the bulls pulled out the pair by the end of the US session, maintaining balance in the market.

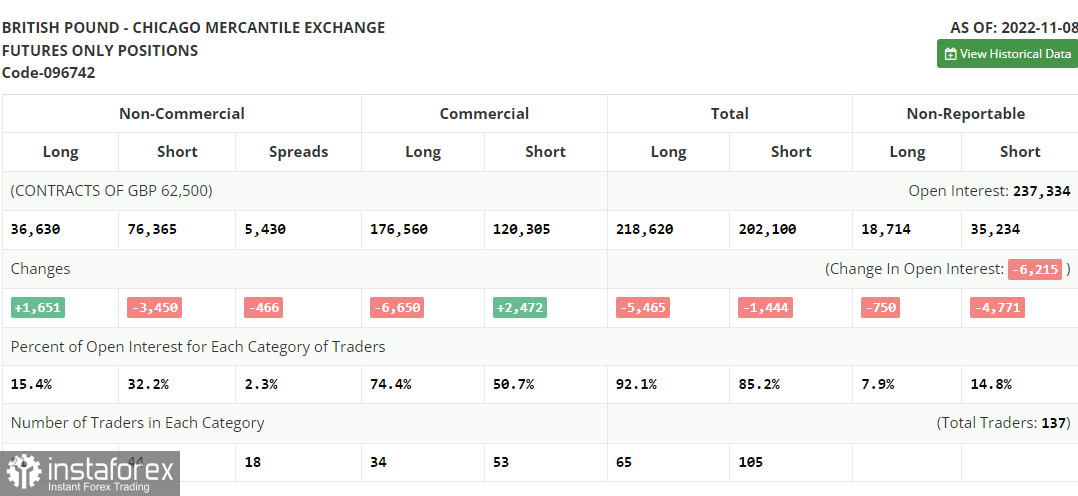

COT report:

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for November 8 showed that short positions decreased, while long ones increased. The results of the Bank of England meeting influenced the alignment of forces: even though the central bank no longer plans to pursue a super-aggressive policy, demand for a cheap pound remains, as it enjoys support amid news that inflation in the US was lower than economists predicted, but we don't know how long this will help the bulls to hold on to the highs. Problems in the UK economy, and recent data on GDP confirmed this, weighing on the government and on the BoE, which slows down the economy even more with its rate hikes. In the near future, reports on the labor market will be released, and if we see serious negative changes there, the British pound may react with a strong fall. The latest COT report indicated that long non-commercial positions rose by 1,651 to 36,630, while short non-commercial positions decreased by 3,450 to 76,365, which led to a further decline in the negative non-commercial net position to -39,735 against -44,836 a week earlier. The weekly closing price increased and amounted to 1.1549 against 1.1499.

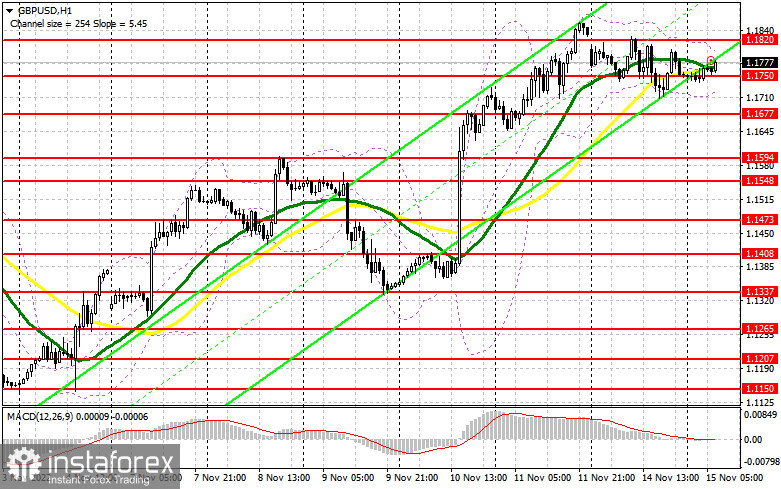

When to go long on GBP/USD:

A fairly large number of statistics will be released today, which can affect the British pound and influence its direction. This refers to data on the unemployment rate in the UK, changes in the number of applications for unemployment benefits and changes in the level of average earnings in the UK. If the labor market breaks down and we see a significant jump in unemployment and a larger decline in average wages, the pound's decline is inevitable. For this reason, in order to maintain an upward potential, the bulls need to show themselves in the area of the nearest support at 1.1750, in the area of which the moving averages are passing, playing on the bulls' side. A false breakout at this level and maintaining stability in the labor market - all this will lead to a buy signal with a re-exit at 1.1820, which we failed to break above yesterday. Without this level, it will be difficult for the bulls to count on building a bull market in the future.

We can finally talk about the continuation of the upward trend when the pair rises further, and a breakout of 1.1820, together with a reverse downward test, will open the way to a high of 1.1899, where it will become more difficult for bulls to control the market. A more distant target will be 1.1972, which will lead to a fairly large capitulation of bears - I recommend taking profit there.

If the bulls do not cope with the tasks set and miss 1.1750, the level at the end of yesterday, then the pair will be under pressure. If this happens, I recommend postponing long positions to 1.1677, where we did not reach yesterday. It will be wise to go long after a false breakout. It is also possible to buy the asset just after a bounce off from 1.1594, or even lower at 1.1548, expecting a rise of 30-35 pips.

When to go short on GBP/USD:

Yesterday, the bears did everything to achieve a more significant correction, but still failed. In case the pound grows amid good statistics for the UK, a false breakout at 1.1820 forms a sell signal in anticipation of a downward correction and a second decline to the nearest support at 1.1750. A breakout and reverse test from the bottom up of this range will provide an entry point with an update of a low like 1.1677, which will increase pressure on the pound. A more distant target will be 1.1594, where I recommend locking in profits. A test of 1.1594 will be a strong blow to the bulls' positions.

In case the pair grows and bears fail to protect 1.1820, then the bulls will regain control of the situation, which will lead to the growth of GBP/USD to the area of a new monthly high of 1.1899. A false breakout at this level forms an entry point, expecting a decline. If traders are not active there as well, the pair may be pushed to a high like 1.1972. There, I advise you to go short after a rebound, expecting a decline of 30-35 pips.

Indicator signals:

Trading is performed in the 30- and 50-day moving averages, which indicates the horizontal nature of the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A break of the upper limit of the indicator in the 1.1805 level will lead to a new wave of growth for the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.