EUR/USD

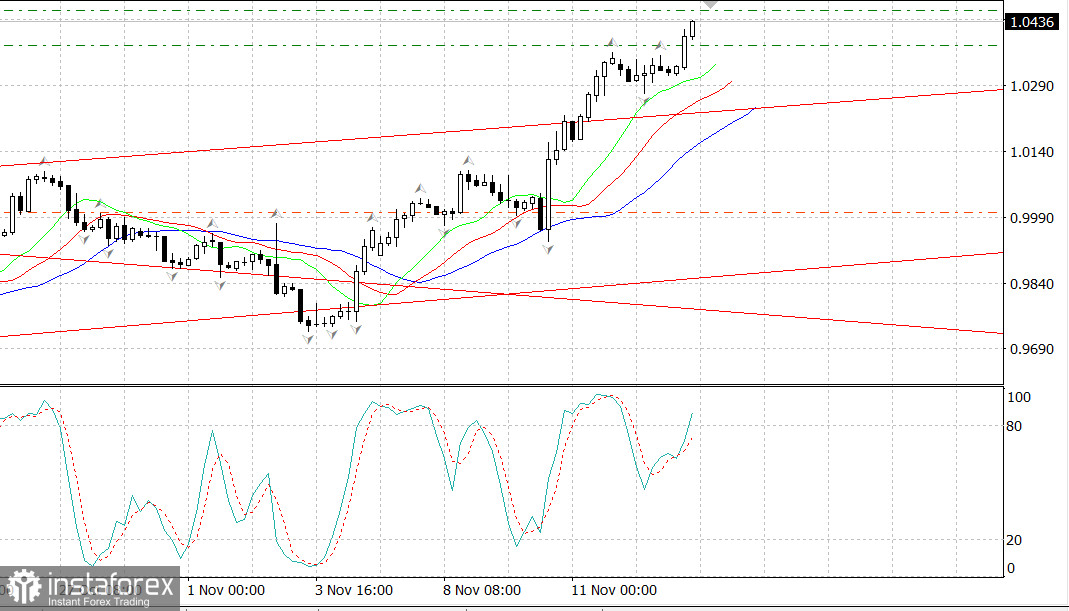

Euro has risen more than 500 pips in just one week due to weaker dollar demand and slowdown in the Fed's rate hike, which markets were hoping for.

However, the Fed will undoubtedly raise the rate in mid-December, most likely by at least 0.5%.

Further, the outlook for the US economy is much stronger than that of the EU because even though a recession is inevitable in both regions as a result of higher lending rates, there is an extremely sharp jump in fuel prices in the EU. Gas prices within the US are also several times lower since gas transportation using LNG technology is both underdeveloped and quite expensive.

It is for this reason that there is no upside trend in euro right now, but it can happen in the spring if the EU goes through the winter better than forecasts.

Conclusion: you can start selling euro from current prices, gradually increasing the volumes every 80-100 pips. Set a margin of 200-250 pips of possible drawdown.