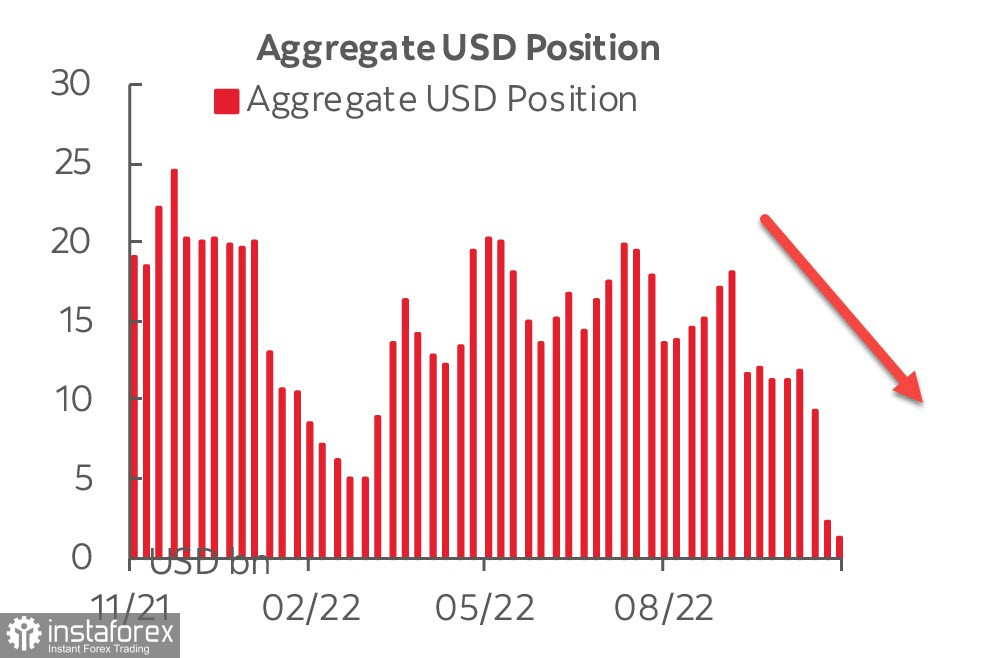

On Monday, the Commodity Futures Trading Commission (CFTC) released its report later than usual because markets were shut on Friday on the occasion of the national holiday. The report revealed that the bullish sentiment on USD was waning. The overall long positions on USD declined to 1.2 billion, the lowest level since early 2021.

Besides, the net long positions on gold jumped rapidly by 3.5 billion to stand at 14.1 billion. The notable growth in bets for gold is another indirect evidence of a further USD's slide.

Some FOMC policymakers came up with comments on a rapid decline in the US dollar. They tried to quell extremely dovish sentiment. Member of the Fed's Board of Governors Christopher Waller noted that markets overreacted to softer-than-expected inflation data. He said it was "just one data point" and the central bank had "a ways to go" before it would stop raising rates. Everybody should take a deep breath and calm down. Indeed, financial markets overcame excessive optimism. Yields of US Treasuries halted a rally and the US dollar's fall stemmed.

Apparently, global investors are regaining the risk-off mood. Analysts at DanskeBank stick to the viewpoint that EUR/USD will sink again below the parity level to 0.93 in 12 months ahead. The bank explains its forecast by the fact that the US labor market remains healthy. So, growing personal income is likely to encourage further inflation acceleration. Scotiabank also pinpoints the threat of considerable wage growth in most countries which will prop up global inflation, including the US. Experts at Mizuho say that real consumer spending in Japan surged by 5.9% in annual terms. The think tank also expects further growth in wages. ANZ appeals for caution because the global inflation cycle is in full swing.

EUR/USD

The euro is showing the strongest performance on Forex. It owes its strength to external factors such as a slowdown in US inflation, the reopening of China's economy, and stabilization in supply chains as well as internal factors. Indeed, European benchmark gas prices dropped steeply in recent months on the back of waning demand, mild weather conditions, and replenishment of gas inventories. The European manufacturing sector is likely to survive the coming winter without economic shocks. The relocation of some European production facilities to the US and China has not devolved into a dominating trend yet.

As for the economic calendar, the eurozone's GDP data for Q3 2022 is on tap today. Besides, ZEW experts are due to present their survey on economic sentiment in Germany and the EU for November. The forecast for Europe is negative but analysts foresee some improvement in the morale among institutional investors which could encourage further EUR's growth.

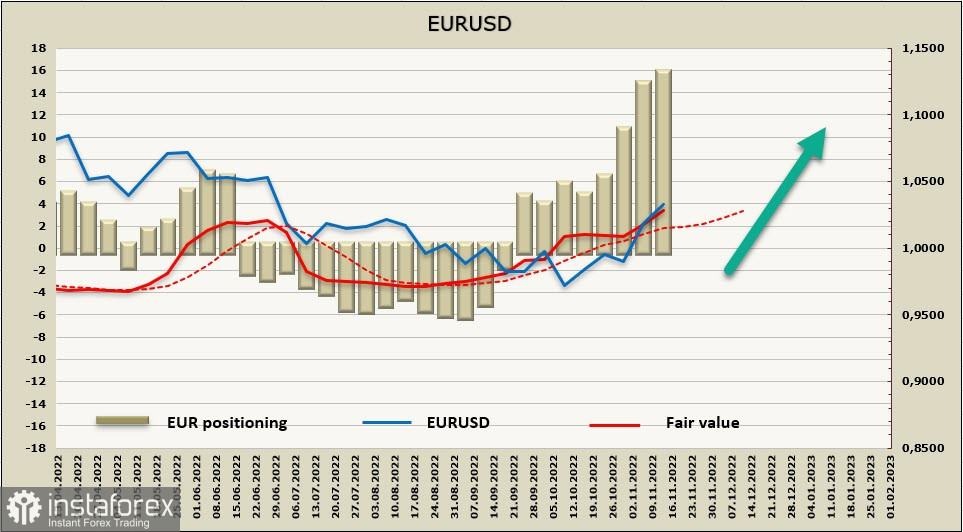

Net long positions on EUR increased by 488 million to 13.55 billion. Hence, the bullish sentiment clearly prevails. The expected price of EUR/USD is above the long-term average and is pointed upwards.

Resistance at 1.02 has been successfully passed. EUR/USD maintains bullish momentum. It was trading at levels close to the local high of 1.0365 on Tuesday morning. If the price consolidates above, technical indicators will reinforce clear-cut signals of further growth. EUR is expected to climb higher. The target is resistance in the area of 1.0600/20 whereas support is at 1.02. The odds are that traders will resume buying as soon as the price retraces to this support.

GBP/USD

On the whole, macroeconomic indicators on the UK economy have been commonly stronger than expected. The UK GDP slowed down to 2.4% in Q3 2022 on year, better than the forecast for a decrease to 2.1%. Industrial production expanded in September, defying expectations of a minor decline. A trade balance deficit came in worse than projected.

On Wednesday, the UK will report on its inflation for October. The data will be of crucial importance for the Bank of England to revise its stance on monetary policy. Any deviation from the forecast will matter a lot to the central bank to fine-tune its monetary policy. If so, this will cause gyrations in the pound sterling.

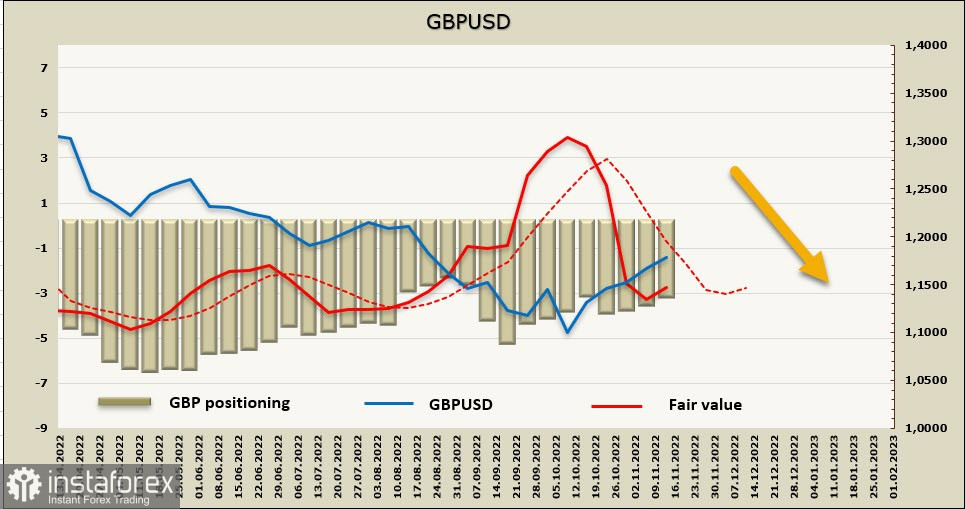

Net short positions on GBP contracted by 351 million to -2.87 billion last week. Despite a small decline, the bearish sentiment is still valid. From the point of large market players, the sterling looks much weaker than the euro. GBP/USD is trying to reverse upwards, though it remains below the long-term average.

A week earlier, we reckoned that resistance at 1.1644 would survive. However, the US inflation report, which triggered the rally in the currency market, cemented the sterling's confidence which it lacked to develop growth. As of early Tuesday, the currency pair managed to defend resistance at 1.1832 which coincides with the 38.2% Fibonacci retracement from a slump in June 2021. The most feasible scenario is sideways trading from the support of 1.1640/50. A further GBP's dynamic will depend on the UK inflation data for October which is due on Wednesday. Any deviation from the forecast will entail changes in expectations of yields differential.